- Mexico

- /

- Oil and Gas

- /

- BMV:VISTA A

Optimistic Investors Push Vista Energy, S.A.B. de C.V. (BMV:VISTAA) Shares Up 27% But Growth Is Lacking

Vista Energy, S.A.B. de C.V. (BMV:VISTAA) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

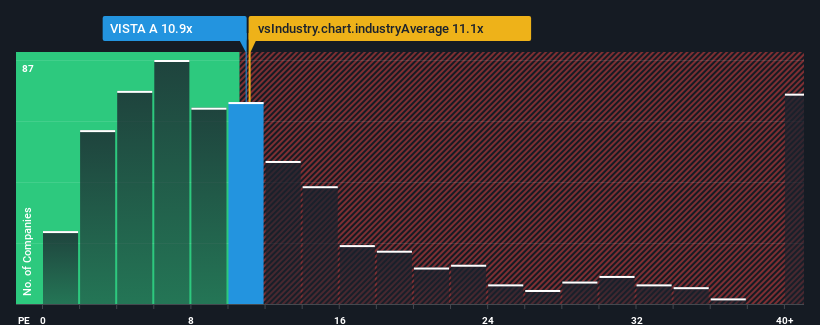

Although its price has surged higher, you could still be forgiven for feeling indifferent about Vista Energy. de's P/E ratio of 10.9x, since the median price-to-earnings (or "P/E") ratio in Mexico is also close to 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Vista Energy. de certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Vista Energy. de

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Vista Energy. de's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. Pleasingly, EPS has also lifted 559% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 18% during the coming year according to the nine analysts following the company. Meanwhile, the broader market is forecast to expand by 15%, which paints a poor picture.

In light of this, it's somewhat alarming that Vista Energy. de's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

Vista Energy. de's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Vista Energy. de currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Vista Energy. de (at least 2 which make us uncomfortable), and understanding these should be part of your investment process.

You might be able to find a better investment than Vista Energy. de. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VISTA A

Vista Energy. de

Through its subsidiaries, engages in the exploration and production of oil and gas in Latin America.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives