- Malaysia

- /

- Auto Components

- /

- KLSE:ESAFE

Eversafe Rubber Berhad's (KLSE:ESAFE) 33% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Eversafe Rubber Berhad (KLSE:ESAFE) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

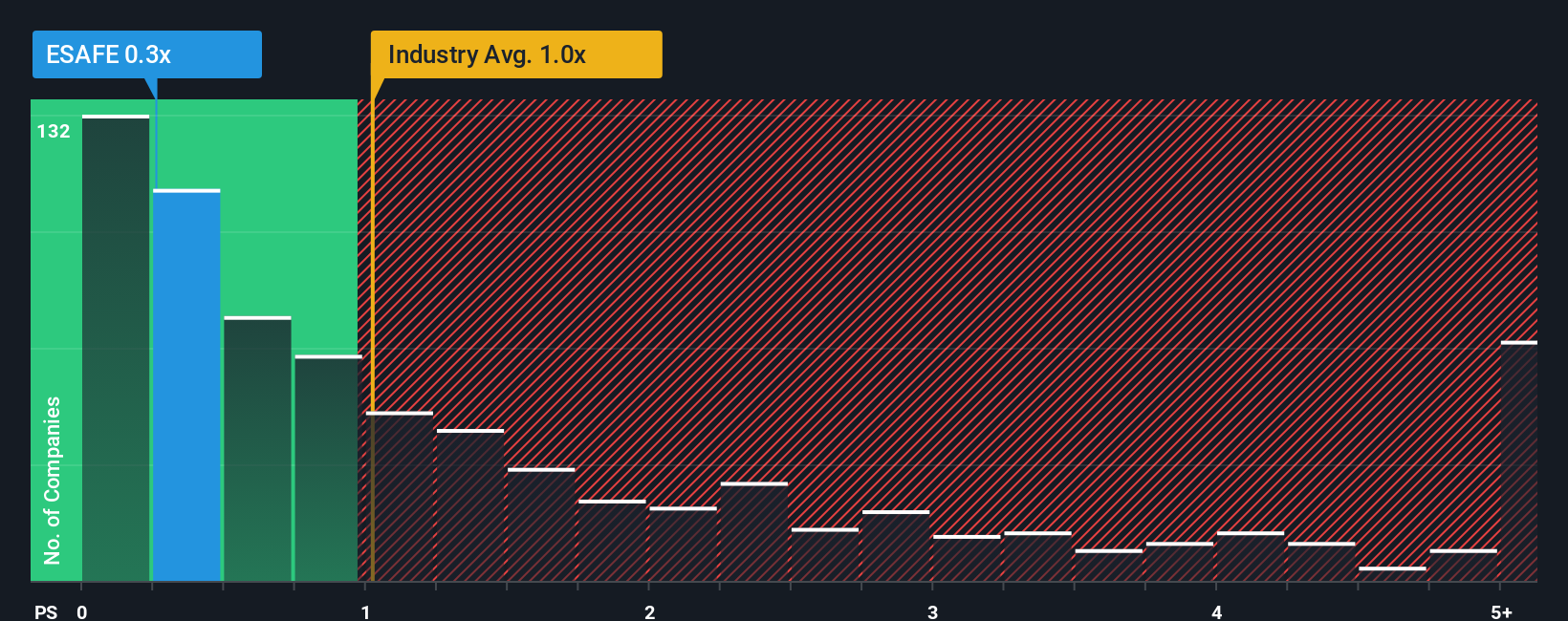

Even after such a large drop in price, it's still not a stretch to say that Eversafe Rubber Berhad's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Malaysia, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Eversafe Rubber Berhad

What Does Eversafe Rubber Berhad's P/S Mean For Shareholders?

For instance, Eversafe Rubber Berhad's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eversafe Rubber Berhad's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Eversafe Rubber Berhad?

The only time you'd be comfortable seeing a P/S like Eversafe Rubber Berhad's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.5% decrease to the company's top line. As a result, revenue from three years ago have also fallen 26% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that Eversafe Rubber Berhad's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Eversafe Rubber Berhad looks to be in line with the rest of the Auto Components industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Eversafe Rubber Berhad currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you take the next step, you should know about the 4 warning signs for Eversafe Rubber Berhad (3 make us uncomfortable!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eversafe Rubber Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ESAFE

Eversafe Rubber Berhad

An investment holding company, develops, manufactures, distributes, and sells tyre retreading materials to tyre retreaders and rubber material traders.

Good value with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success