- South Korea

- /

- Chemicals

- /

- KOSDAQ:A121600

December 2025's Asian Stock Selections Possibly Priced Below Fair Value

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape marked by technological enthusiasm and economic challenges, investors are keenly observing opportunities that may arise from shifting valuations. In this context, identifying stocks potentially priced below their fair value requires a careful analysis of market trends and economic indicators, offering potential entry points for those looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.56 | CN¥303.64 | 48.8% |

| Nippon Thompson (TSE:6480) | ¥722.00 | ¥1394.19 | 48.2% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.08 | CN¥26.02 | 49.7% |

| Morimatsu International Holdings (SEHK:2155) | HK$8.33 | HK$16.04 | 48.1% |

| MNC SolutionLtd (KOSE:A484870) | ₩124900.00 | ₩243739.89 | 48.8% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.59 | CN¥20.43 | 48.2% |

| H.U. Group Holdings (TSE:4544) | ¥3402.00 | ¥6592.59 | 48.4% |

| COVER (TSE:5253) | ¥1580.00 | ¥3098.08 | 49% |

| China Beststudy Education Group (SEHK:3978) | HK$4.68 | HK$9.30 | 49.7% |

| Beijing Roborock Technology (SHSE:688169) | CN¥154.07 | CN¥301.15 | 48.8% |

We'll examine a selection from our screener results.

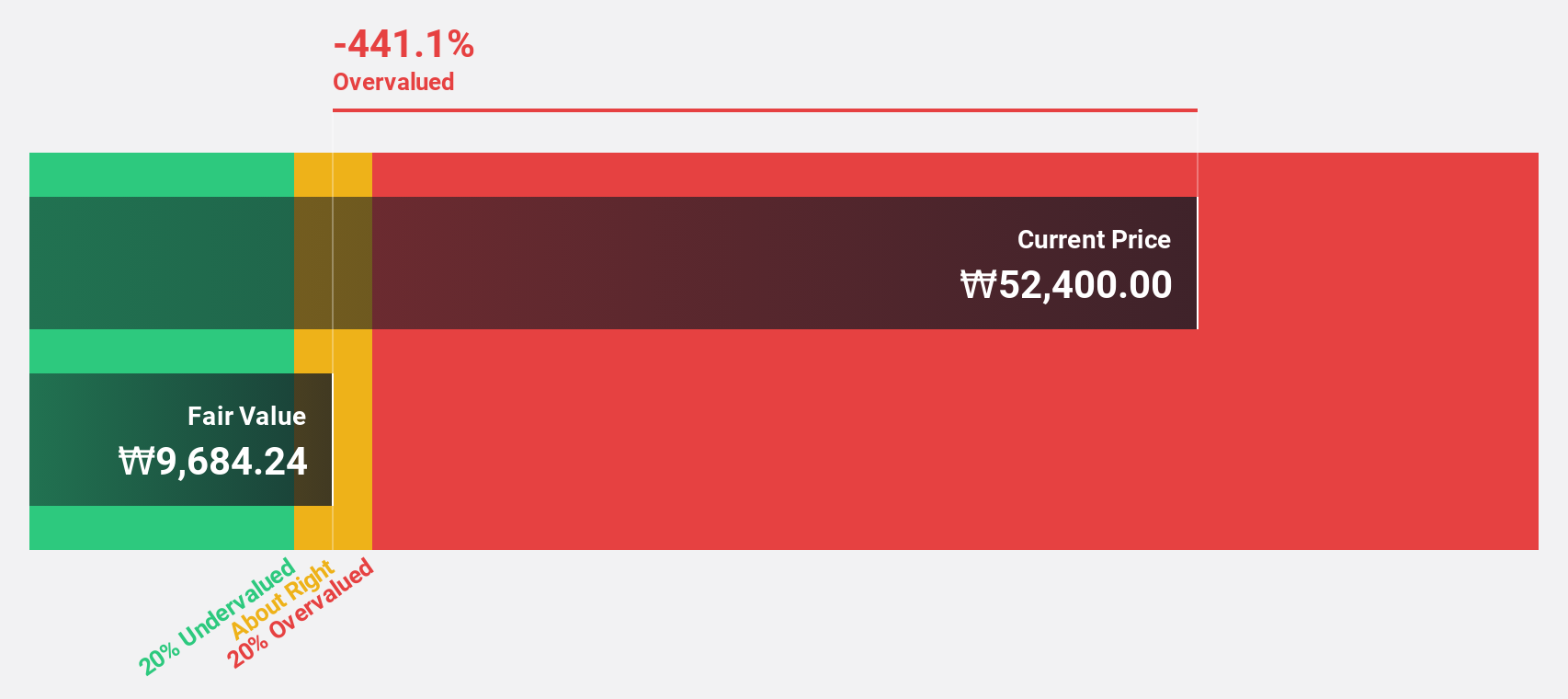

Advanced Nano Products (KOSDAQ:A121600)

Overview: Advanced Nano Products Co., Ltd. is a company that produces and markets high-tech materials including displays, semiconductors, secondary batteries, and solar cells both in South Korea and internationally, with a market cap of approximately ₩686.55 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to approximately ₩105.60 billion.

Estimated Discount To Fair Value: 34.7%

Advanced Nano Products is trading significantly below its estimated fair value, offering potential for investors focusing on cash flow undervaluation. Despite reporting negative sales recently, the company achieved a substantial increase in net income and earnings per share. Analysts forecast strong annual revenue growth of 33.1%, outpacing the market, with profitability expected within three years. However, return on equity remains a concern at a low forecasted rate of 8.3%.

- The growth report we've compiled suggests that Advanced Nano Products' future prospects could be on the up.

- Get an in-depth perspective on Advanced Nano Products' balance sheet by reading our health report here.

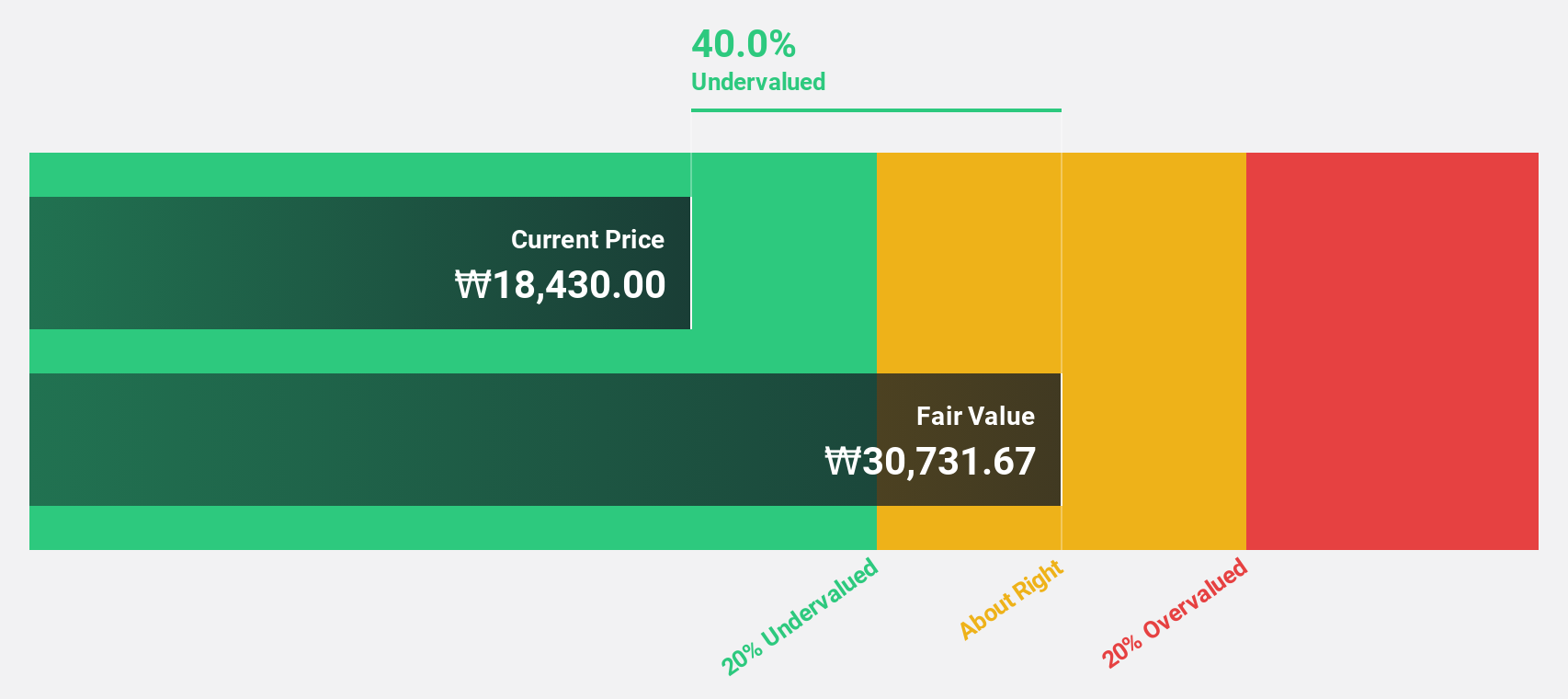

Korea Circuit (KOSE:A007810)

Overview: Korea Circuit Co., Ltd. produces and sells printed circuit boards globally, with a market cap of ₩844.30 billion.

Operations: Korea Circuit Co., Ltd. generates its revenue through the global production and sale of printed circuit boards.

Estimated Discount To Fair Value: 25.6%

Korea Circuit is trading at ₩34,100, significantly below its estimated fair value of ₩45,833.32, highlighting potential undervaluation based on cash flows. The company's earnings are expected to grow by 80.89% annually, with profitability anticipated in the next three years—outpacing average market growth. However, the forecasted return on equity remains modest at 17.3%. Despite recent share price volatility, Korea Circuit presents good relative value compared to peers and industry standards.

- Insights from our recent growth report point to a promising forecast for Korea Circuit's business outlook.

- Click to explore a detailed breakdown of our findings in Korea Circuit's balance sheet health report.

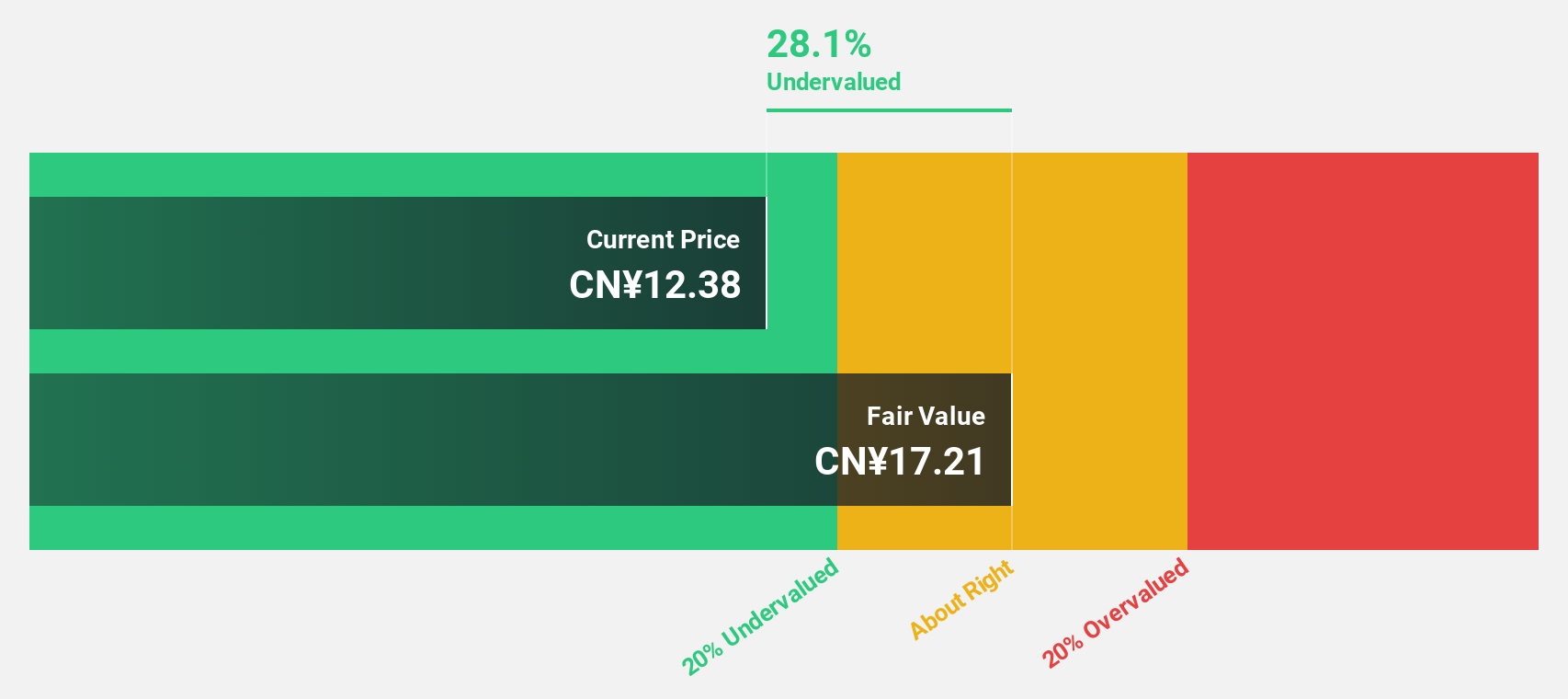

Guangzhou Guanggang Gases & EnergyLtd (SHSE:688548)

Overview: Guangzhou Guanggang Gases & Energy Co., Ltd. (SHSE:688548) operates in the industrial gases and energy sector with a market cap of CN¥16.55 billion.

Operations: The company's revenue is derived from its operations in the industrial gases and energy sector.

Estimated Discount To Fair Value: 27.1%

Guangzhou Guanggang Gases & Energy Ltd. is trading at CN¥12.55, below its estimated fair value of CN¥17.21, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 27.9% annually over the next three years, surpassing the broader Chinese market growth rate. Despite this growth outlook, its return on equity is forecasted to remain low at 7.6%, and its dividend yield of 0.73% lacks strong coverage from free cash flows.

- According our earnings growth report, there's an indication that Guangzhou Guanggang Gases & EnergyLtd might be ready to expand.

- Navigate through the intricacies of Guangzhou Guanggang Gases & EnergyLtd with our comprehensive financial health report here.

Taking Advantage

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 275 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121600

Advanced Nano Products

Manufactures and sells high-tech materials, such as displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026