Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

June 2024 Insights Into Three KRX Stocks Estimated As Undervalued

Reviewed by Simply Wall St

The South Korean market has shown promising growth, rising 1.3% in the past week and achieving a 3.7% increase over the last year, with earnings expected to grow by 29% annually. In this context, identifying stocks that are potentially undervalued could offer investors an opportunity to capitalize on these robust market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Poongsan Holdings (KOSE:A005810) | ₩27850.00 | ₩49494.84 | 43.7% |

| Solum (KOSE:A248070) | ₩21700.00 | ₩40011.63 | 45.8% |

| Iljin ElectricLtd (KOSE:A103590) | ₩25650.00 | ₩50794.09 | 49.5% |

| DYPNFLtd (KOSDAQ:A104460) | ₩19800.00 | ₩39742.77 | 50.2% |

| Caregen (KOSDAQ:A214370) | ₩23550.00 | ₩43428.59 | 45.8% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49562.21 | 49.8% |

| Intellian Technologies (KOSDAQ:A189300) | ₩57500.00 | ₩107659.72 | 46.6% |

| IMLtd (KOSDAQ:A101390) | ₩7330.00 | ₩13654.85 | 46.3% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩76900.00 | ₩137549.91 | 44.1% |

| Hancom Lifecare (KOSE:A372910) | ₩5590.00 | ₩10716.61 | 47.8% |

Let's uncover some gems from our specialized screener

C&C International (KOSDAQ:A352480)

Overview: C&C International Co., Ltd specializes in the research, development, manufacturing, and sales of cosmetics within Korea, boasting a market capitalization of approximately ₩1.18 billion.

Operations: The firm primarily generates its revenue from the research, development, manufacturing, and sales of cosmetics within Korea.

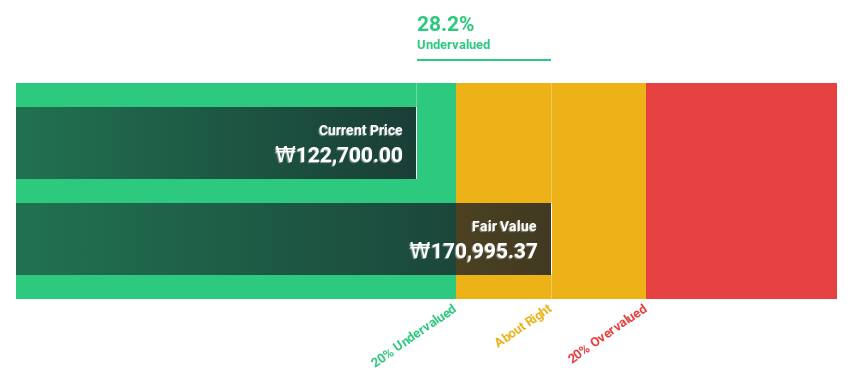

Estimated Discount To Fair Value: 24.8%

C&C International, a South Korean company, is recognized for its robust forecasted Return on Equity at 23% in three years. Despite earnings expected to grow at 24% annually—slightly below the market average of 28.9%—the firm benefits from a high level of non-cash earnings, indicating quality in its profit generation. This blend of strong equity returns and significant earnings growth positions it as an intriguing option among undervalued stocks based on cash flows.

- According our earnings growth report, there's an indication that C&C International might be ready to expand.

- Unlock comprehensive insights into our analysis of C&C International stock in this financial health report.

ISU Petasys (KOSE:A007660)

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs), with a market capitalization of approximately ₩3.31 billion.

Operations: The company generates its revenue primarily from the manufacture and sale of printed circuit boards (PCBs) globally.

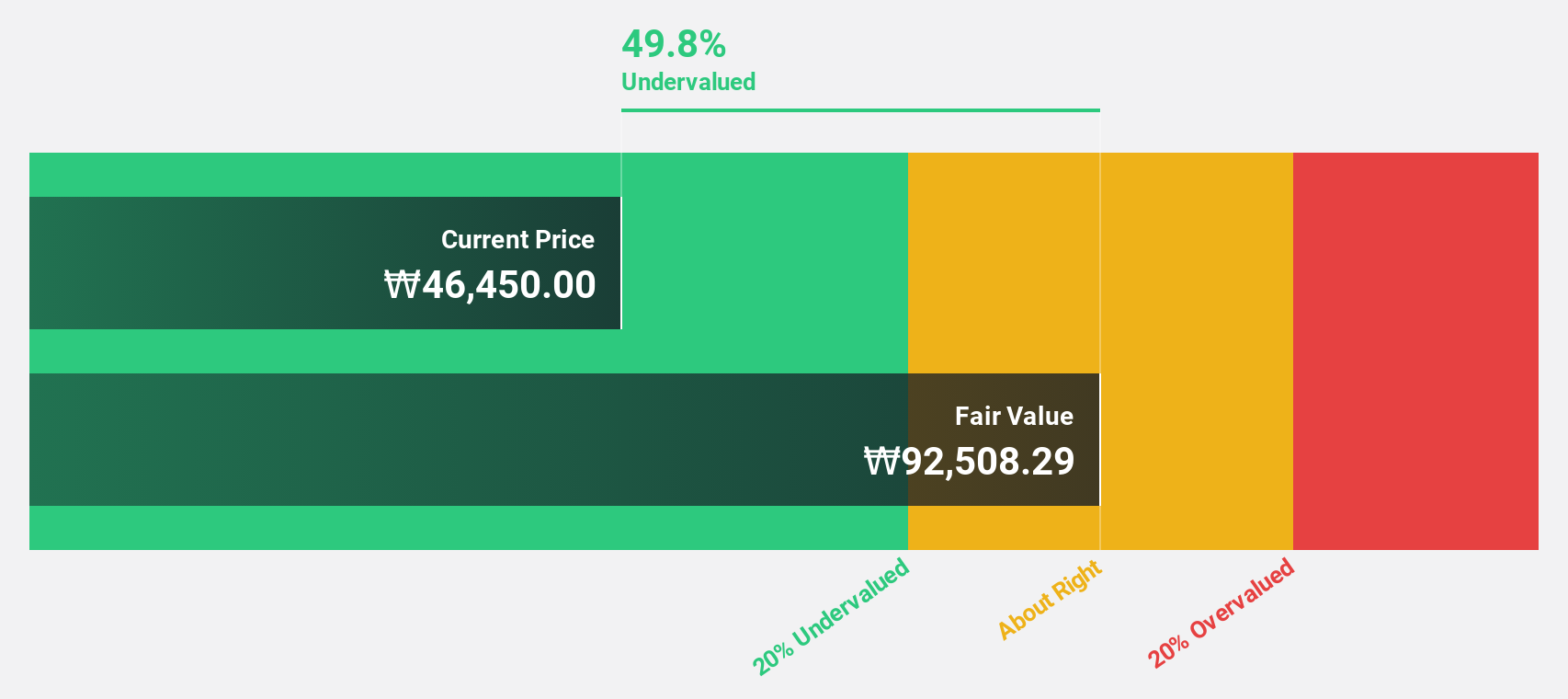

Estimated Discount To Fair Value: 31.7%

ISU Petasys is significantly undervalued, trading at ₩52,400, well below its fair value of ₩82,714.23. Expected to outperform with a revenue growth of 15.3% annually—faster than the South Korean market average—and a projected earnings increase of 41.5% per year, it shows promise despite concerns over debt coverage by operating cash flow and a recent dip in profit margins from 15.1% to 7%. Its forecasted Return on Equity stands impressively at 34.5%, suggesting strong future profitability amidst current volatility.

- In light of our recent growth report, it seems possible that ISU Petasys' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in ISU Petasys' balance sheet health report.

Cosmax (KOSE:A192820)

Overview: Cosmax, Inc. is a company based in Korea that specializes in the research, development, production, and manufacturing of cosmetic and health function food products globally, with a market capitalization of approximately ₩2.14 trillion.

Operations: The company generates revenue primarily from the production and sale of cosmetics and health function food products, both domestically and internationally.

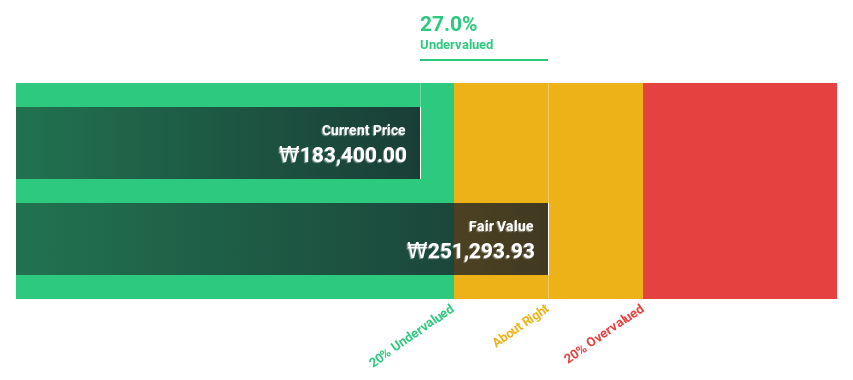

Estimated Discount To Fair Value: 19.7%

Cosmax, priced at ₩188,400, is positioned below the calculated fair value of ₩234,547.91, marking it as moderately undervalued. The company's earnings have surged by a very large margin over the past year and are expected to grow by 26.83% annually. Although this growth rate lags slightly behind the broader South Korean market forecast of 28.9%, Cosmax's revenue growth projections exceed local market averages. However, its financial leverage is high, which may raise concerns about sustainability amidst these positive outlooks.

- Our growth report here indicates Cosmax may be poised for an improving outlook.

- Dive into the specifics of Cosmax here with our thorough financial health report.

Where To Now?

- Discover the full array of 35 Undervalued KRX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether ISU Petasys is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

High growth potential with adequate balance sheet.