Here's What We Learned About The CEO Pay At DRB-HICOM Berhad (KLSE:DRBHCOM)

Syed Faisal Bin Syed A.R. Albar has been the CEO of DRB-HICOM Berhad (KLSE:DRBHCOM) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether DRB-HICOM Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for DRB-HICOM Berhad

How Does Total Compensation For Syed Faisal Bin Syed A.R. Albar Compare With Other Companies In The Industry?

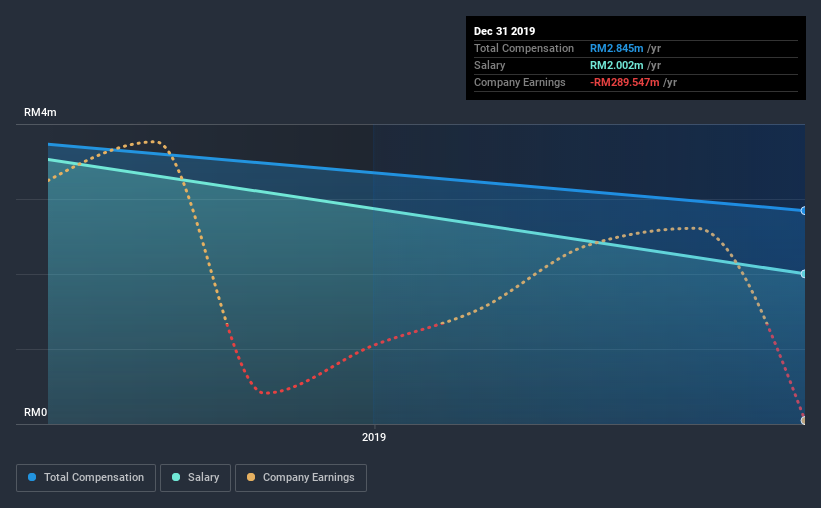

Our data indicates that DRB-HICOM Berhad has a market capitalization of RM3.9b, and total annual CEO compensation was reported as RM2.8m for the year to December 2019. We note that's a decrease of 24% compared to last year. In particular, the salary of RM2.00m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from RM1.6b to RM6.5b, the reported median CEO total compensation was RM343k. Hence, we can conclude that Syed Faisal Bin Syed A.R. Albar is remunerated higher than the industry median.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM2.0m | RM3.5m | 70% |

| Other | RM843k | RM203k | 30% |

| Total Compensation | RM2.8m | RM3.7m | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. DRB-HICOM Berhad pays out 70% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

DRB-HICOM Berhad's Growth

DRB-HICOM Berhad has seen its earnings per share (EPS) increase by 46% a year over the past three years. Its revenue is up 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has DRB-HICOM Berhad Been A Good Investment?

DRB-HICOM Berhad has generated a total shareholder return of 18% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we touched on above, DRB-HICOM Berhad is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, we must not forget that the EPS growth has been very strong over three years. We also note that, over the same time frame, shareholder returns haven't been bad. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't say CEO compensation problematic.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at DRB-HICOM Berhad.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading DRB-HICOM Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:DRBHCOM

DRB-HICOM Berhad

Engages in automotive, aerospace and defence, banking, postal, services, and properties businesses.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion