Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

Lotte Energy Materials Corporation (KRX:020150) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Lotte Energy Materials Corporation (KRX:020150) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

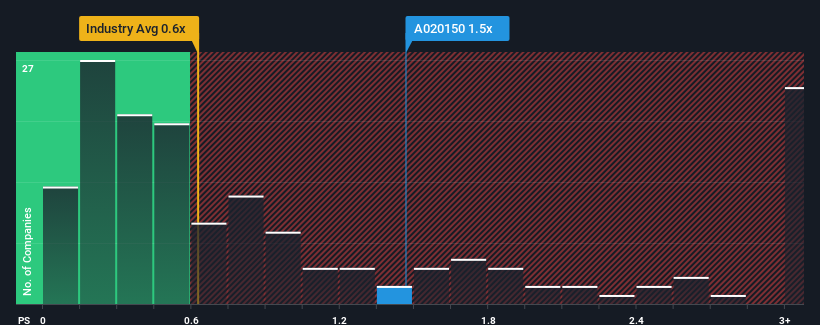

Although its price has dipped substantially, you could still be forgiven for thinking Lotte Energy Materials is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.5x, considering almost half the companies in Korea's Electronic industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Lotte Energy Materials

What Does Lotte Energy Materials' P/S Mean For Shareholders?

Lotte Energy Materials certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lotte Energy Materials.How Is Lotte Energy Materials' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Lotte Energy Materials' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 66% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.3% during the coming year according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.5%, which is not materially different.

With this in consideration, we find it intriguing that Lotte Energy Materials' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Lotte Energy Materials' P/S Mean For Investors?

Lotte Energy Materials' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Lotte Energy Materials' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Lotte Energy Materials that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.