Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies HMM Co.,Ltd (KRX:011200) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does HMMLtd Carry?

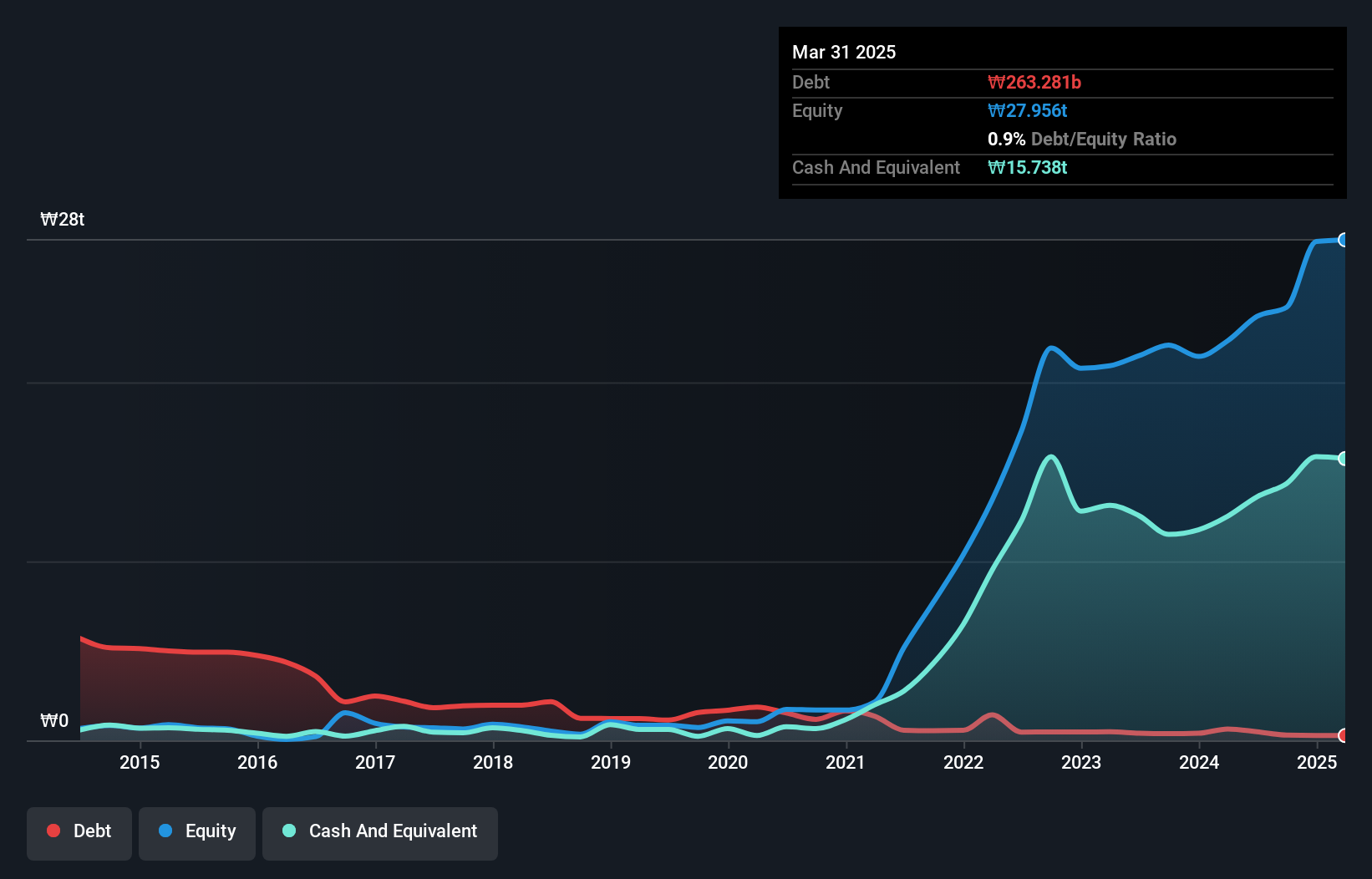

As you can see below, HMMLtd had ₩263.3b of debt at March 2025, down from ₩632.0b a year prior. But it also has ₩16t in cash to offset that, meaning it has ₩15t net cash.

How Strong Is HMMLtd's Balance Sheet?

The latest balance sheet data shows that HMMLtd had liabilities of ₩2.72t due within a year, and liabilities of ₩3.59t falling due after that. Offsetting this, it had ₩16t in cash and ₩1.41t in receivables that were due within 12 months. So it can boast ₩11t more liquid assets than total liabilities.

This luscious liquidity implies that HMMLtd's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that HMMLtd has more cash than debt is arguably a good indication that it can manage its debt safely.

View our latest analysis for HMMLtd

Better yet, HMMLtd grew its EBIT by 443% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine HMMLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While HMMLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, HMMLtd generated free cash flow amounting to a very robust 90% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that HMMLtd has net cash of ₩15t, as well as more liquid assets than liabilities. And it impressed us with free cash flow of ₩2.5t, being 90% of its EBIT. The bottom line is that HMMLtd's use of debt is absolutely fine. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with HMMLtd (at least 2 which make us uncomfortable) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if HMMLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011200

HMMLtd

An integrated logistics company, provides shipping and logistics services in Japan and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success