- Japan

- /

- Consumer Services

- /

- TSE:9733

Three Stocks Estimated To Be Trading Below Intrinsic Value In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by volatile corporate earnings, competitive pressures in the AI sector, and shifting monetary policies, investors are keenly watching for opportunities to capitalize on undervalued stocks. Amidst these developments, identifying stocks that are trading below their intrinsic value can offer potential for growth as they may rebound when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$527.77 | 49.9% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.01 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.358 | £0.71 | 49.7% |

| GlobalData (AIM:DATA) | £1.78 | £3.55 | 49.9% |

| Bufab (OM:BUFAB) | SEK467.40 | SEK928.96 | 49.7% |

| EuroGroup Laminations (BIT:EGLA) | €2.604 | €5.17 | 49.6% |

| AeroEdge (TSE:7409) | ¥1749.00 | ¥3474.82 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| Prodways Group (ENXTPA:PWG) | €0.576 | €1.15 | 49.8% |

| Gold Royalty (NYSEAM:GROY) | US$1.32 | US$2.63 | 49.9% |

Let's review some notable picks from our screened stocks.

FibraHotel (BMV:FIHO 12)

Overview: FibraHotel is a Mexican trust focused on acquiring, developing, and operating hotels in Mexico with a market cap of MX$8.03 billion.

Operations: FibraHotel generates revenue through the acquisition, development, and operation of hotels across Mexico.

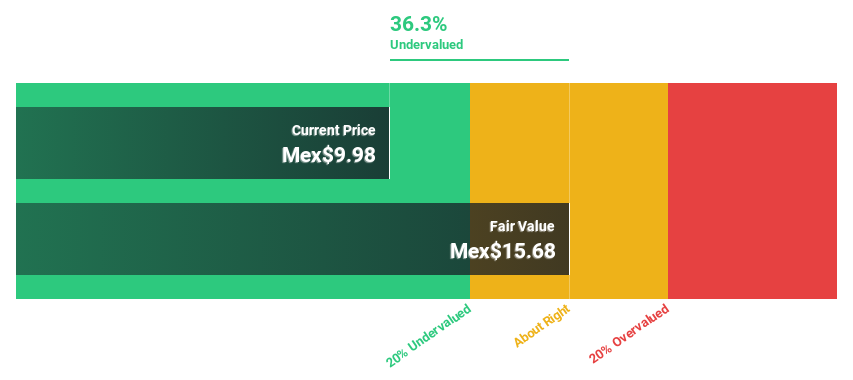

Estimated Discount To Fair Value: 39.2%

FibraHotel is trading at MX$10.2, significantly below its estimated fair value of MX$16.78, indicating it is undervalued by over 20%. Despite a forecasted low return on equity of 6.1% in three years, earnings are expected to grow significantly at 29.3% annually, outpacing the MX market's growth rate. However, revenue growth is slower than desired and profit margins have decreased from last year’s levels.

- Our earnings growth report unveils the potential for significant increases in FibraHotel's future results.

- Click to explore a detailed breakdown of our findings in FibraHotel's balance sheet health report.

Stemmer Imaging (HMSE:S9I)

Overview: Stemmer Imaging AG offers machine vision technology for various applications globally, with a market cap of €349.70 million.

Operations: The company's revenue segment is primarily derived from Machine Vision Technology, totaling €113.27 million.

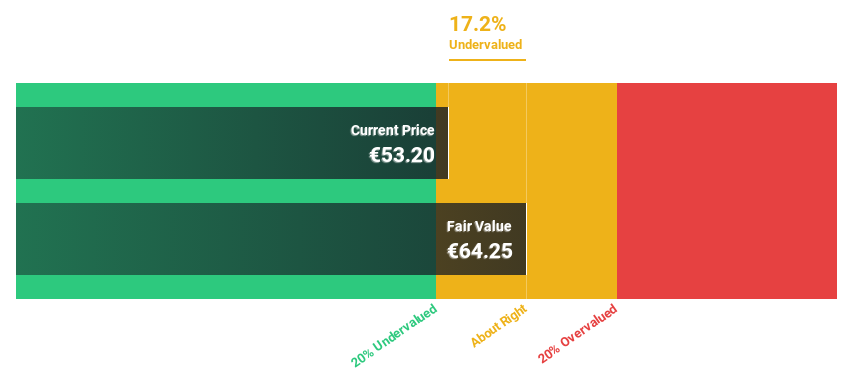

Estimated Discount To Fair Value: 20.5%

Stemmer Imaging is trading at €53.8, below its estimated fair value of €67.66, suggesting it is undervalued by over 20%. Earnings are forecast to grow significantly at 49% annually, outpacing the German market's growth rate. However, recent earnings reports show a decline in sales and profit margins compared to last year. The company's shares are highly illiquid and a delisting process has been initiated with an offer price of €48 per share.

- The growth report we've compiled suggests that Stemmer Imaging's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Stemmer Imaging.

Nagase Brothers (TSE:9733)

Overview: Nagase Brothers Inc. is a company that provides education services in Japan, with a market cap of ¥49.55 billion.

Operations: Revenue Segments (in millions of ¥):

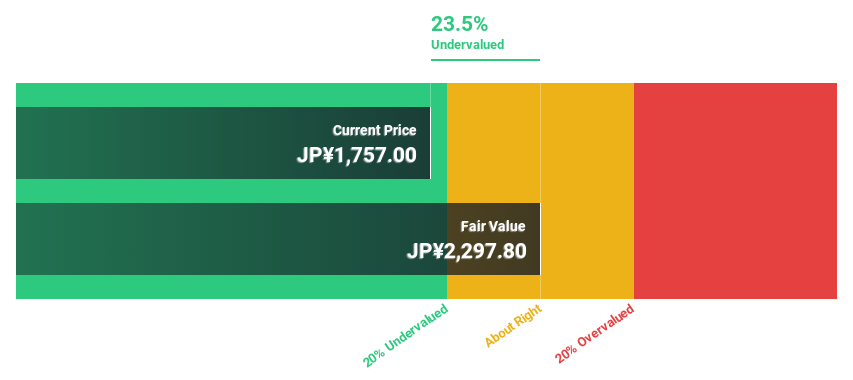

Estimated Discount To Fair Value: 40.9%

Nagase Brothers, trading at ¥1889, is undervalued by over 40% compared to its estimated fair value of ¥3196.28. Despite high debt levels and a dividend yield of 5.29% not covered by earnings, the company shows promising financials with earnings projected to grow significantly at 30.72% annually, surpassing the Japanese market's growth rate. Revenue growth is also expected to exceed market averages but remains moderate at 9.3% per year.

- The analysis detailed in our Nagase Brothers growth report hints at robust future financial performance.

- Take a closer look at Nagase Brothers' balance sheet health here in our report.

Seize The Opportunity

- Reveal the 920 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagase Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9733

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives