Can Mixed Fundamentals Have A Negative Impact on MaltaPost p.l.c. (MTSE:MTP) Current Share Price Momentum?

Most readers would already be aware that MaltaPost's (MTSE:MTP) stock increased significantly by 11% over the past week. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Specifically, we decided to study MaltaPost's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for MaltaPost is:

9.7% = €3.2m ÷ €33m (Based on the trailing twelve months to March 2025).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.10 in profit.

See our latest analysis for MaltaPost

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of MaltaPost's Earnings Growth And 9.7% ROE

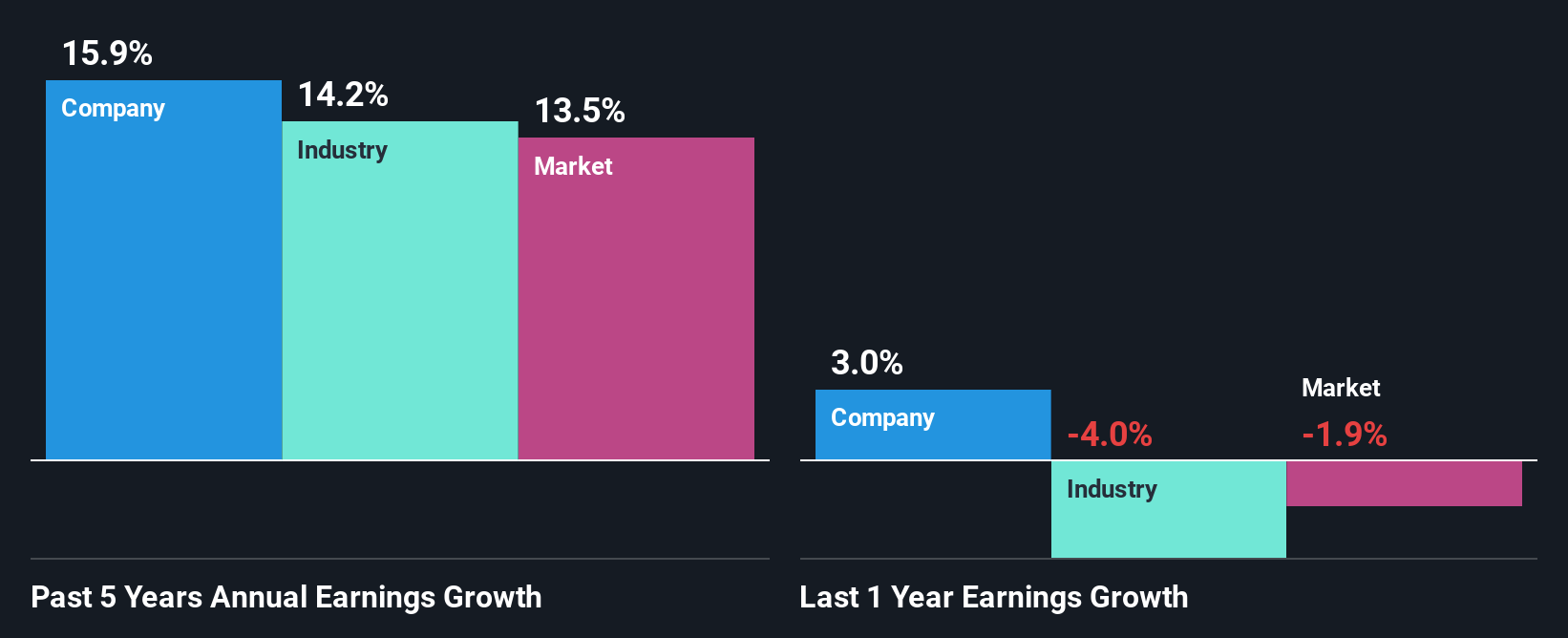

When you first look at it, MaltaPost's ROE doesn't look that attractive. Next, when compared to the average industry ROE of 17%, the company's ROE leaves us feeling even less enthusiastic. MaltaPost was still able to see a decent net income growth of 16% over the past five years. So, the growth in the company's earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared MaltaPost's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 14% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about MaltaPost's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is MaltaPost Using Its Retained Earnings Effectively?

The really high three-year median payout ratio of 125% for MaltaPost suggests that the company is paying its shareholders more than what it is earning. Still the company's earnings have grown respectably. It would still be worth keeping an eye on that high payout ratio, if for some reason the company runs into problems and business deteriorates. Our risks dashboard should have the 3 risks we have identified for MaltaPost.

Additionally, MaltaPost has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

Overall, we have mixed feelings about MaltaPost. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into MaltaPost's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:MTP

MaltaPost

Provides postal and financial services in Malta and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success