- Mexico

- /

- Food and Staples Retail

- /

- BMV:SORIANA B

Some Confidence Is Lacking In Organización Soriana, S. A. B. de C. V.'s (BMV:SORIANAB) P/E

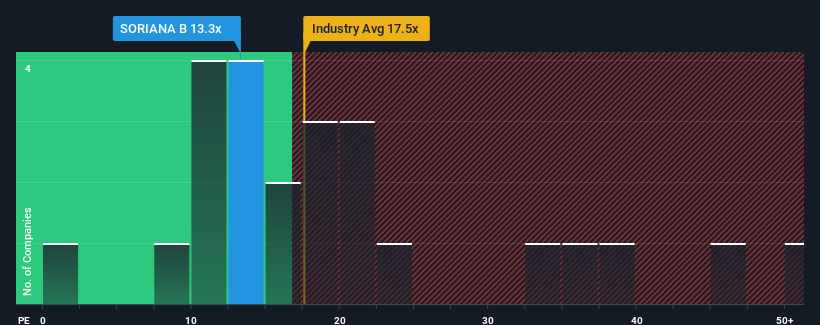

It's not a stretch to say that Organización Soriana, S. A. B. de C. V.'s (BMV:SORIANAB) price-to-earnings (or "P/E") ratio of 13.3x right now seems quite "middle-of-the-road" compared to the market in Mexico, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Organización Soriana S. A. B. de C. V as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Organización Soriana S. A. B. de C. V

Is There Some Growth For Organización Soriana S. A. B. de C. V?

There's an inherent assumption that a company should be matching the market for P/E ratios like Organización Soriana S. A. B. de C. V's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 48% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 4.8% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 9.5% per annum growth forecast for the broader market.

In light of this, it's curious that Organización Soriana S. A. B. de C. V's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Organización Soriana S. A. B. de C. V's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Organización Soriana S. A. B. de C. V with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:SORIANA B

Organización Soriana S. A. B. de C. V

Operates various formats of stores and clubs in Mexico.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives