- Mexico

- /

- Food and Staples Retail

- /

- BMV:SORIANA B

Organización Soriana S. A. B. de C. V's (BMV:SORIANAB) Stock Price Has Reduced 58% In The Past Five Years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example, after five long years the Organización Soriana, S. A. B. de C. V. (BMV:SORIANAB) share price is a whole 58% lower. We certainly feel for shareholders who bought near the top. There was little comfort for shareholders in the last week as the price declined a further 3.4%.

See our latest analysis for Organización Soriana S. A. B. de C. V

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

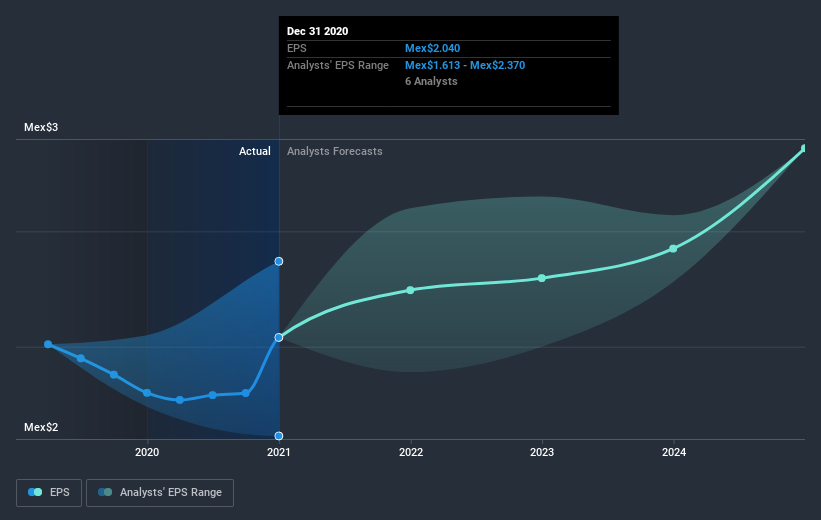

During the five years over which the share price declined, Organización Soriana S. A. B. de C. V's earnings per share (EPS) dropped by 0.3% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 16% per year, over the period. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 8.50.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Organización Soriana S. A. B. de C. V has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

While the broader market gained around 22% in the last year, Organización Soriana S. A. B. de C. V shareholders lost 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before forming an opinion on Organización Soriana S. A. B. de C. V you might want to consider these 3 valuation metrics.

We will like Organización Soriana S. A. B. de C. V better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you’re looking to trade Organización Soriana S. A. B. de C. V, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:SORIANA B

Organización Soriana S. A. B. de C. V

Operates various formats of stores and clubs in Mexico.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives