Controladora Vuela Compañía de Aviación, S.A.B. de C.V.'s (BMV:VOLARA) 32% Share Price Surge Not Quite Adding Up

The Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) share price has done very well over the last month, posting an excellent gain of 32%. Unfortunately, despite the strong performance over the last month, the full year gain of 4.2% isn't as attractive.

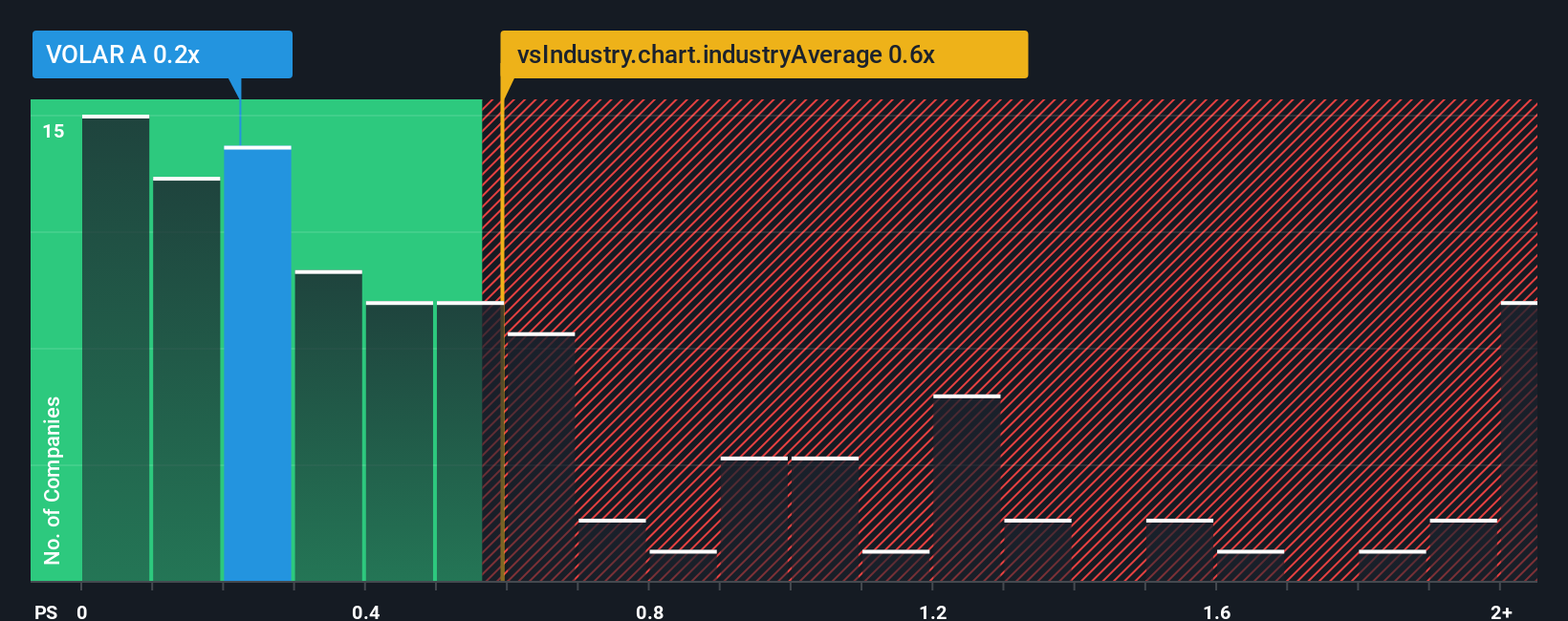

Even after such a large jump in price, there still wouldn't be many who think Controladora Vuela Compañía de Aviación. de's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Mexico's Airlines industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Controladora Vuela Compañía de Aviación. de

What Does Controladora Vuela Compañía de Aviación. de's Recent Performance Look Like?

Controladora Vuela Compañía de Aviación. de could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Controladora Vuela Compañía de Aviación. de will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Controladora Vuela Compañía de Aviación. de?

In order to justify its P/S ratio, Controladora Vuela Compañía de Aviación. de would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 9.1% per annum as estimated by the analysts watching the company. That's shaping up to be materially lower than the 432% per year growth forecast for the broader industry.

With this information, we find it interesting that Controladora Vuela Compañía de Aviación. de is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Controladora Vuela Compañía de Aviación. de's P/S?

Controladora Vuela Compañía de Aviación. de's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Controladora Vuela Compañía de Aviación. de's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Controladora Vuela Compañía de Aviación. de has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Controladora Vuela Compañía de Aviación. de's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives