Here's Why Shareholders Should Examine BMIT Technologies p.l.c.'s (MTSE:BMIT) CEO Compensation Package More Closely

Key Insights

- BMIT Technologies will host its Annual General Meeting on 29th of May

- Total pay for CEO Christian Sammut includes €150.9k salary

- Total compensation is 39% above industry average

- Over the past three years, BMIT Technologies' EPS fell by 0.2% and over the past three years, the total loss to shareholders 12%

Shareholders will probably not be too impressed with the underwhelming results at BMIT Technologies p.l.c. (MTSE:BMIT) recently. At the upcoming AGM on 29th of May, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for BMIT Technologies

How Does Total Compensation For Christian Sammut Compare With Other Companies In The Industry?

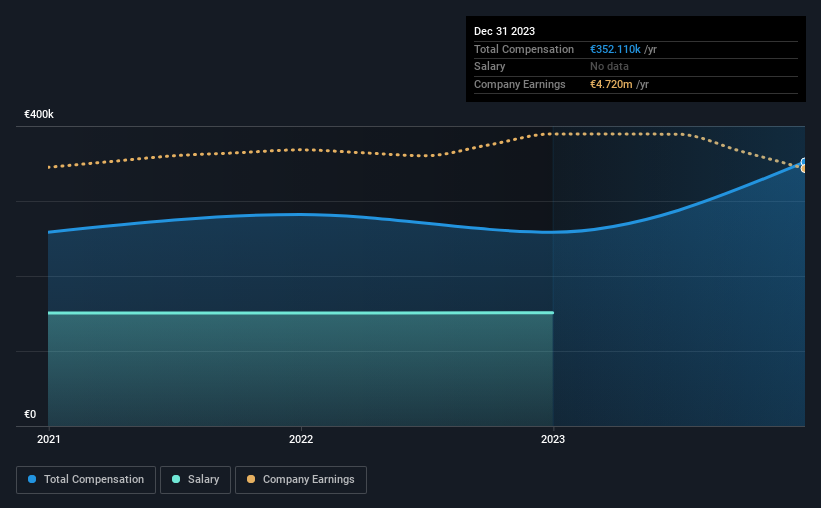

According to our data, BMIT Technologies p.l.c. has a market capitalization of €71m, and paid its CEO total annual compensation worth €352k over the year to December 2023. We note that's an increase of 36% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €151k.

For comparison, other companies in the Europe IT industry with market capitalizations below €185m, reported a median total CEO compensation of €254k. This suggests that Christian Sammut is paid more than the median for the industry.

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. BMIT Technologies pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

BMIT Technologies p.l.c.'s Growth

Over the last three years, BMIT Technologies p.l.c. has not seen its earnings per share change much, though they have deteriorated slightly. It achieved revenue growth of 11% over the last year.

Its a bit disappointing to see that the company has failed to grow its EPS. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has BMIT Technologies p.l.c. Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in BMIT Technologies p.l.c. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for BMIT Technologies you should be aware of, and 3 of them are potentially serious.

Important note: BMIT Technologies is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if BMIT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:BMIT

BMIT Technologies

Provides digital infrastructure and managed services in Malta.

Medium-low risk and fair value.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

Tesla, Inc. (TSLA): The Autonomy Transition – From "Car Maker" to "AI Utility" in 2026.

Comfort Systems USA Inc. (FIX): The Data Center Vanguard – Powering the AI Physical Layer in 2026.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks