- South Korea

- /

- Electric Utilities

- /

- KOSDAQ:A453450

Gridwiz Co.,Ltd.'s (KOSDAQ:453450) 29% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Gridwiz Co.,Ltd. (KOSDAQ:453450) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

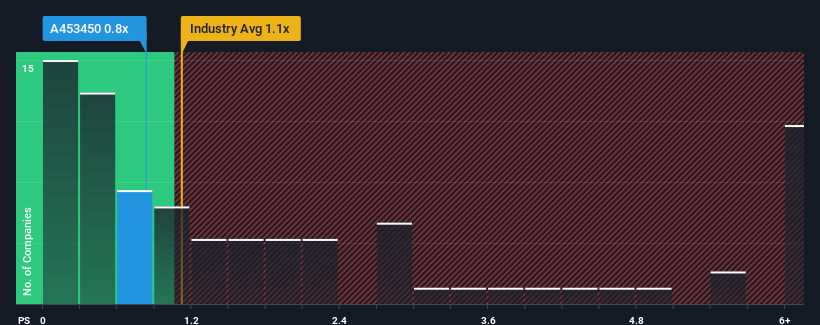

In spite of the heavy fall in price, when almost half of the companies in Korea's Electric Utilities industry have price-to-sales ratios (or "P/S") below 0.2x, you may still consider GridwizLtd as a stock probably not worth researching with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for GridwizLtd

How Has GridwizLtd Performed Recently?

While the industry has experienced revenue growth lately, GridwizLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think GridwizLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For GridwizLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like GridwizLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 4.9% over the next year. With the industry predicted to deliver 7.2% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that GridwizLtd's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Despite the recent share price weakness, GridwizLtd's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for GridwizLtd, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for GridwizLtd that you should be aware of.

If these risks are making you reconsider your opinion on GridwizLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A453450

GridwizLtd

Gridwiz Co., Ltd provides charging infrastructure management services and authentication cloud platform for the plug and charge services.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion