Controladora Vuela Compañía de Aviación, S.A.B. de C.V.'s (BMV:VOLARA) Shares May Have Run Too Fast Too Soon

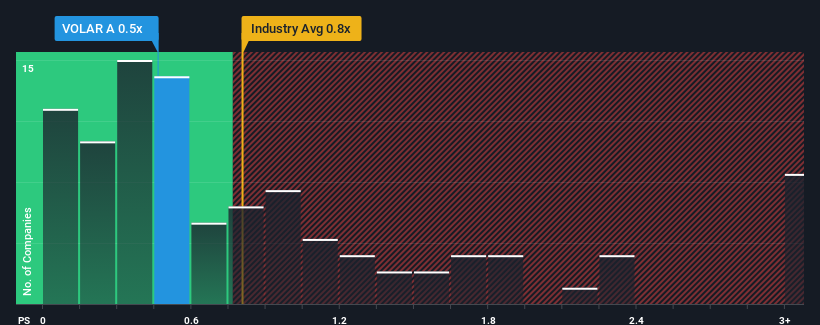

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Airlines industry in Mexico, you could be forgiven for feeling indifferent about Controladora Vuela Compañía de Aviación, S.A.B. de C.V.'s (BMV:VOLARA) P/S ratio of 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Controladora Vuela Compañía de Aviación. de

What Does Controladora Vuela Compañía de Aviación. de's P/S Mean For Shareholders?

Recent times haven't been great for Controladora Vuela Compañía de Aviación. de as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Controladora Vuela Compañía de Aviación. de's future stacks up against the industry? In that case, our free report is a great place to start.How Is Controladora Vuela Compañía de Aviación. de's Revenue Growth Trending?

In order to justify its P/S ratio, Controladora Vuela Compañía de Aviación. de would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 149% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 9.4% each year over the next three years. With the industry predicted to deliver 14% growth per year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Controladora Vuela Compañía de Aviación. de's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Controladora Vuela Compañía de Aviación. de's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Controladora Vuela Compañía de Aviación. de's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Controladora Vuela Compañía de Aviación. de with six simple checks.

If you're unsure about the strength of Controladora Vuela Compañía de Aviación. de's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives