Here's Why Controladora Vuela Compañía de Aviación. de (BMV:VOLARA) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Controladora Vuela Compañía de Aviación. de

How Much Debt Does Controladora Vuela Compañía de Aviación. de Carry?

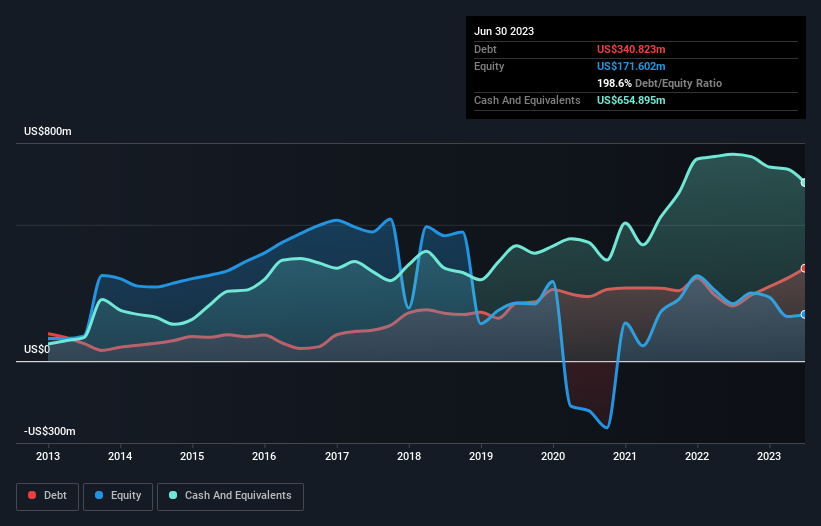

You can click the graphic below for the historical numbers, but it shows that as of June 2023 Controladora Vuela Compañía de Aviación. de had US$340.8m of debt, an increase on US$202.4m, over one year. But it also has US$654.9m in cash to offset that, meaning it has US$314.1m net cash.

How Strong Is Controladora Vuela Compañía de Aviación. de's Balance Sheet?

The latest balance sheet data shows that Controladora Vuela Compañía de Aviación. de had liabilities of US$1.63b due within a year, and liabilities of US$2.98b falling due after that. On the other hand, it had cash of US$654.9m and US$289.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.67b.

The deficiency here weighs heavily on the US$1.11b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Controladora Vuela Compañía de Aviación. de would likely require a major re-capitalisation if it had to pay its creditors today. Controladora Vuela Compañía de Aviación. de boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Importantly, Controladora Vuela Compañía de Aviación. de's EBIT fell a jaw-dropping 64% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Controladora Vuela Compañía de Aviación. de can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Controladora Vuela Compañía de Aviación. de has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Controladora Vuela Compañía de Aviación. de actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While Controladora Vuela Compañía de Aviación. de does have more liabilities than liquid assets, it also has net cash of US$314.1m. The cherry on top was that in converted 223% of that EBIT to free cash flow, bringing in US$200m. Despite the cash, we do find Controladora Vuela Compañía de Aviación. de's level of total liabilities concerning, so we're not particularly comfortable with the stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Controladora Vuela Compañía de Aviación. de that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives