- Mexico

- /

- Telecom Services and Carriers

- /

- BMV:SITES1 A-1

There's Reason For Concern Over Operadora de Sites Mexicanos, S.A.B. de C.V.'s (BMV:SITES1A-1) Price

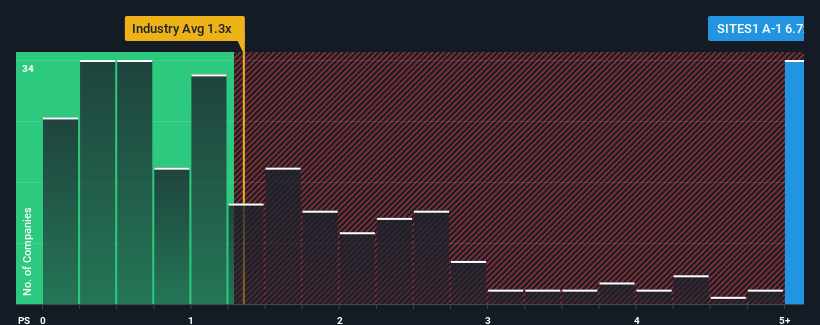

When you see that almost half of the companies in the Telecom industry in Mexico have price-to-sales ratios (or "P/S") below 1.4x, Operadora de Sites Mexicanos, S.A.B. de C.V. (BMV:SITES1A-1) looks to be giving off strong sell signals with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Operadora de Sites Mexicanos. de

What Does Operadora de Sites Mexicanos. de's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Operadora de Sites Mexicanos. de has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Operadora de Sites Mexicanos. de's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Operadora de Sites Mexicanos. de?

The only time you'd be truly comfortable seeing a P/S as steep as Operadora de Sites Mexicanos. de's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 7.6% during the coming year according to the four analysts following the company. That's shaping up to be materially lower than the 48% growth forecast for the broader industry.

In light of this, it's alarming that Operadora de Sites Mexicanos. de's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Operadora de Sites Mexicanos. de's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Operadora de Sites Mexicanos. de, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Operadora de Sites Mexicanos. de that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:SITES1 A-1

Operadora de Sites Mexicanos. de

Operadora de Sites Mexicanos, S.A.B. de C.V.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives