- Malta

- /

- Food and Staples Retail

- /

- MTSE:MZ

Most Shareholders Will Probably Find That The Compensation For M&Z p.l.c.'s (MTSE:MZ) CEO Is Reasonable

Key Insights

- M&Z will host its Annual General Meeting on 4th of June

- Total pay for CEO Greta Avallone includes €79.2k salary

- The total compensation is 61% less than the average for the industry

- Over the past three years, M&Z's EPS grew by 4.1% and over the past three years, the total loss to shareholders 19%

Shareholders may be wondering what CEO Greta Avallone plans to do to improve the less than great performance at M&Z p.l.c. (MTSE:MZ) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 4th of June. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for M&Z

How Does Total Compensation For Greta Avallone Compare With Other Companies In The Industry?

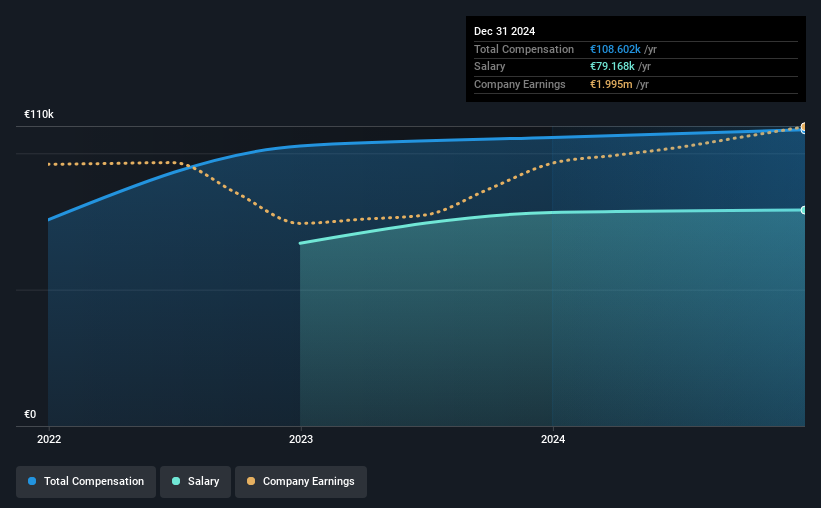

Our data indicates that M&Z p.l.c. has a market capitalization of €24m, and total annual CEO compensation was reported as €109k for the year to December 2024. This means that the compensation hasn't changed much from last year. In particular, the salary of €79.2k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Europe Consumer Retailing industry with market capitalizations under €177m, the reported median total CEO compensation was €280k. In other words, M&Z pays its CEO lower than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €79k | €78k | 73% |

| Other | €29k | €28k | 27% |

| Total Compensation | €109k | €106k | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. According to our research, M&Z has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at M&Z p.l.c.'s Growth Numbers

M&Z p.l.c. has seen its earnings per share (EPS) increase by 4.1% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has M&Z p.l.c. Been A Good Investment?

With a three year total loss of 19% for the shareholders, M&Z p.l.c. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The lacklustre earnings growth perhaps may have something to do with the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for M&Z (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:MZ

M&Z

Engages in sourcing, importation, distribution, and marketing of products for the retail and catering industry.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion