- South Korea

- /

- Telecom Services and Carriers

- /

- KOSDAQ:A093320

KINX, Inc.'s (KOSDAQ:093320) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

KINX (KOSDAQ:093320) has had a rough three months with its share price down 20%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study KINX's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for KINX

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for KINX is:

11% = ₩22b ÷ ₩198b (Based on the trailing twelve months to March 2024).

The 'return' is the profit over the last twelve months. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

KINX's Earnings Growth And 11% ROE

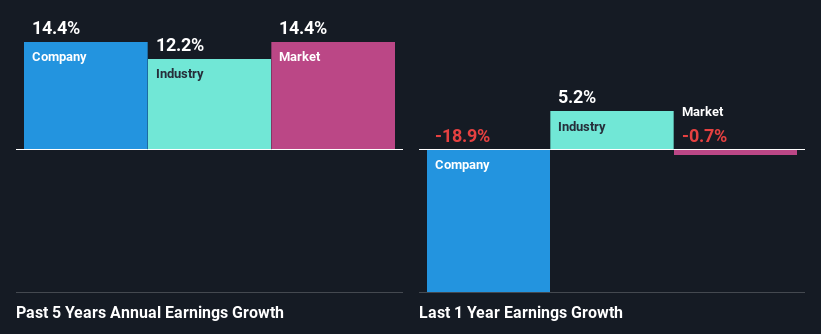

To begin with, KINX seems to have a respectable ROE. On comparing with the average industry ROE of 7.0% the company's ROE looks pretty remarkable. This probably laid the ground for KINX's moderate 14% net income growth seen over the past five years.

Next, on comparing KINX's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 12% over the last few years.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if KINX is trading on a high P/E or a low P/E, relative to its industry.

Is KINX Using Its Retained Earnings Effectively?

KINX's three-year median payout ratio to shareholders is 13% (implying that it retains 87% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Moreover, KINX is determined to keep sharing its profits with shareholders which we infer from its long history of five years of paying a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 13%. As a result, KINX's ROE is not expected to change by much either, which we inferred from the analyst estimate of 11% for future ROE.

Conclusion

In total, we are pretty happy with KINX's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if KINX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A093320

KINX

Engages in the provision of Internet exchange (IX) services to various carriers, content providers, multiple system operators, financial institutions, and government agencies in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026