- South Korea

- /

- Electric Utilities

- /

- KOSE:A015760

Korea Electric Power Corporation's (KRX:015760) P/S Is Still On The Mark Following 26% Share Price Bounce

Korea Electric Power Corporation (KRX:015760) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 60%.

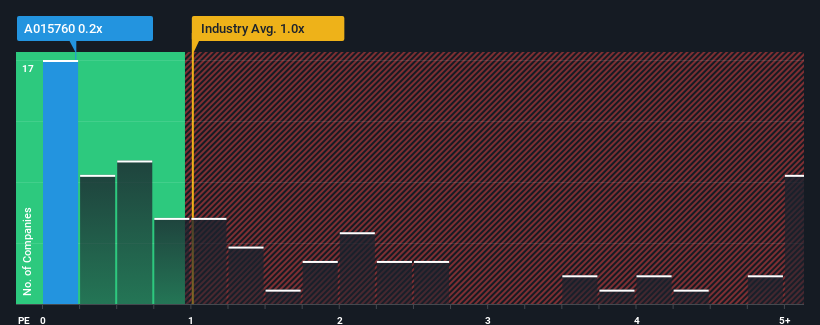

In spite of the firm bounce in price, there still wouldn't be many who think Korea Electric Power's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Korea's Electric Utilities industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 2 warning signs about Korea Electric Power. View them for free.View our latest analysis for Korea Electric Power

What Does Korea Electric Power's P/S Mean For Shareholders?

There hasn't been much to differentiate Korea Electric Power's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Korea Electric Power will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Korea Electric Power?

In order to justify its P/S ratio, Korea Electric Power would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.9% last year. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 1.8% per annum over the next three years. That's shaping up to be similar to the 2.4% each year growth forecast for the broader industry.

With this information, we can see why Korea Electric Power is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Korea Electric Power's P/S Mean For Investors?

Korea Electric Power's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Korea Electric Power's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electric Utilities industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Korea Electric Power (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Korea Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A015760

Korea Electric Power

An integrated electric utility company, engages in the generation, transmission, and distribution of electricity in South Korea and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives