Stock Analysis

Potential Upside For Orbia Advance Corporation, S.A.B. de C.V. (BMV:ORBIA) Not Without Risk

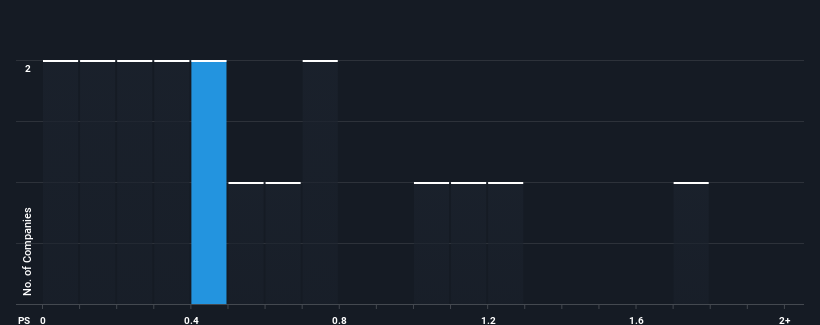

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Chemicals industry in Mexico, you could be forgiven for feeling indifferent about Orbia Advance Corporation, S.A.B. de C.V.'s (BMV:ORBIA) P/S ratio of 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Orbia Advance Corporation. de

What Does Orbia Advance Corporation. de's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Orbia Advance Corporation. de has been doing relatively well. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Orbia Advance Corporation. de's future stacks up against the industry? In that case, our free report is a great place to start.How Is Orbia Advance Corporation. de's Revenue Growth Trending?

Orbia Advance Corporation. de's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 6.9% as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 4.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Orbia Advance Corporation. de's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Orbia Advance Corporation. de currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 3 warning signs for Orbia Advance Corporation. de (1 shouldn't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Orbia Advance Corporation. de is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:ORBIA *

Good value with moderate growth potential.