- Mexico

- /

- Metals and Mining

- /

- BMV:ICH B

Earnings Tell The Story For Industrias CH, S. A. B. de C. V. (BMV:ICHB)

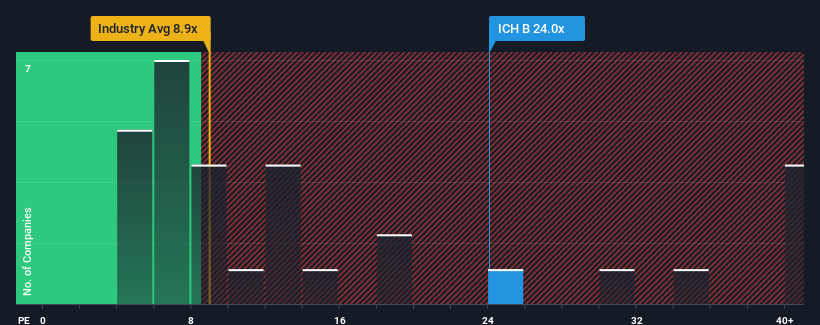

Industrias CH, S. A. B. de C. V.'s (BMV:ICHB) price-to-earnings (or "P/E") ratio of 24x might make it look like a strong sell right now compared to the market in Mexico, where around half of the companies have P/E ratios below 13x and even P/E's below 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Industrias CH S. A. B. de C. V's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Industrias CH S. A. B. de C. V

How Is Industrias CH S. A. B. de C. V's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Industrias CH S. A. B. de C. V's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 62%. Still, the latest three year period has seen an excellent 650% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 10% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Industrias CH S. A. B. de C. V is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Industrias CH S. A. B. de C. V's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Industrias CH S. A. B. de C. V revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Industrias CH S. A. B. de C. V, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Industrias CH S. A. B. de C. V, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:ICH B

Industrias CH S. A. B. de C. V

Through its subsidiaries, engages in the production and processing of steel in Mexico and North America.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives