- Taiwan

- /

- Infrastructure

- /

- TWSE:2607

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating indices and economic adjustments, with notable rate cuts from the ECB and SNB alongside expectations for a Fed cut, investors are closely watching how these shifts impact their portfolios. Amidst this backdrop, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to balance growth with consistent returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1868 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

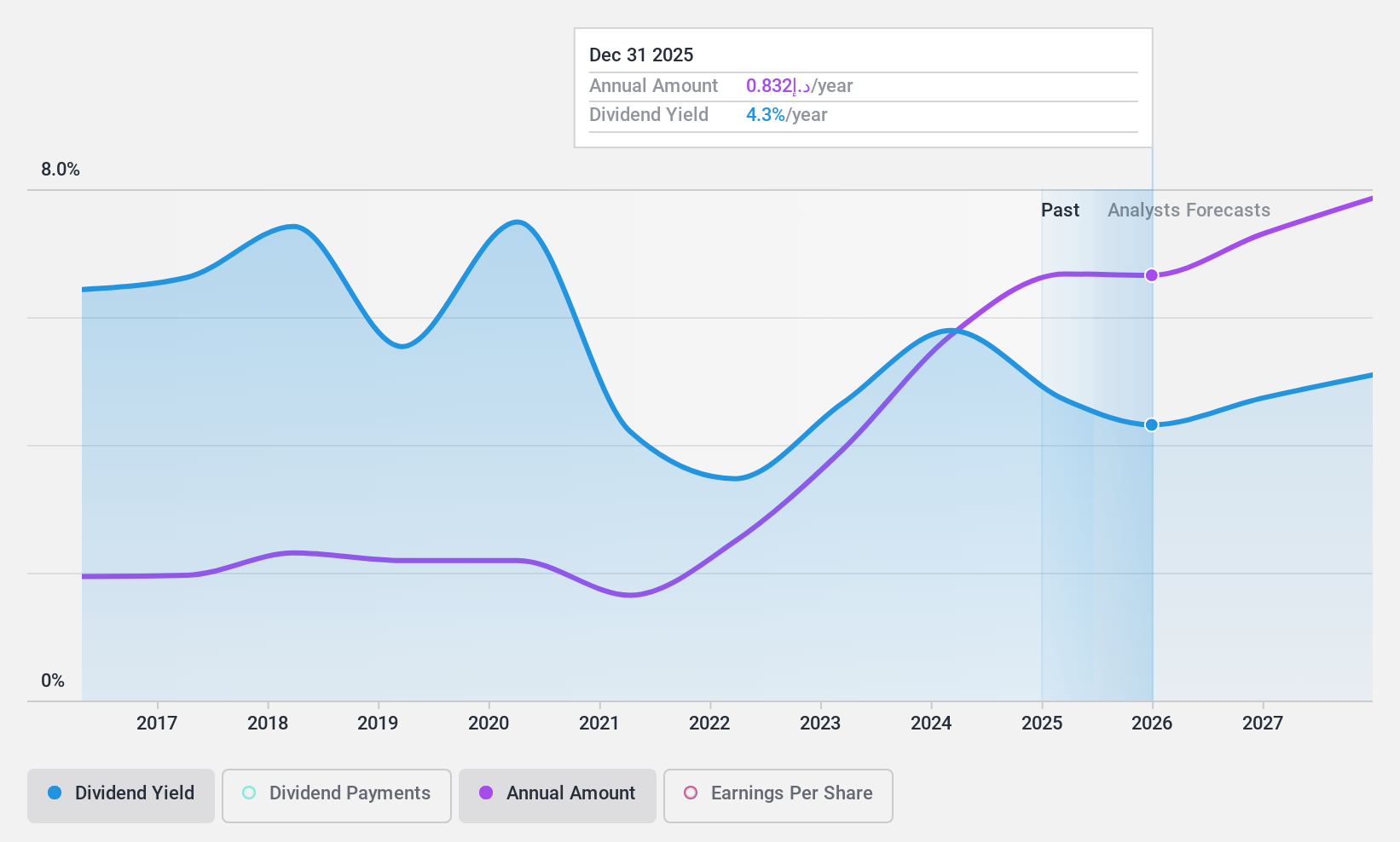

Abu Dhabi Islamic Bank PJSC (ADX:ADIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Islamic Bank PJSC offers banking, financing, and investing services both in the United Arab Emirates and internationally, with a market cap of AED49.40 billion.

Operations: Abu Dhabi Islamic Bank PJSC's revenue segments include Global Retail Banking (AED5.29 billion), Global Wholesale Banking (AED1.65 billion), Associates & Subsidiaries (AED1.40 billion), Treasury (AED176.50 million), Real Estate (AED168.80 million), and Private Banking (AED241.83 million).

Dividend Yield: 5.3%

Abu Dhabi Islamic Bank PJSC's dividend payments are currently well covered by earnings, with a payout ratio of 47.6%, and this coverage is expected to remain stable over the next three years. Despite a history of volatility in dividend payments, there has been growth over the past decade. The bank's price-to-earnings ratio of 9.1x suggests it offers good value compared to the broader AE market, although its bad loans level at 3.9% remains high.

- Click here and access our complete dividend analysis report to understand the dynamics of Abu Dhabi Islamic Bank PJSC.

- According our valuation report, there's an indication that Abu Dhabi Islamic Bank PJSC's share price might be on the expensive side.

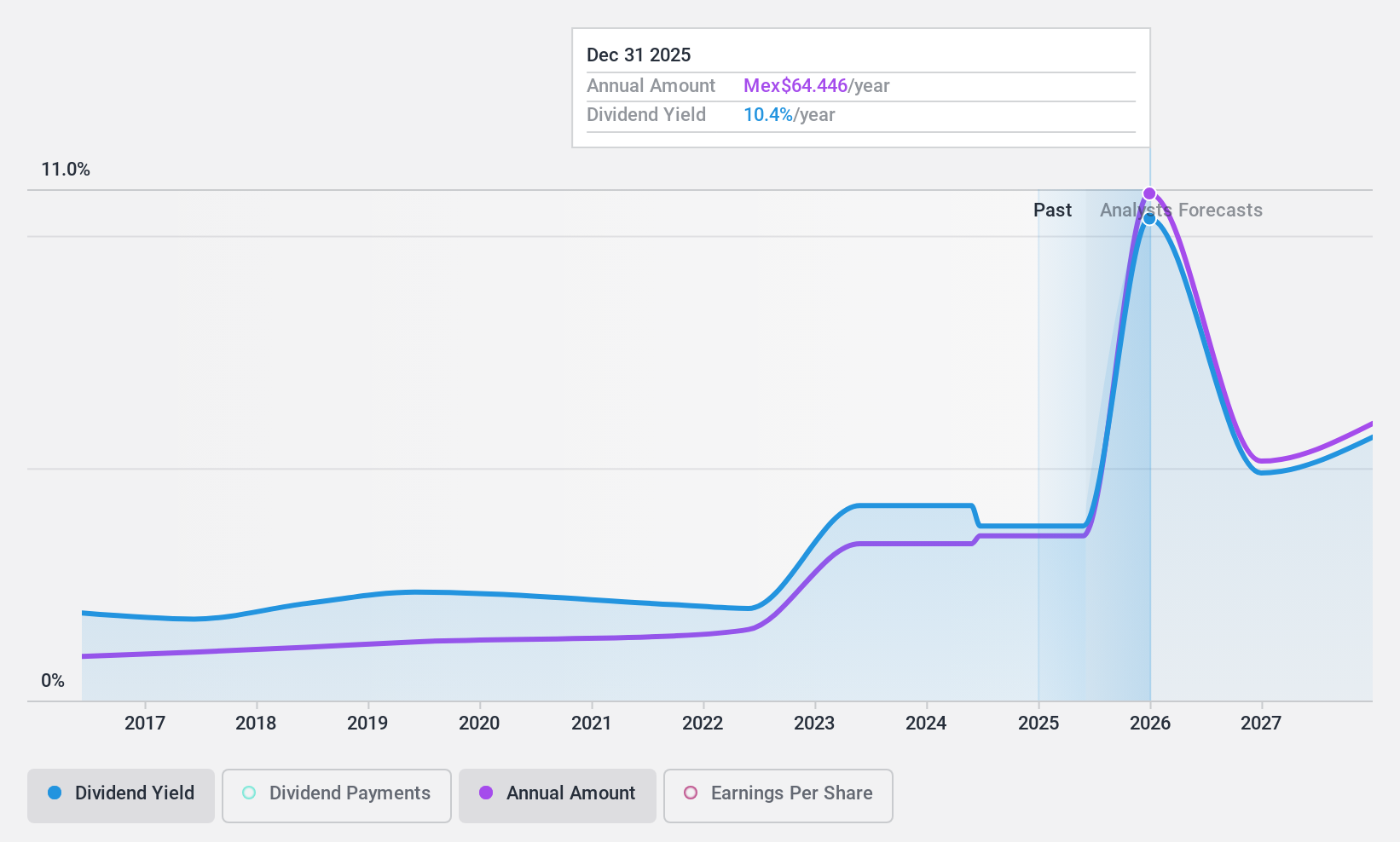

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates airport facilities and services, with a market cap of MX$166.88 billion.

Operations: Grupo Aeroportuario del Sureste, S. A. B. de C. V generates revenue through its operations in Cancun (MX$17.17 billion), San Juan, Puerto Rico, US (MX$4.50 billion), Colombia (MX$3.12 billion), Merida (MX$1.41 billion), and Villahermosa (MX$599.27 million).

Dividend Yield: 3.8%

Grupo Aeroportuario del Sureste's dividends are well covered by earnings, with a payout ratio of 25.9%, and cash flows, with a cash payout ratio of 54.9%. Despite historical volatility in dividend payments, there has been growth over the past decade. The stock trades at a price-to-earnings ratio of 13x, below the industry average of 14.4x, indicating relative value. However, its dividend yield is lower than the top tier in Mexico's market at 3.81%.

- Take a closer look at Grupo Aeroportuario del Sureste S. A. B. de C. V's potential here in our dividend report.

- Our valuation report here indicates Grupo Aeroportuario del Sureste S. A. B. de C. V may be undervalued.

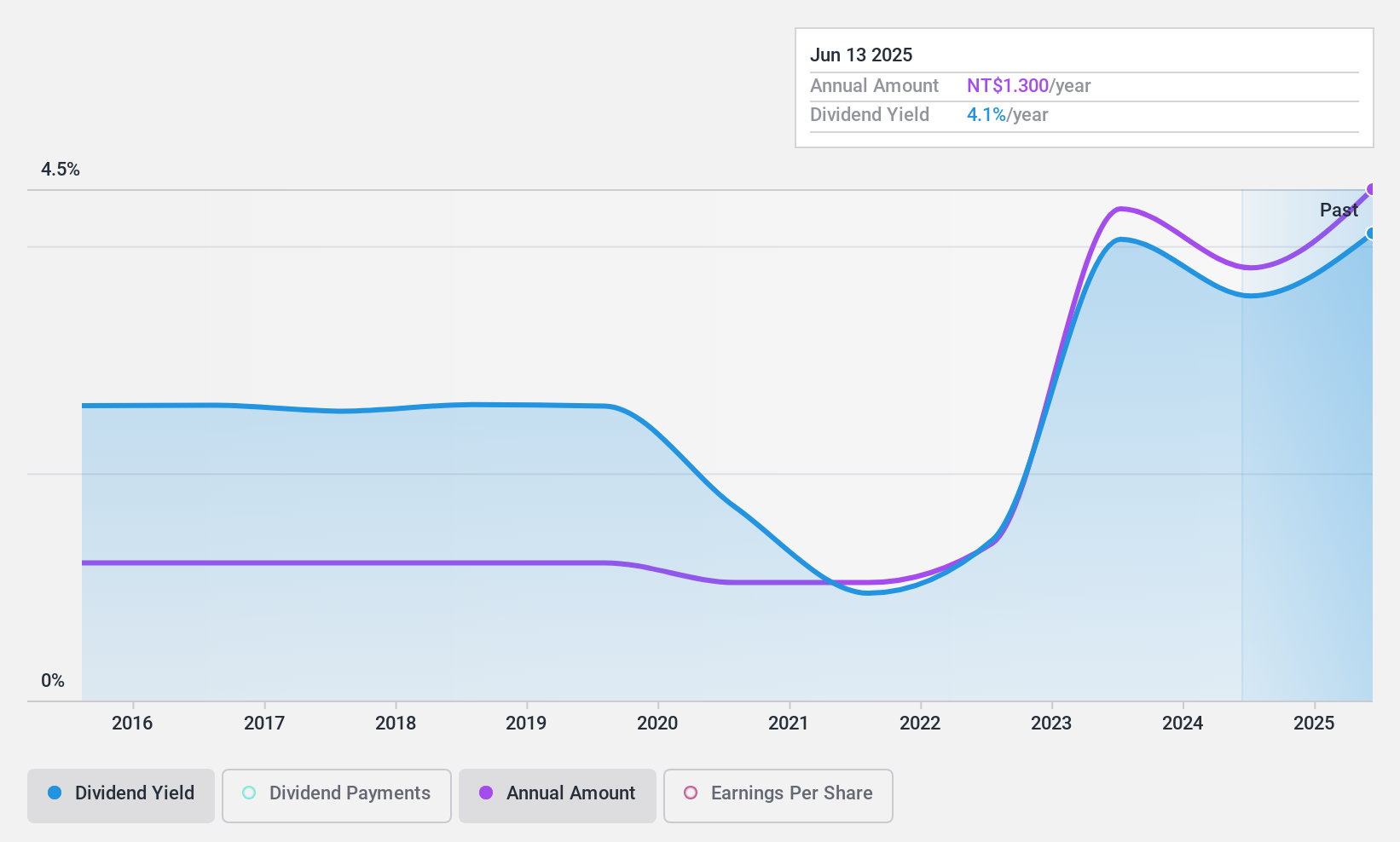

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations in Taiwan, America, and internationally, with a market cap of NT$33.99 billion.

Operations: Evergreen International Storage & Transport Corporation generates revenue primarily from cargo shipment (NT$15.52 billion), international sea transportation (NT$2.87 billion), inland transport (NT$1.87 billion), container yard operations (NT$958.26 million), and gas stations (NT$425.33 million).

Dividend Yield: 3.5%

Evergreen International Storage & Transport's dividends are well supported by earnings and cash flows, with payout ratios of 49.1% and 38.1%, respectively. The dividend yield of 3.45% is stable but below the top quartile in Taiwan's market. Despite a recent decline in profit margins to 11.4%, the company reported increased sales for Q3, enhancing its ability to sustain dividends that have grown steadily over the past decade without volatility.

- Dive into the specifics of Evergreen International Storage & Transport here with our thorough dividend report.

- Our expertly prepared valuation report Evergreen International Storage & Transport implies its share price may be too high.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1865 more companies for you to explore.Click here to unveil our expertly curated list of 1868 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergreen International Storage & Transport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2607

Evergreen International Storage & Transport

Provides inland container transport and container terminal operations in Taiwan, America, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives