- South Korea

- /

- Telecom Services and Carriers

- /

- KOSE:A006490

Further weakness as Inscobee (KRX:006490) drops 16% this week, taking three-year losses to 71%

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Inscobee., Inc. (KRX:006490); the share price is down a whopping 71% in the last three years. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 41% in the last year. The falls have accelerated recently, with the share price down 30% in the last three months.

Since Inscobee has shed ₩19b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Inscobee

Inscobee isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Inscobee saw its revenue grow by 16% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 20% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

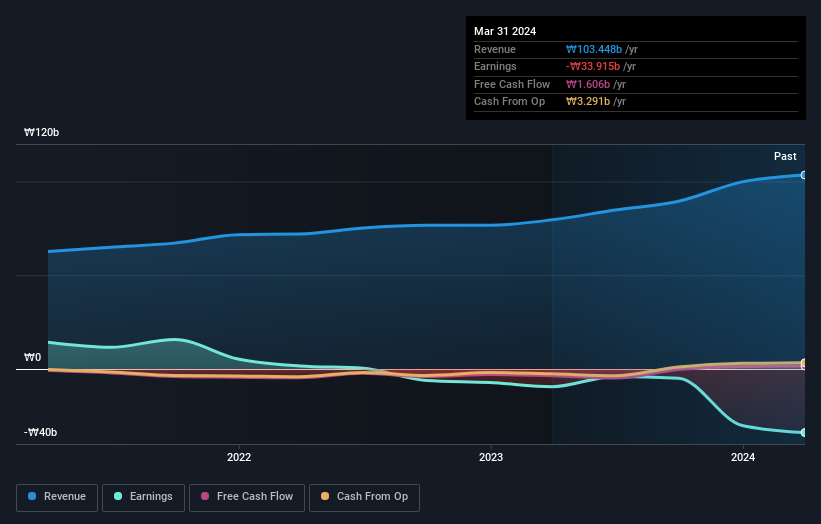

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Inscobee shareholders are down 41% for the year, but the market itself is up 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Inscobee better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Inscobee you should be aware of, and 1 of them is a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006490

Inscobee

Engages in the smart grid, mobile virtual network operator (MVNO), bio, watch, and distribution businesses in South Korea and Hong Kong.

Mediocre balance sheet low.