- South Korea

- /

- Marine and Shipping

- /

- KOSE:A003280

Here's Why Heung-A ShippingLtd (KRX:003280) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Heung-A Shipping Co.,Ltd. (KRX:003280) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Heung-A ShippingLtd

What Is Heung-A ShippingLtd's Debt?

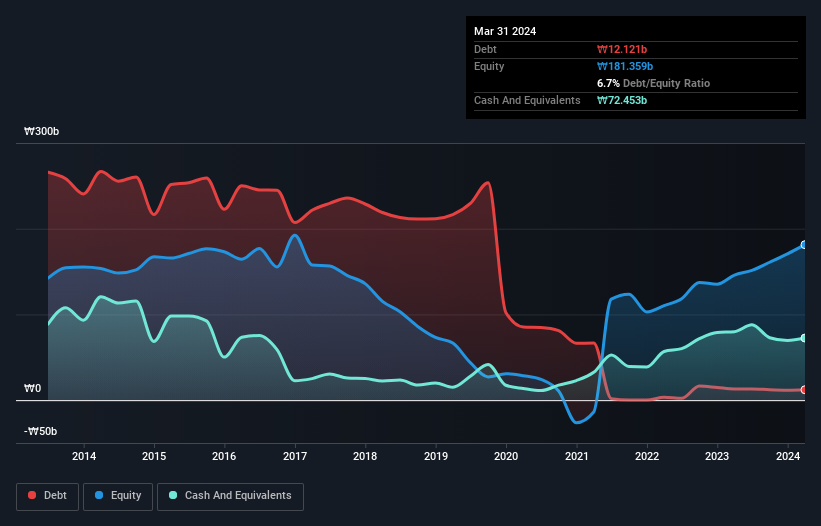

As you can see below, Heung-A ShippingLtd had ₩12.1b of debt at March 2024, down from ₩13.0b a year prior. However, it does have ₩72.5b in cash offsetting this, leading to net cash of ₩60.3b.

How Healthy Is Heung-A ShippingLtd's Balance Sheet?

The latest balance sheet data shows that Heung-A ShippingLtd had liabilities of ₩57.6b due within a year, and liabilities of ₩98.5b falling due after that. Offsetting these obligations, it had cash of ₩72.5b as well as receivables valued at ₩16.0b due within 12 months. So it has liabilities totalling ₩67.7b more than its cash and near-term receivables, combined.

Given Heung-A ShippingLtd has a market capitalization of ₩618.7b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Heung-A ShippingLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Heung-A ShippingLtd's saving grace is its low debt levels, because its EBIT has tanked 50% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is Heung-A ShippingLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Heung-A ShippingLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last two years, Heung-A ShippingLtd recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

Although Heung-A ShippingLtd's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₩60.3b. And it impressed us with free cash flow of ₩18b, being 93% of its EBIT. So we are not troubled with Heung-A ShippingLtd's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Heung-A ShippingLtd has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Heung-A ShippingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003280

Heung-A ShippingLtd

Operates as a marine shipping agency in Korea and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026