- South Korea

- /

- Capital Markets

- /

- KOSE:A026890

Here's What We Like About Digital Power CommunicationsLtd's (KRX:026890) Upcoming Dividend

Digital Power Communications Co.,Ltd. (KRX:026890) is about to trade ex-dividend in the next 3 days. You can purchase shares before the 29th of December in order to receive the dividend, which the company will pay on the 8th of April.

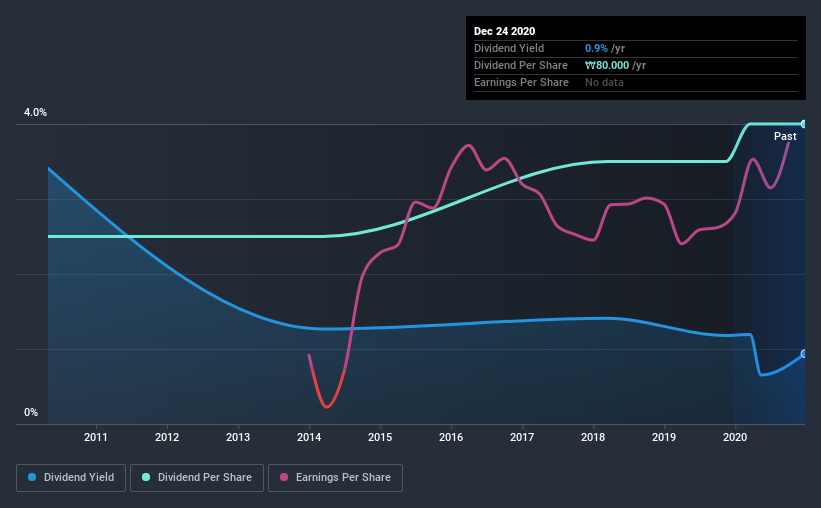

Digital Power CommunicationsLtd's next dividend payment will be ₩80.00 per share, and in the last 12 months, the company paid a total of ₩80.00 per share. Based on the last year's worth of payments, Digital Power CommunicationsLtd stock has a trailing yield of around 0.9% on the current share price of ₩8520. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Digital Power CommunicationsLtd

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Digital Power CommunicationsLtd has a low and conservative payout ratio of just 19% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Fortunately, it paid out only 26% of its free cash flow in the past year.

It's positive to see that Digital Power CommunicationsLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Digital Power CommunicationsLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, Digital Power CommunicationsLtd's earnings per share have been growing at 14% a year for the past five years. Earnings per share are growing rapidly and the company is keeping more than half of its earnings within the business; an attractive combination which could suggest the company is focused on reinvesting to grow earnings further. This will make it easier to fund future growth efforts and we think this is an attractive combination - plus the dividend can always be increased later.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Digital Power CommunicationsLtd has lifted its dividend by approximately 4.8% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Digital Power CommunicationsLtd is keeping back more of its profits to grow the business.

To Sum It Up

Should investors buy Digital Power CommunicationsLtd for the upcoming dividend? We love that Digital Power CommunicationsLtd is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. It's a promising combination that should mark this company worthy of closer attention.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. For example, Digital Power CommunicationsLtd has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Digital Power CommunicationsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A026890

STIC Investments

A private equity and venture capital firm specializing fund of fund investment and direct investment in series A, series B, buyouts, secondary direct investments, corporate restructurings, mid-cap, seed/startups, emerging growth, turnaround, middle market, late venture, PIPES, recapitalization and growth capital.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion