- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

High Growth Tech Stocks To Watch In June 2025

Reviewed by Simply Wall St

As of June 2025, global markets have been experiencing notable shifts with U.S. stocks climbing for the second consecutive week, led by small-cap stocks and a strong performance in the information technology sector, driven by positive sentiment around artificial intelligence-related developments. In this environment of cautious optimism and technological advancement, identifying high-growth tech stocks involves looking for companies that are well-positioned to leverage emerging technologies like AI while navigating broader economic challenges such as trade tensions and fluctuating labor market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We'll examine a selection from our screener results.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩3.02 billion.

Operations: ISU Petasys focuses on the global production and sale of printed circuit boards (PCBs). The company's operations are supported by a market capitalization of ₩3.02 billion.

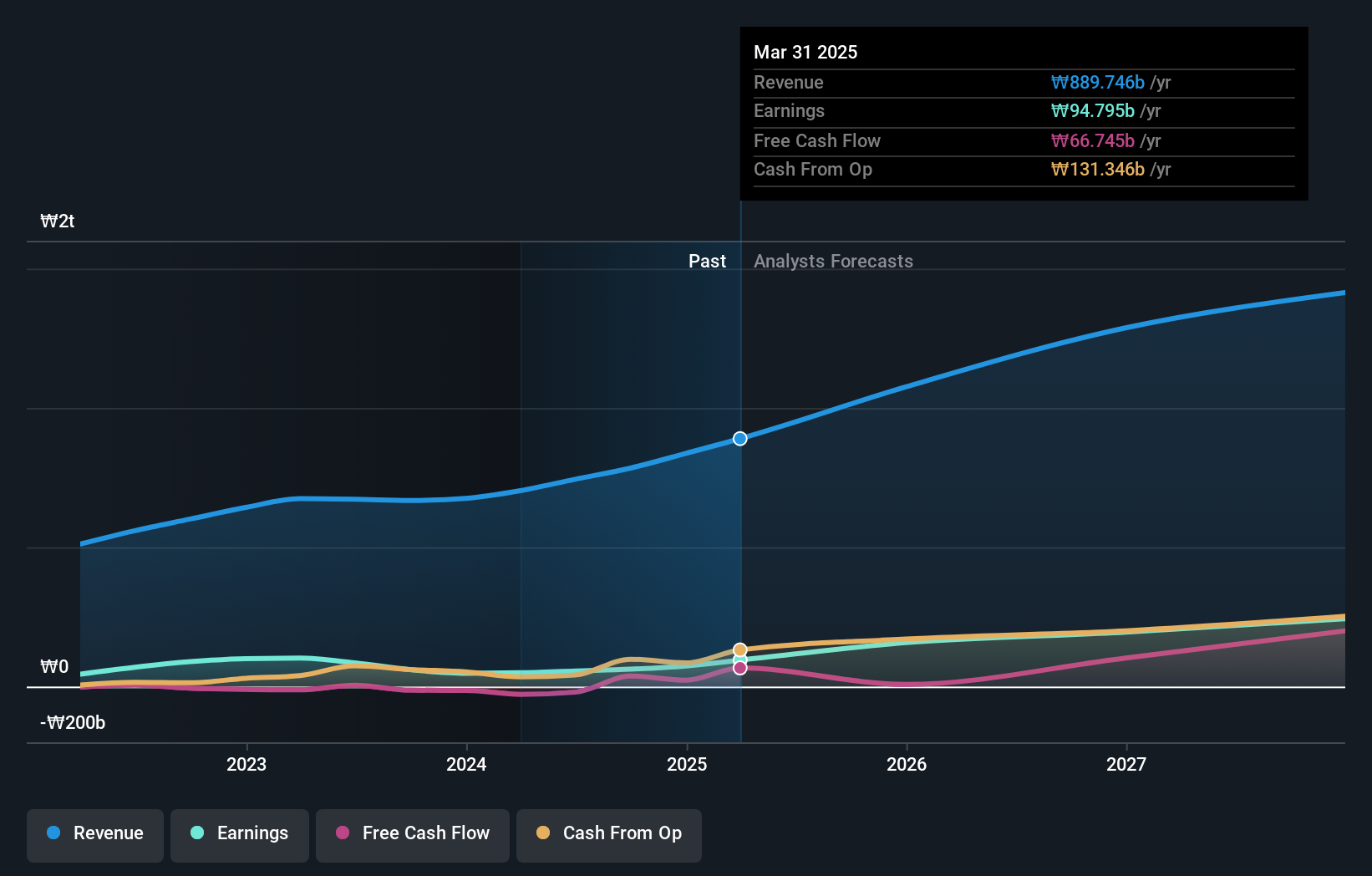

ISU Petasys has demonstrated a robust growth trajectory, with earnings surging by 91.4% over the past year, significantly outpacing the electronic industry's average of 16%. This performance is underpinned by a strong forecast for both revenue and earnings; expected to grow annually at 16.7% and 30.4%, respectively, surpassing broader market expectations. Despite high volatility in its share price and a considerable level of debt, the company's strategic initiatives like the recent Follow-on Equity Offering of KRW 282.53 billion indicate proactive steps to bolster financial flexibility and fuel further growth. With R&D investments aligning with these ambitious growth targets, ISU Petasys is positioning itself as a dynamic contender in its sector, though challenges such as shareholder dilution need careful monitoring.

- Delve into the full analysis health report here for a deeper understanding of ISU Petasys.

Examine ISU Petasys' past performance report to understand how it has performed in the past.

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China, with a market cap of CN¥9.41 billion.

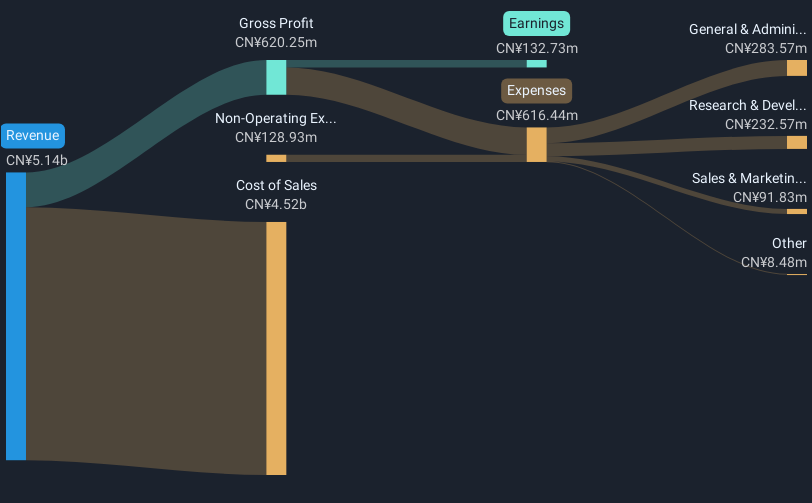

Operations: The company generates revenue primarily from the Neodymium Iron Boron segment, which amounts to CN¥5.14 billion.

Ningbo Yunsheng has shown a remarkable turnaround, transitioning from a net loss to reporting a net income of CN¥95.08 million for the full year ended December 31, 2024. This improvement is reflected in its annual revenue growth of 17.8% and an impressive earnings growth forecast at 39.8% per year, outpacing the Chinese market's average. The company’s strategic focus on R&D is evident with significant investments aimed at fostering innovation and maintaining competitive edge in the tech sector, aligning with industry shifts towards advanced manufacturing technologies. Recent activities like their comprehensive share buyback program further underscore their commitment to enhancing shareholder value amidst these positive financial dynamics.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech industry with a market capitalization of approximately CN¥14.07 billion.

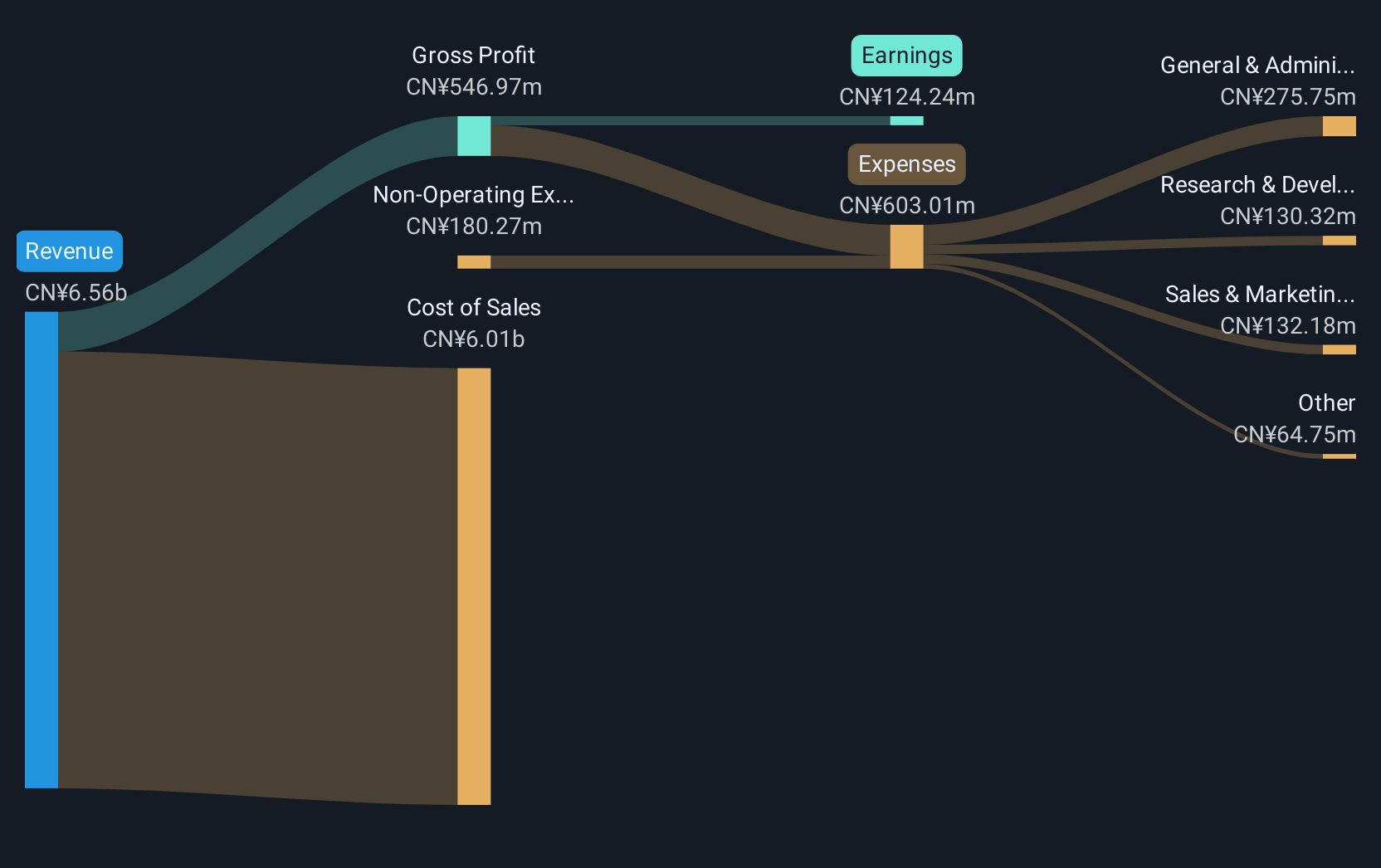

Operations: Zhong Ke San Huan High-Tech primarily engages in the production and sale of high-performance magnetic materials. The company focuses on leveraging advanced technology to cater to various industries, enhancing its competitive position in the market.

Beijing Zhong Ke San Huan High-Tech has demonstrated resilience with a significant turnaround from a net loss to a net income of CNY 13.49 million in Q1 2025, contrasting sharply with the previous year's loss. This recovery is part of a broader trend where the company's annual revenue growth is projected at 19.9%, outstripping the Chinese market average of 12.4%. Moreover, its earnings are expected to surge by an impressive 43.9% annually, eclipsing sector norms significantly. Despite recent challenges indicated by reduced dividends and fluctuating sales figures, such strategic financial maneuvers and robust R&D investments underscore its potential for sustained growth in the competitive tech landscape.

Where To Now?

- Access the full spectrum of 748 Global High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives