- Malaysia

- /

- Auto Components

- /

- KLSE:ESAFE

Here's Why Eversafe Rubber Berhad (KLSE:ESAFE) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Eversafe Rubber Berhad (KLSE:ESAFE) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Eversafe Rubber Berhad

How Much Debt Does Eversafe Rubber Berhad Carry?

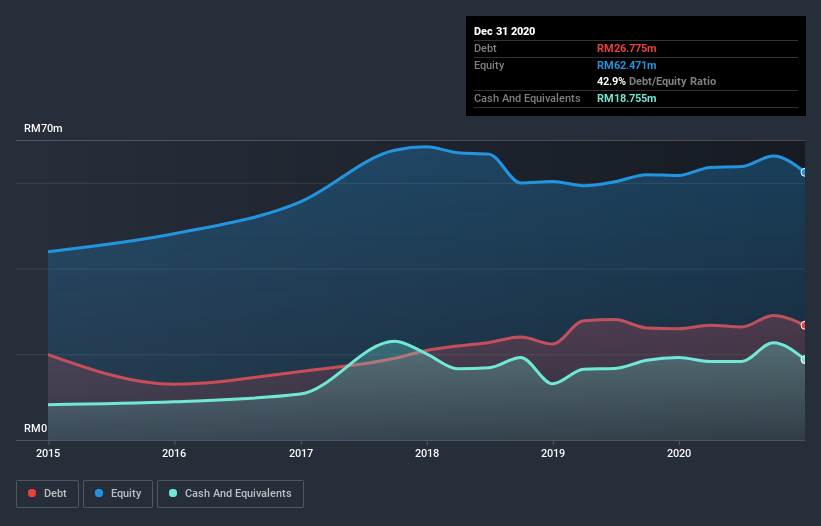

As you can see below, Eversafe Rubber Berhad had RM26.8m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it also had RM18.8m in cash, and so its net debt is RM8.02m.

How Strong Is Eversafe Rubber Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Eversafe Rubber Berhad had liabilities of RM33.8m due within 12 months and liabilities of RM12.7m due beyond that. Offsetting these obligations, it had cash of RM18.8m as well as receivables valued at RM24.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM3.10m.

Since publicly traded Eversafe Rubber Berhad shares are worth a total of RM58.9m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Eversafe Rubber Berhad's low debt to EBITDA ratio of 0.67 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.9 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. It is well worth noting that Eversafe Rubber Berhad's EBIT shot up like bamboo after rain, gaining 55% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Eversafe Rubber Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Eversafe Rubber Berhad produced sturdy free cash flow equating to 66% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Eversafe Rubber Berhad's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its interest cover does undermine this impression a bit. Zooming out, Eversafe Rubber Berhad seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Eversafe Rubber Berhad you should be aware of, and 1 of them doesn't sit too well with us.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Eversafe Rubber Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eversafe Rubber Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ESAFE

Eversafe Rubber Berhad

An investment holding company, develops, manufactures, distributes, and sells tyre retreading materials to tyre retreaders and rubber material traders.

Good value with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026