- Thailand

- /

- Auto Components

- /

- SET:TSC

Discover 3 Leading Dividend Stocks Yielding Up To 7.9%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with major indices reflecting both gains and declines, investors are keenly evaluating opportunities amidst fluctuating economic indicators. Despite recent contractions in manufacturing activity and revised GDP forecasts, the broader market has demonstrated resilience with notable annual gains in key indices like the S&P 500 and Nasdaq Composite. In such an environment, dividend stocks can offer a compelling investment avenue by providing steady income streams even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

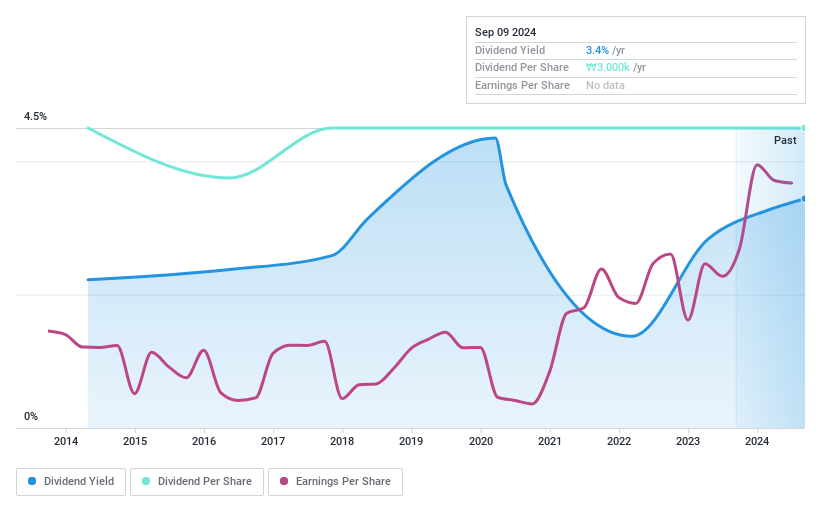

SamchullyLtd (KOSE:A004690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samchully Co., Ltd. supplies natural gas in South Korea and the United States, with a market cap of ₩310.22 billion.

Operations: Samchully Co., Ltd. generates revenue through its operations in the natural gas supply sector across South Korea and the United States.

Dividend Yield: 3.3%

Samchully Ltd.'s dividend payments have been stable yet unreliable over the past decade, with no growth observed. Despite a low yield of 3.31%, compared to the top 25% in South Korea, dividends are well-covered by earnings and cash flows due to low payout ratios (9.3% and 5.8%, respectively). However, large one-off items affect financial results, impacting overall earnings quality. The stock is trading significantly below its estimated fair value, suggesting potential undervaluation.

- Get an in-depth perspective on SamchullyLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of SamchullyLtd shares in the market.

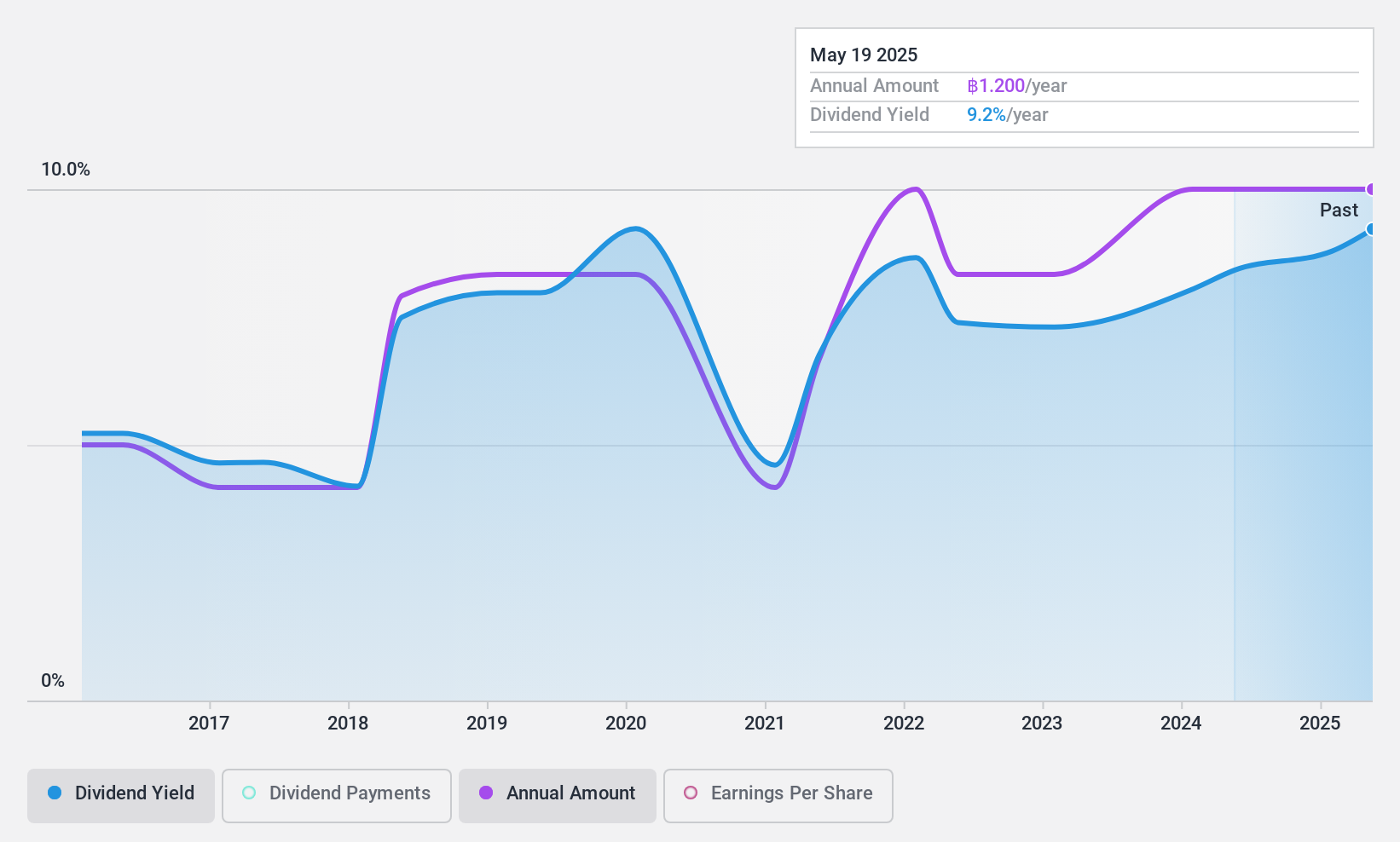

Thai Steel Cable (SET:TSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Steel Cable Public Company Limited manufactures and distributes automobile and motorcycle control cables, as well as automobile window regulators in Thailand, with a market cap of ฿3.92 billion.

Operations: Thai Steel Cable's revenue is primarily derived from its control cables for automobiles and motorcycles, and automobile window regulators, totaling ฿2.68 billion.

Dividend Yield: 7.9%

Thai Steel Cable's dividend yield of 7.95% ranks in the top 25% of Thai market payers but is not well covered by earnings, with a high payout ratio of 105.6%. Although net income rose to THB 295.22 million from THB 278.6 million, dividends remain volatile over the past decade despite some growth. The company's cash payout ratio stands at a manageable 75%, yet overall sustainability concerns persist due to inconsistent dividend history and coverage issues.

- Delve into the full analysis dividend report here for a deeper understanding of Thai Steel Cable.

- Insights from our recent valuation report point to the potential overvaluation of Thai Steel Cable shares in the market.

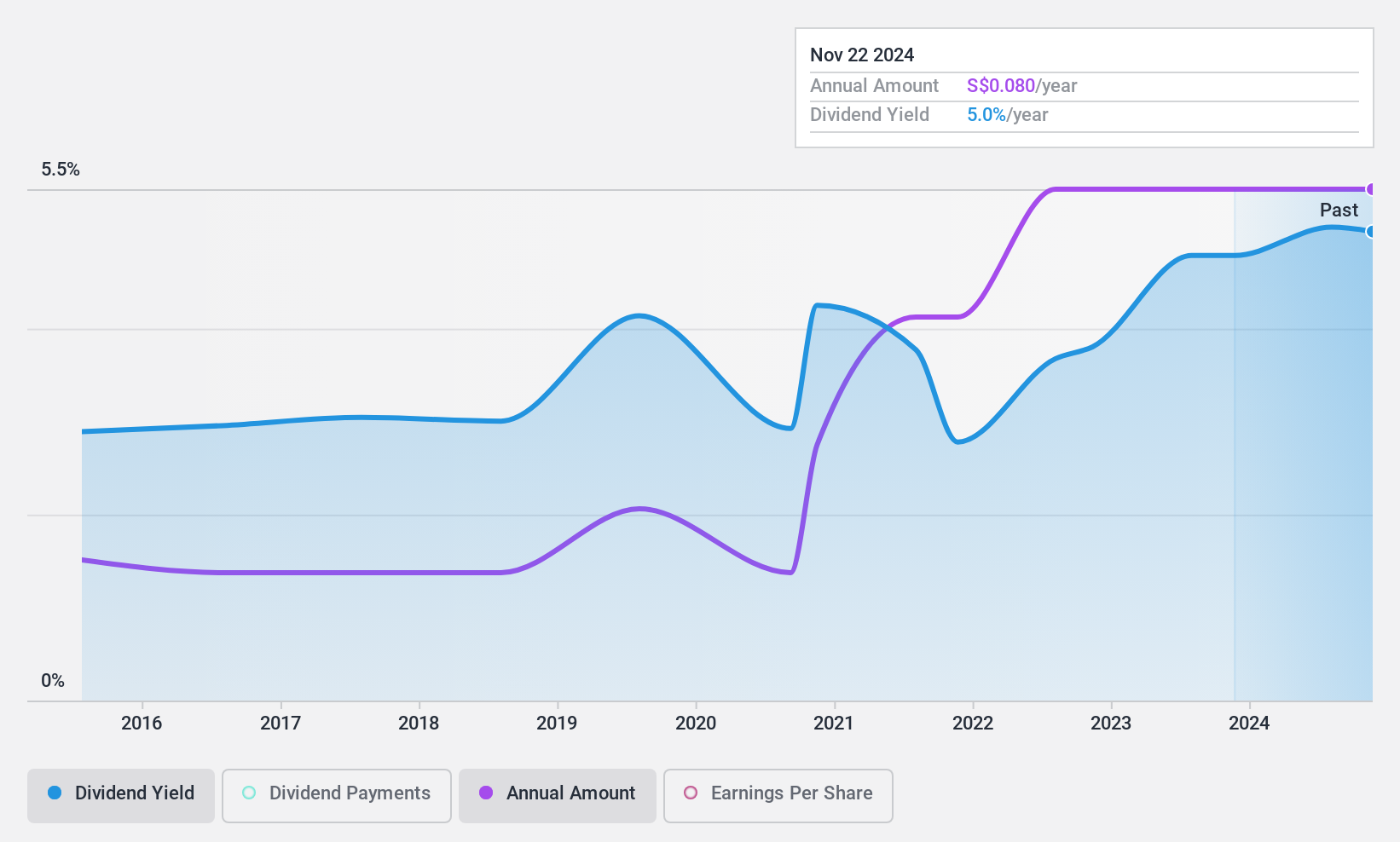

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.01 billion.

Operations: The Hour Glass Limited generates revenue of SGD1.11 billion from its retailing and distribution activities in watches, jewelry, and other luxury products.

Dividend Yield: 5.1%

Hour Glass's dividend history has been volatile, with payments increasing over the past decade but remaining unreliable. Despite a low payout ratio of 37% and a cash payout ratio of 46.5%, which indicate dividends are well covered by earnings and cash flows, the yield is below top-tier levels in Singapore's market. Recent interim dividend declarations suggest commitment to shareholder returns, although net income decreased to S$61.42 million from S$77.01 million year-on-year, reflecting potential pressure on future payouts.

- Click to explore a detailed breakdown of our findings in Hour Glass' dividend report.

- According our valuation report, there's an indication that Hour Glass' share price might be on the expensive side.

Turning Ideas Into Actions

- Dive into all 1982 of the Top Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thai Steel Cable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TSC

Thai Steel Cable

Manufactures and distributes automobile and motorcycle control cables, and automobile window regulators in Thailand.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives