- China

- /

- Metals and Mining

- /

- SHSE:603211

Discovering None And 2 Other Hidden Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with the S&P 500 marking its best two-year stretch in decades despite recent economic uncertainties, investors are increasingly turning their attention to small-cap stocks as potential opportunities. In this context, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and adaptability amidst fluctuating economic indicators and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

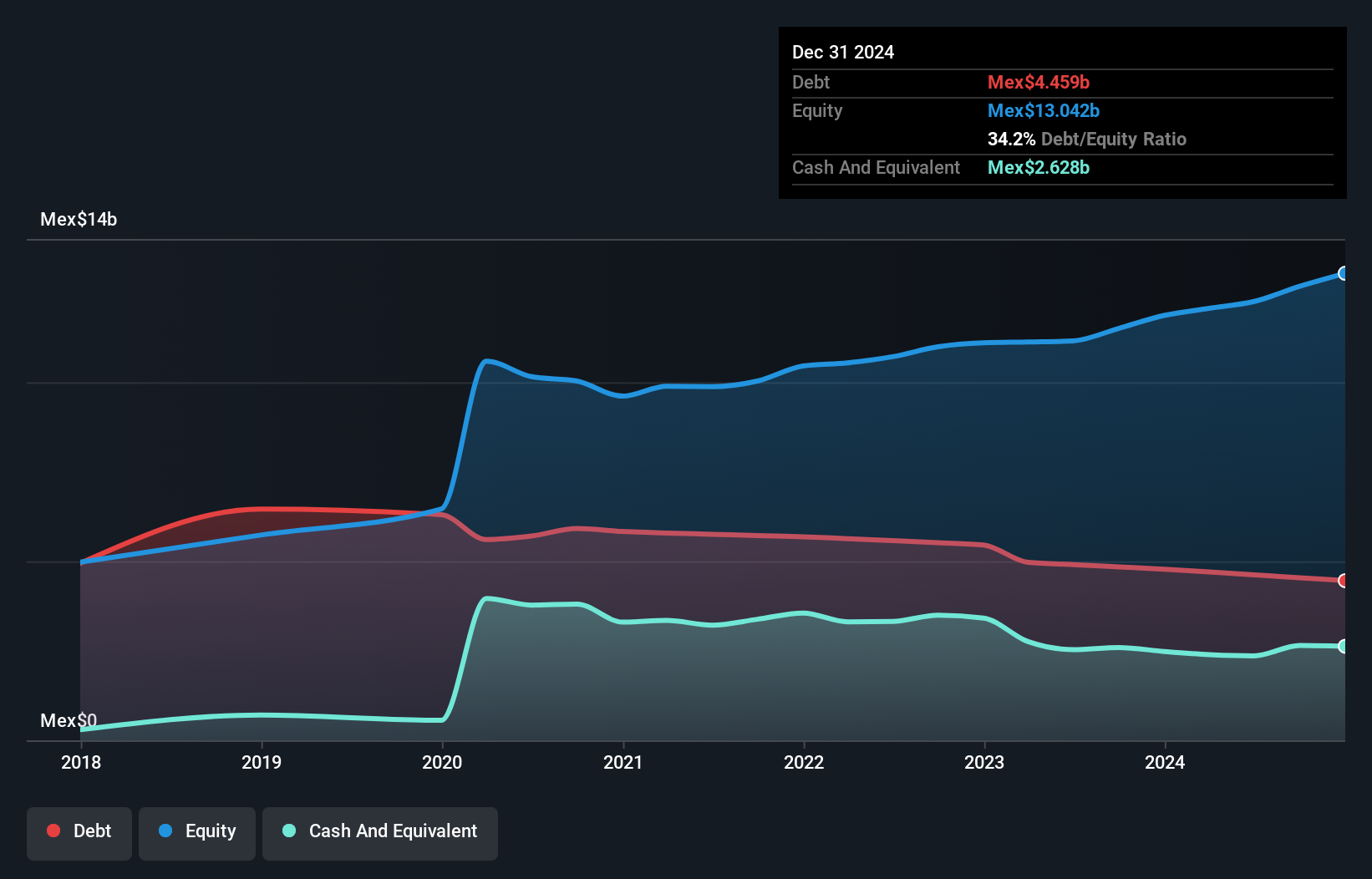

Acosta Verde. de (BMV:GAV A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acosta Verde, S.A.B. de C.V. is a company that develops, manages, and operates shopping centers in Mexico with a market capitalization of MX$10.75 billion.

Operations: Revenue primarily comes from shopping center properties, amounting to MX$1.57 billion.

Acosta Verde's recent performance is noteworthy, with earnings surging by 147% over the past year, significantly outpacing the real estate industry's 21%. The company's net debt to equity ratio stands at a satisfactory 15%, highlighting prudent financial management. Trading at roughly half its estimated fair value suggests potential undervaluation. Despite a large one-off gain of MX$990 million impacting recent results, its interest payments are well covered with an EBIT coverage of 4.2 times. However, liquidity remains a concern due to highly illiquid shares and ongoing acquisition talks with Planigrupo LATAM add an intriguing dimension to its future prospects.

- Take a closer look at Acosta Verde. de's potential here in our health report.

Evaluate Acosta Verde. de's historical performance by accessing our past performance report.

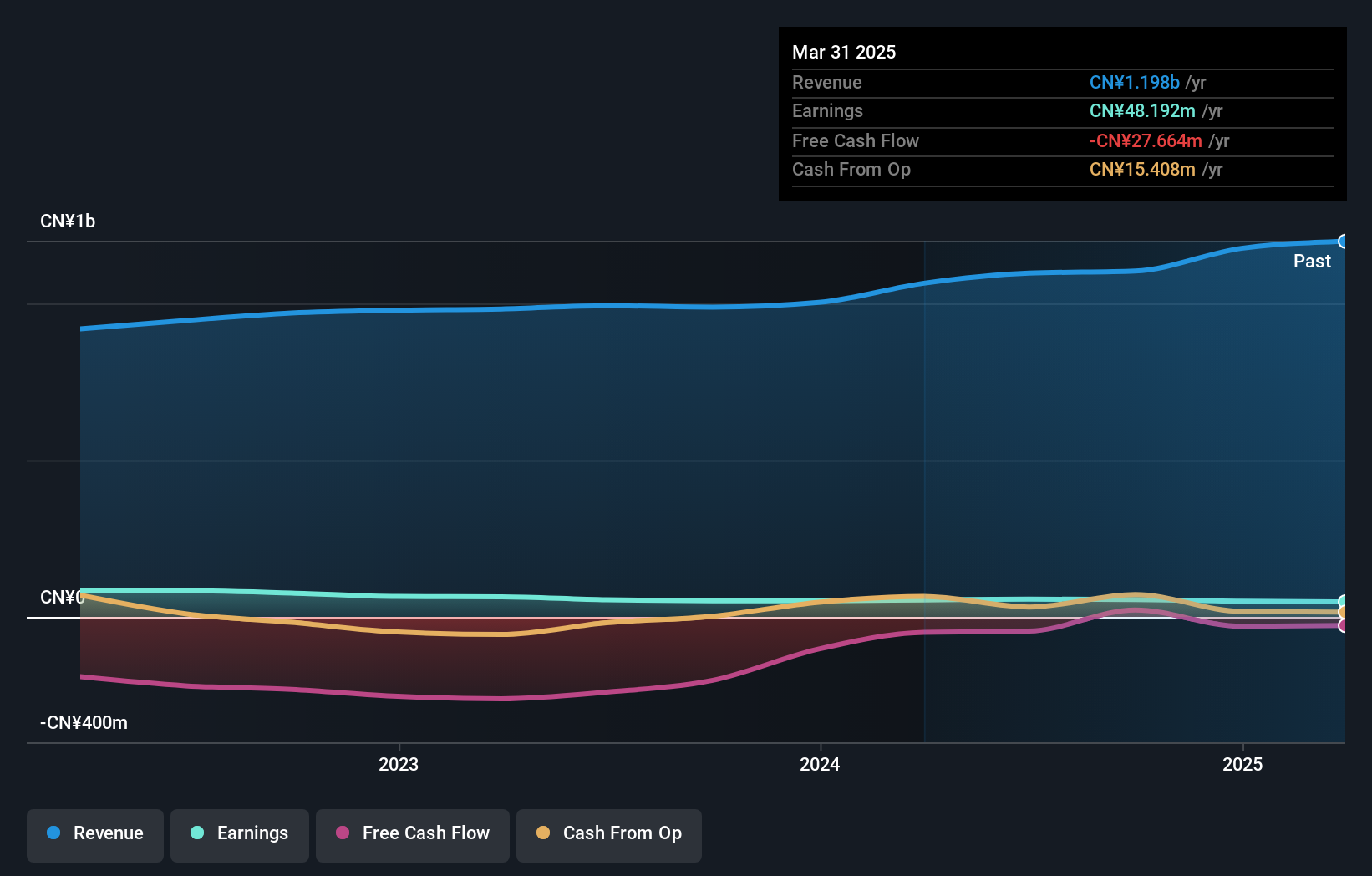

Jintuo Technology (SHSE:603211)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jintuo Technology Co., Ltd. specializes in the research, development, production, and sale of aluminum alloy precision die castings with a market cap of CN¥4.14 billion.

Operations: Jintuo Technology generates revenue primarily through the sale of aluminum alloy precision die castings. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin.

Jintuo Technology, a smaller player in its industry, reported significant financial developments recently. For the nine months ending September 2024, sales reached CNY 829.32 million from last year's CNY 729.18 million, while net income rose to CNY 43.07 million from CNY 38.99 million. Earnings per share improved to CNY 0.16 from CNY 0.14 previously noted in the same period last year, highlighting earnings growth of around 7.8% over the past year despite a broader industry contraction of -2.3%. The company's debt-to-equity ratio increased to a still satisfactory level of 36.6%, suggesting manageable leverage alongside well-covered interest payments by EBIT at a multiple of 5.8x.

- Unlock comprehensive insights into our analysis of Jintuo Technology stock in this health report.

Explore historical data to track Jintuo Technology's performance over time in our Past section.

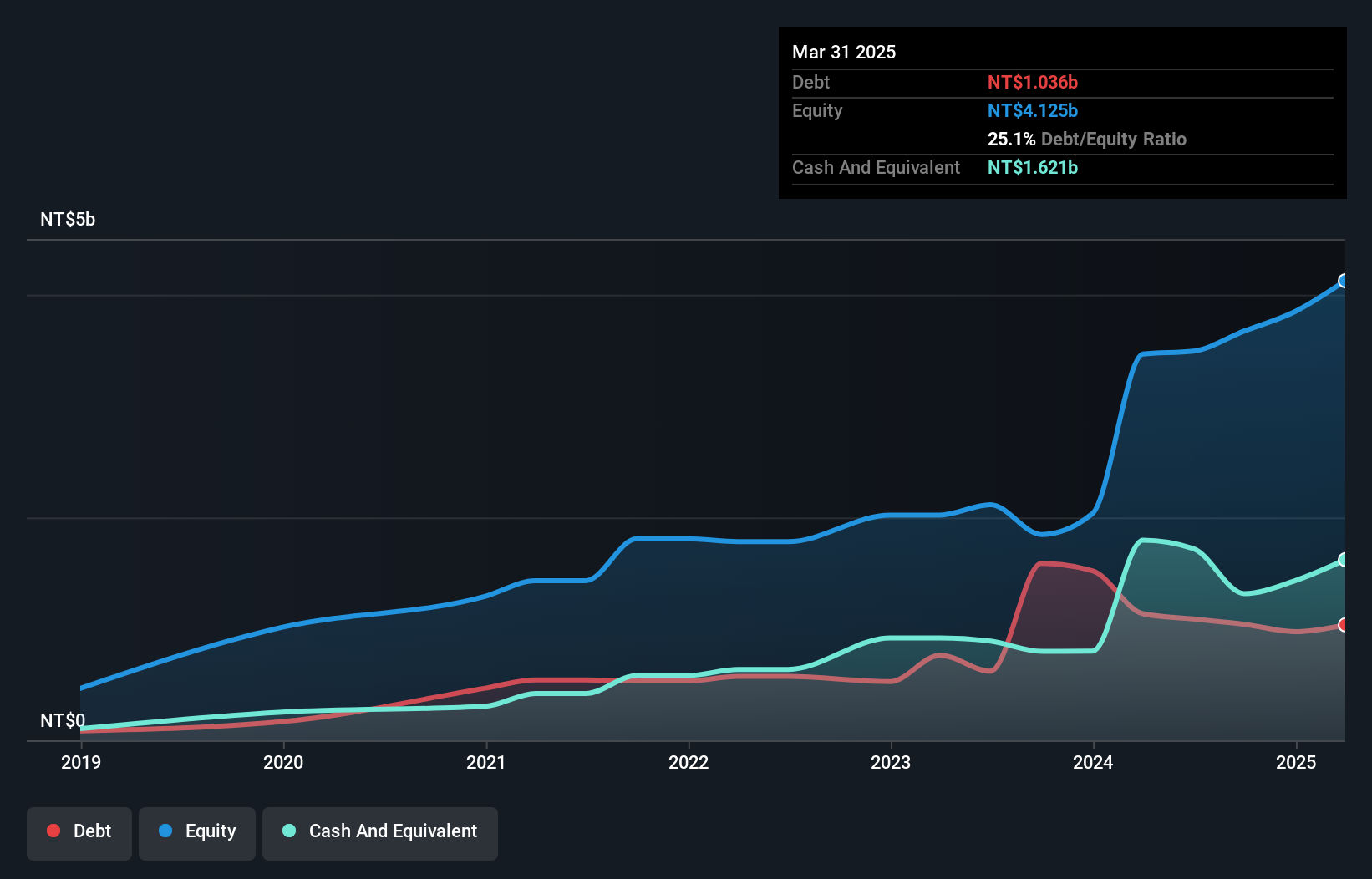

Vizionfocus (TWSE:4771)

Simply Wall St Value Rating: ★★★★★★

Overview: Vizionfocus Inc. is a company that manufactures medical equipment across Taiwan, China, Japan, and the United States with a market capitalization of NT$10.02 billion.

Operations: Vizionfocus generates revenue primarily through its segments, with VIZIONFOCUS contributing NT$1.89 billion and Jiangsu Vision adding NT$1.23 billion. Adjustments and write-offs amount to a negative NT$78.30 million, impacting the overall financials.

Vizionfocus, a nimble player in the medical equipment sector, has been making waves with its impressive earnings growth of 40.8% over the past year, outpacing the industry average of 5%. The company boasts a price-to-earnings ratio of 14.6x, which is attractively lower than the Taiwan market's average of 20.9x. Despite facing legal challenges regarding patent infringement claims from Pegavision Corporation in late 2024, Vizionfocus remains financially robust with more cash than total debt and well-covered interest payments at an impressive EBIT coverage ratio of 69.3x. However, shareholder dilution occurred recently and net income for Q3 was TWD 144 million compared to TWD 171 million last year.

- Click here to discover the nuances of Vizionfocus with our detailed analytical health report.

Review our historical performance report to gain insights into Vizionfocus''s past performance.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4656 more companies for you to explore.Click here to unveil our expertly curated list of 4659 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603211

Jintuo Technology

Engages in the research, development, production, and sale of aluminum alloy precision die castings.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion