- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A353200

Investors Appear Satisfied With DAEDUCK ELECTRONICS Co., Ltd.'s (KRX:353200) Prospects As Shares Rocket 26%

Despite an already strong run, DAEDUCK ELECTRONICS Co., Ltd. (KRX:353200) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

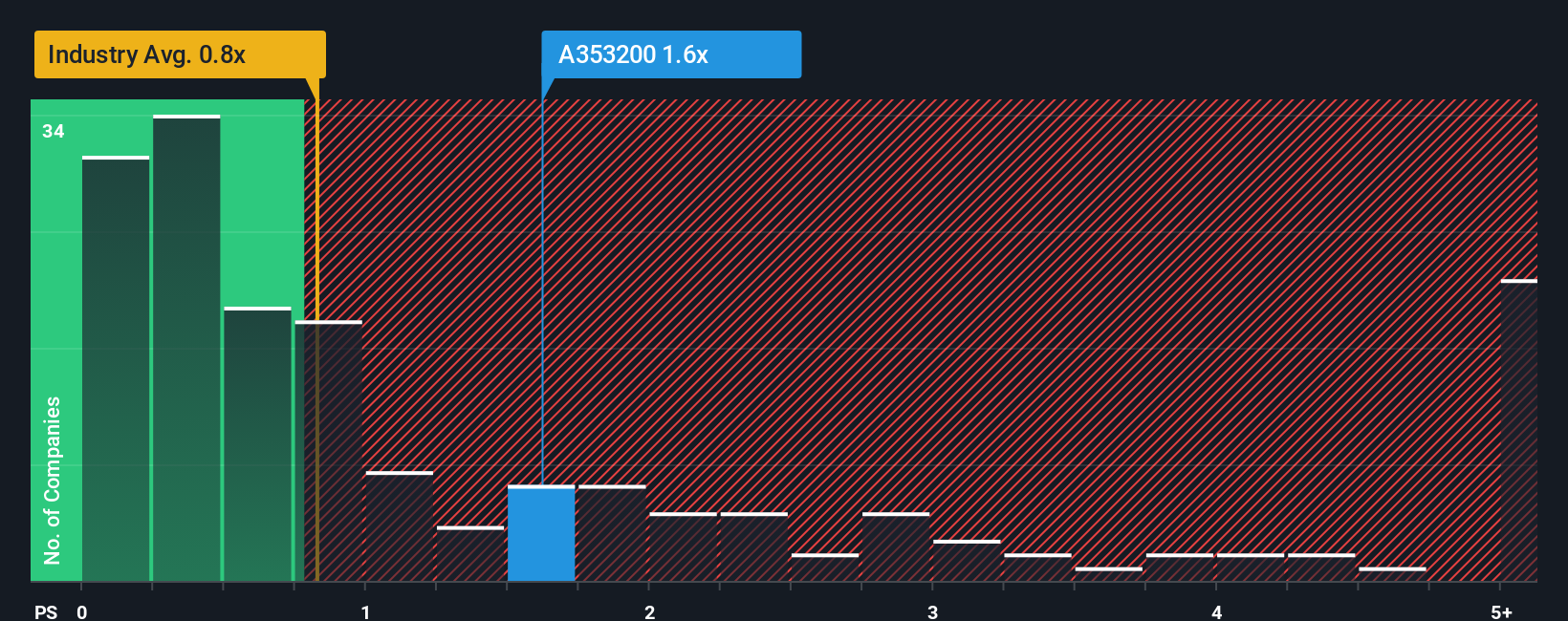

Following the firm bounce in price, when almost half of the companies in Korea's Electronic industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider DAEDUCK ELECTRONICS as a stock probably not worth researching with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for DAEDUCK ELECTRONICS

How DAEDUCK ELECTRONICS Has Been Performing

DAEDUCK ELECTRONICS has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DAEDUCK ELECTRONICS will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like DAEDUCK ELECTRONICS' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 22% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

In light of this, it's understandable that DAEDUCK ELECTRONICS' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does DAEDUCK ELECTRONICS' P/S Mean For Investors?

DAEDUCK ELECTRONICS shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into DAEDUCK ELECTRONICS shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with DAEDUCK ELECTRONICS, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A353200

DAEDUCK ELECTRONICS

Daeduck Electronics Co., Ltd. provides various printed circuit boards (PCB) in South Korea and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success