- Mexico

- /

- Capital Markets

- /

- BMV:ACTINVR B

How Does Corporación Actinver, S. A. B. de C. V. (BMV:ACTINVRB) Stand Up To These Simple Dividend Safety Checks?

Is Corporación Actinver, S. A. B. de C. V. (BMV:ACTINVRB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

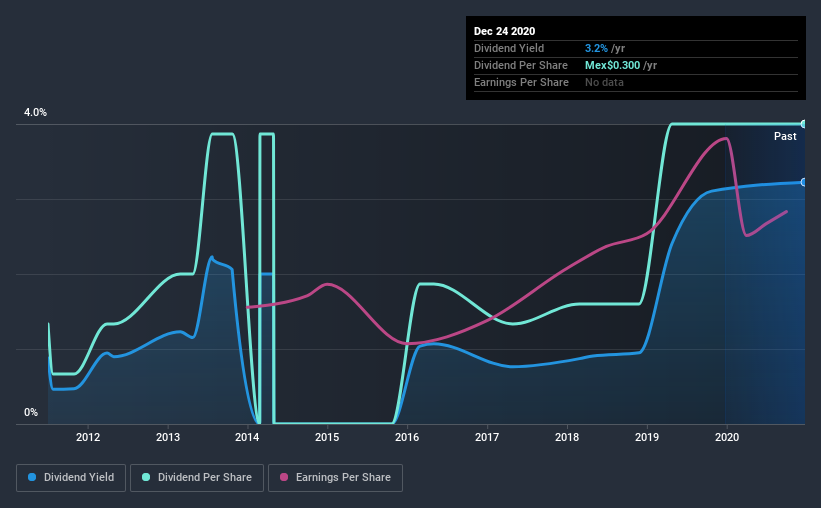

With a nine-year payment history and a 3.2% yield, many investors probably find Corporación Actinver S. A. B. de C. V intriguing. It sure looks interesting on these metrics - but there's always more to the story. The company also bought back stock during the year, equivalent to approximately 3.0% of the company's market capitalisation at the time. Some simple analysis can reduce the risk of holding Corporación Actinver S. A. B. de C. V for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Corporación Actinver S. A. B. de C. V!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Corporación Actinver S. A. B. de C. V paid out 24% of its profit as dividends, over the trailing twelve month period. With a low payout ratio, it looks like the dividend is comprehensively covered by earnings.

We update our data on Corporación Actinver S. A. B. de C. V every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The first recorded dividend for Corporación Actinver S. A. B. de C. V, in the last decade, was nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was Mex$0.1 in 2011, compared to Mex$0.3 last year. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. The dividends haven't grown at precisely 13% every year, but this is a useful way to average out the historical rate of growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Corporación Actinver S. A. B. de C. V has a low and conservative payout ratio. Second, earnings have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. Corporación Actinver S. A. B. de C. V might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Corporación Actinver S. A. B. de C. V that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Corporación Actinver S. A. B. de C. V, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:ACTINVR B

Corporación Actinver S. A. B. de C. V

Through its subsidiaries, provides financial and investment banking services for individuals and businesses in Mexico and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success