- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8046

High Growth Tech Stocks in Asia Featuring ISU Petasys and Two Others

Reviewed by Simply Wall St

In recent weeks, the Asian markets have experienced mixed performances, with Japan's stock indices declining due to concerns over tech valuations and China's economic indicators highlighting slow growth. Amid these fluctuations, investors are increasingly focusing on high-growth tech stocks in Asia that demonstrate resilience and potential for innovation, such as ISU Petasys and others that can capitalize on technological advancements despite broader market challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.60% | 32.84% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

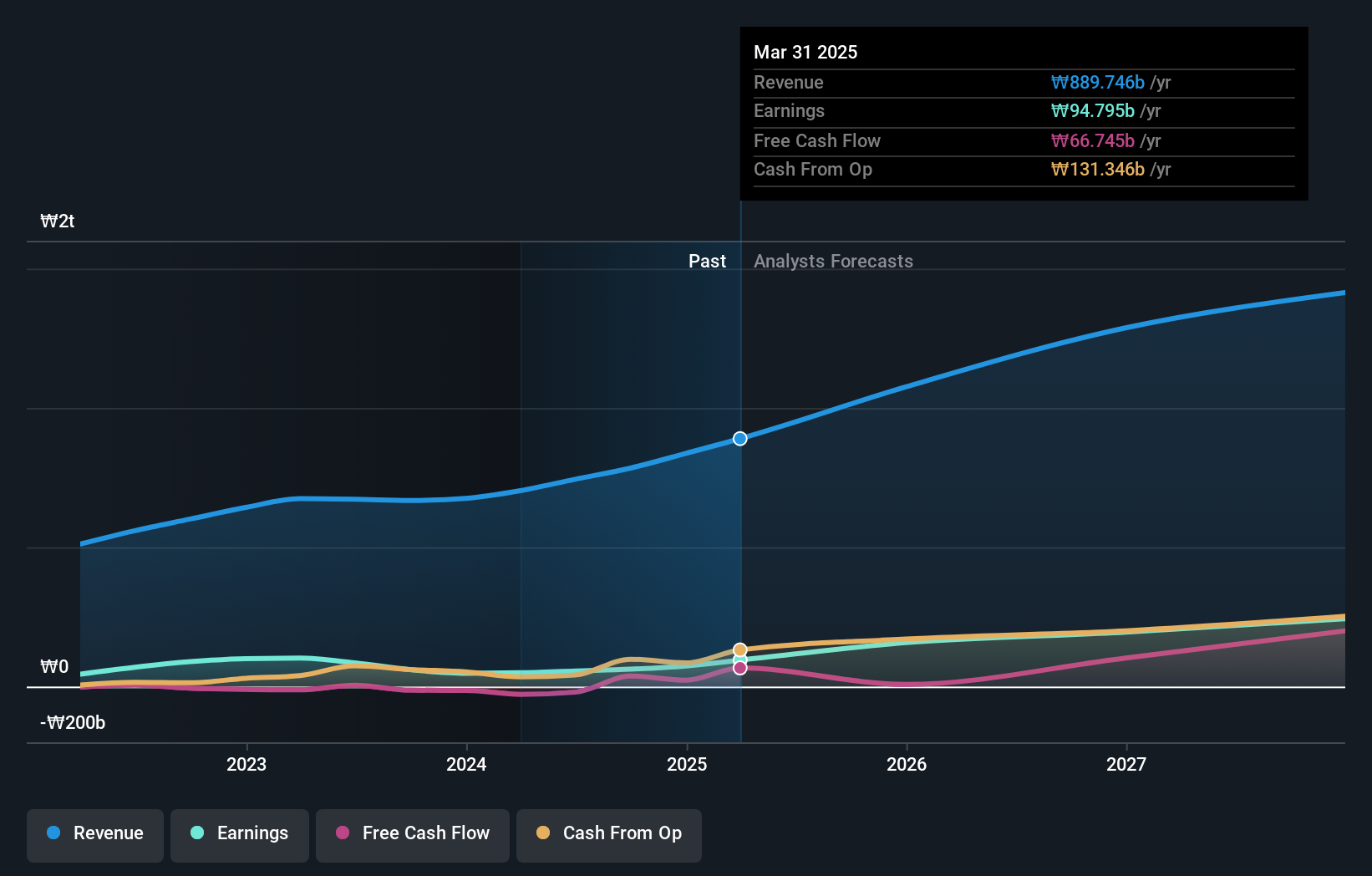

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★★

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market cap of ₩8.99 billion.

Operations: ISU Petasys specializes in the global production and distribution of printed circuit boards (PCBs). The company operates with a market capitalization of approximately ₩8.99 billion, focusing on manufacturing processes that cater to diverse industries worldwide.

ISU Petasys, recently added to the KOSPI 200 Index, exemplifies robust growth in Asia's tech sector with its earnings surging by 119.4% over the past year, outpacing the electronic industry's average of -0.9%. This performance is underpinned by a significant annual revenue increase forecast at 24.1%, well above the Korean market's expectation of 10.6%. The company also stands out for its projected annual earnings growth rate of 33.3%, suggesting a strong upward trajectory compared to the broader market forecast of 30.3%. Despite these promising figures, potential investors should note ISU Petasys’s highly volatile share price and recent shareholder dilution which could imply risks amidst its high-growth narrative.

- Dive into the specifics of ISU Petasys here with our thorough health report.

Understand ISU Petasys' track record by examining our Past report.

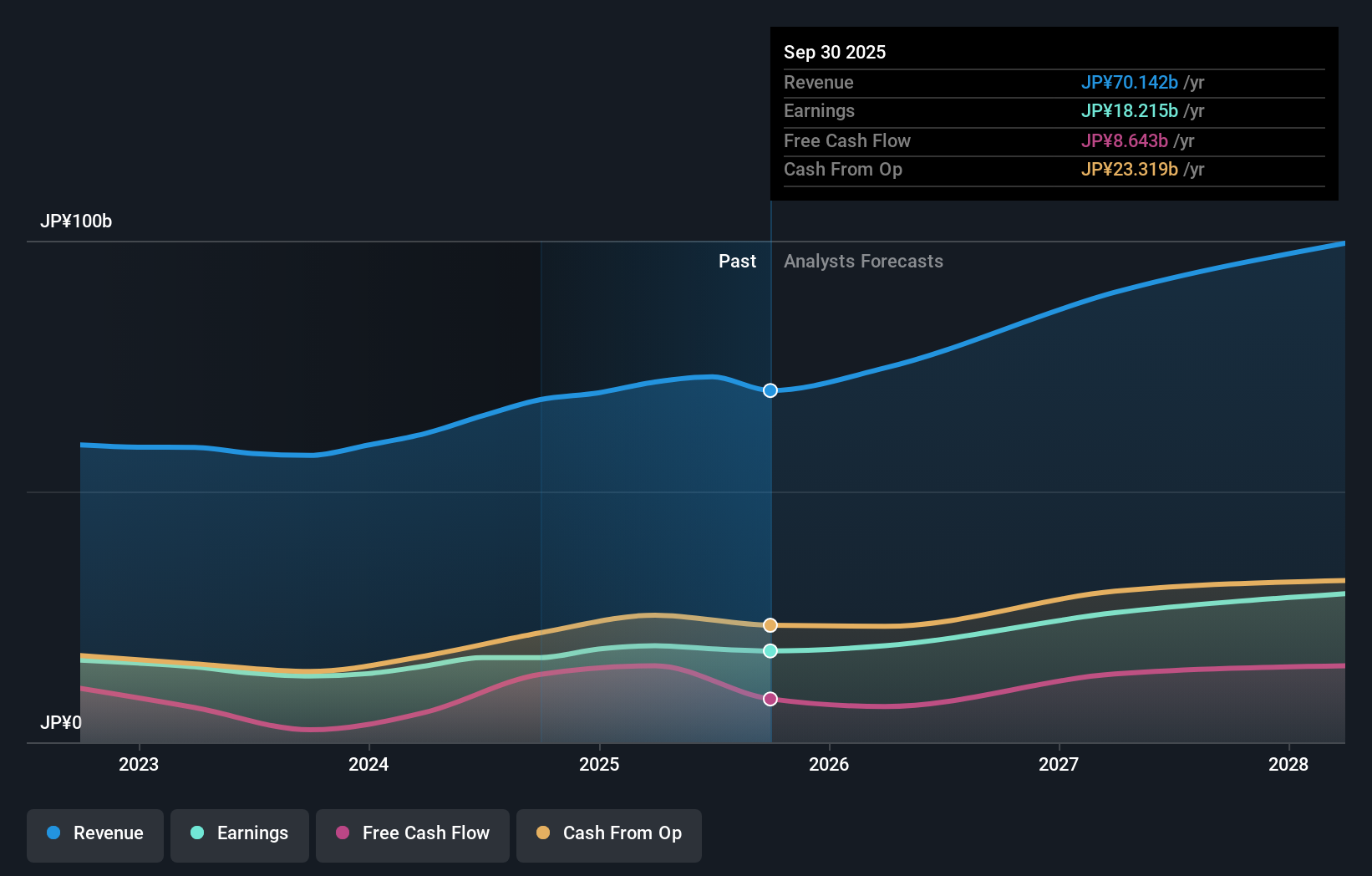

MaruwaLtd (TSE:5344)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maruwa Co., Ltd. is engaged in the production and sale of ceramics and electronic parts both domestically in Japan and internationally, with a market capitalization of ¥540.56 billion.

Operations: The company focuses on producing ceramics and electronic components, catering to both domestic and international markets. Its operations are supported by a market capitalization of ¥540.56 billion, reflecting its significant presence in the industry.

MaruwaLtd, a contender in Asia's high-growth tech landscape, has demonstrated notable financial agility with a 14.7% annual revenue growth and an even more impressive 20.8% increase in earnings per year. These figures surpass the broader Japanese market's expectations of just 4.6% and 8.5%, respectively. The firm’s commitment to innovation is evident from its R&D spending, which significantly bolsters its competitive edge in the tech sector. Recently, Maruwa announced a dividend increase to JPY 51 per share up from JPY 47 last year, reflecting confidence in ongoing profitability despite a slight downward revision in their fiscal year guidance for sales and operating profit to JPY 75.1 billion and JPY 27 billion respectively. This adjustment suggests cautious optimism about future prospects amidst challenging market conditions.

- Unlock comprehensive insights into our analysis of MaruwaLtd stock in this health report.

Assess MaruwaLtd's past performance with our detailed historical performance reports.

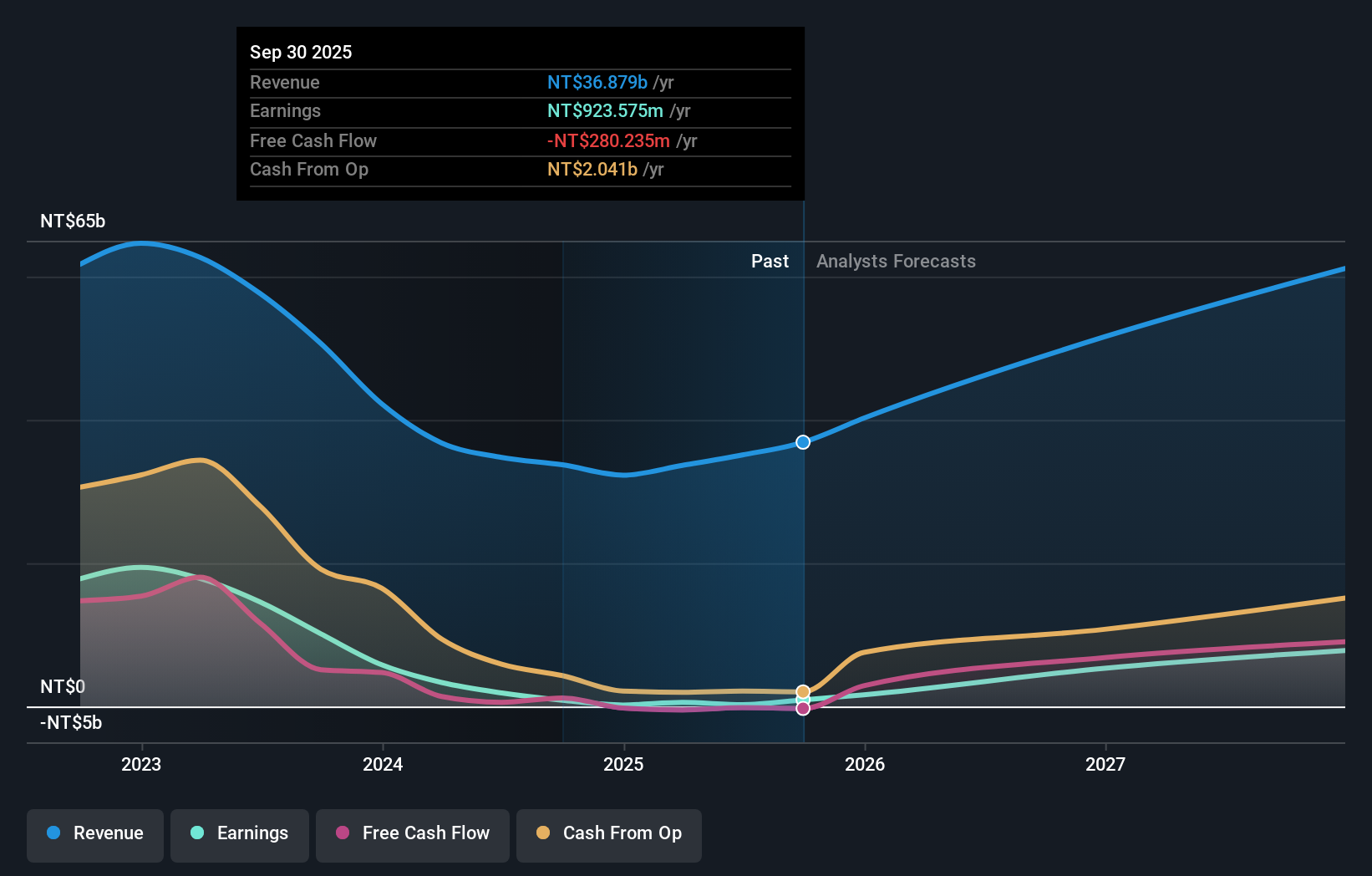

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally with a market capitalization of NT$157.66 billion.

Operations: The company generates significant revenue from its operations in Asia and domestic markets, with NT$14.39 billion and NT$26.67 billion, respectively. Sales in America are considerably lower at NT$30.35 million.

Nan Ya Printed Circuit Board has been making significant strides in the tech sector, with a projected annual revenue growth of 23% and earnings expected to surge by 81.9% annually, outpacing the broader Taiwanese market's growth rates of 13.7% and 20.4%, respectively. This performance is underpinned by robust R&D investments that are pivotal for maintaining its competitive edge in a rapidly evolving industry. Recent financial disclosures reveal substantial gains, with third-quarter sales jumping to TWD 10.97 billion from TWD 9.19 billion year-over-year, and net income soaring to TWD 724.87 million from TWD 58.89 million, reflecting both operational efficiency and market demand strength.

Seize The Opportunity

- Click through to start exploring the rest of the 186 Asian High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nan Ya Printed Circuit Board might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8046

Nan Ya Printed Circuit Board

Manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion