- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

Investors Appear Satisfied With ISU Petasys Co., Ltd.'s (KRX:007660) Prospects As Shares Rocket 31%

Despite an already strong run, ISU Petasys Co., Ltd. (KRX:007660) shares have been powering on, with a gain of 31% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

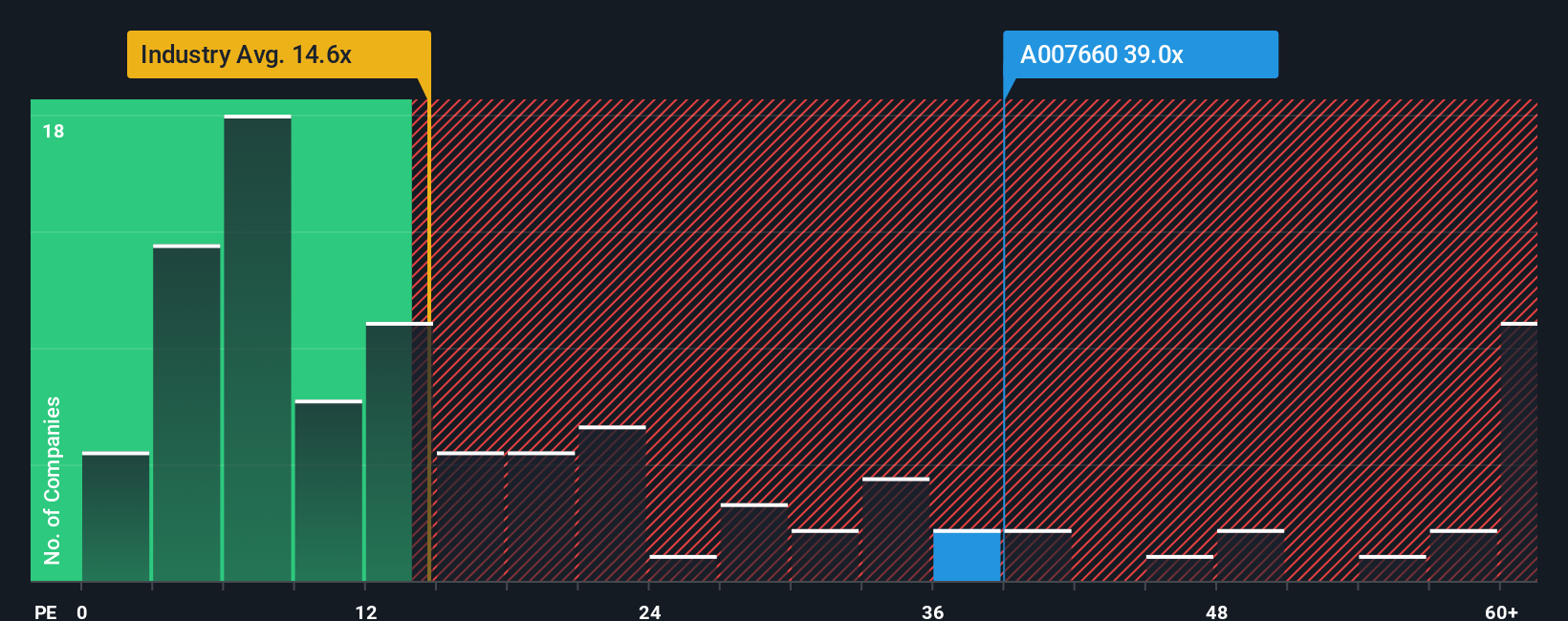

After such a large jump in price, ISU Petasys' price-to-earnings (or "P/E") ratio of 39x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, ISU Petasys has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for ISU Petasys

Is There Enough Growth For ISU Petasys?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ISU Petasys' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 91% gain to the company's bottom line. The latest three year period has also seen an excellent 46% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 24% per year as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 18% per annum growth forecast for the broader market.

In light of this, it's understandable that ISU Petasys' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got ISU Petasys' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of ISU Petasys' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with ISU Petasys.

If these risks are making you reconsider your opinion on ISU Petasys, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives