- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Has Samsung Stock Risen Too Far After AI and Semiconductor Investment Surge in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Samsung Electronics stock is still great value after its recent rise, you are not alone, and there are some compelling signals worth digging into.

- After soaring 87.4% year to date and 78.7% over the past year, investors have seen both big gains and some volatility. In the past month alone, the stock jumped 12.4%.

- Industry headlines have recently centered on Samsung’s investments in next-generation semiconductor manufacturing and AI partnerships, which have driven optimism in the tech sector and helped fuel Samsung’s upward momentum. These developments have also shifted attention towards the company's strategic positioning for future growth and innovation.

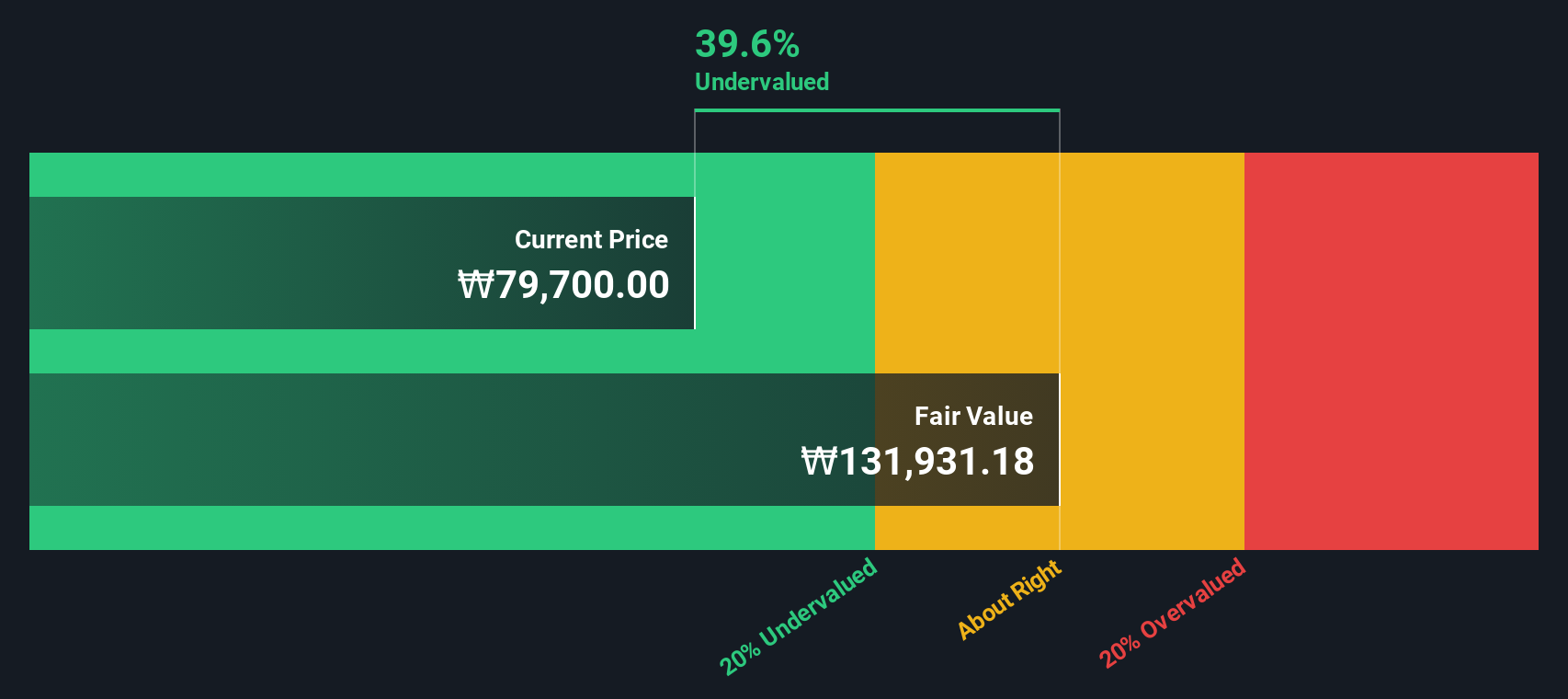

- Currently, Samsung Electronics has a valuation score of 4 out of 6, reflecting the areas where it still appears undervalued. Let’s break down how those valuation checks stack up, and explore whether there is a smarter, more insightful way to think about what the shares are really worth.

Find out why Samsung Electronics's 78.7% return over the last year is lagging behind its peers.

Approach 1: Samsung Electronics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors determine what the stock is truly worth based on the money the business is expected to generate in the future.

For Samsung Electronics, the current Free Cash Flow (FCF) stands at approximately ₩17 trillion, which is ₩17,025,102,452,309 (over ₩17 trillion). Analyst forecasts anticipate that FCF will grow robustly, with projections reaching nearly ₩57.5 trillion by the end of 2027. While direct analyst estimates are available for the next five years, further yearly FCF numbers are extrapolated by Simply Wall St’s model, rising as high as ₩103.9 trillion by 2035.

After discounting all these future cash flows back to the present using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share comes out to ₩211,111. Compared to today’s share price, this suggests Samsung Electronics is about 52.6% undervalued based on projected cash flows.

In summary, the DCF valuation paints a strong case for upside if the forecasts hold true and signals that the stock may offer considerable value at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Samsung Electronics is undervalued by 52.6%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Samsung Electronics Price vs Earnings

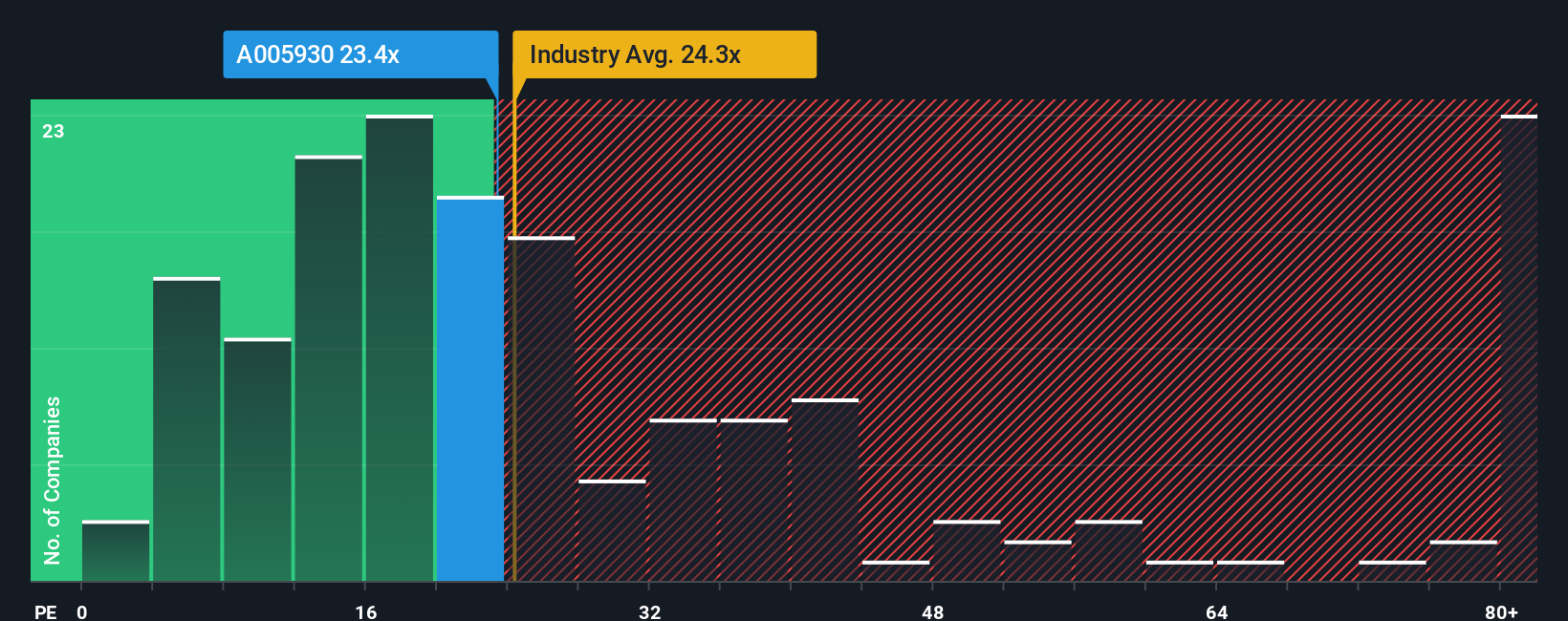

For profitable companies like Samsung Electronics, the Price-to-Earnings (PE) ratio is a widely used and effective valuation metric. It allows investors to quickly gauge how much they are paying for each unit of earnings, which is especially relevant when a company shows solid earnings and a track record of profitability.

Deciding what counts as a “normal” or “fair” PE ratio depends on several factors, including the company’s expected earnings growth, profitability, business risks, and outlook for its industry. Generally, higher growth and lower risk support a higher PE multiple, while more risk or lower growth reduce what investors will pay.

Samsung Electronics currently trades at a PE ratio of 20.60x. This is just above the peer average of 19.52x, but below the wider tech industry average of 23.07x. While peer and industry averages give some context, they do not capture company-specific growth prospects or risk factors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Samsung Electronics, the Fair Ratio is 44.05x, which is calculated using a range of inputs such as earnings growth, profit margins, market capitalization, business risks, and industry dynamics. Unlike simple peer or industry averages, the Fair Ratio offers a more tailored and comprehensive benchmark for valuation.

Comparing Samsung’s actual PE of 20.60x to its Fair Ratio of 44.05x strongly suggests the stock remains undervalued by this measure, since investors are currently paying much less than the company's fundamentals and prospects might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Samsung Electronics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives.

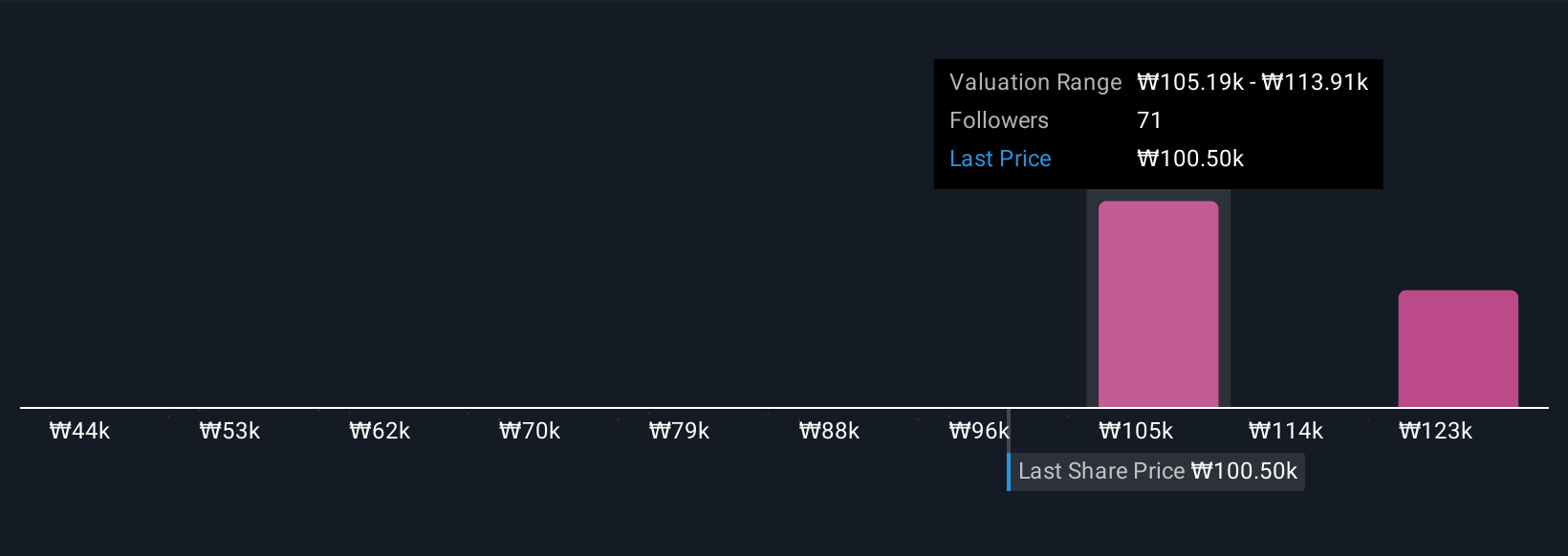

A Narrative is your story or perspective on a company, backed by numbers. It lets you define not just what you believe about Samsung Electronics’s business outlook, but also your assumptions for future revenue, earnings, and margins, connecting company events and market changes to a specific financial forecast and fair value estimate.

This approach brings the numbers to life and helps you see how your beliefs compare with other investors. It makes it much easier to decide whether to buy, sell, or hold by simply comparing your calculated Fair Value to the current Price.

Narratives are easy to create and track using the Community page on Simply Wall St, where millions of investors update their perspectives as news or company results come in. Whenever something important changes, Narratives are dynamically refreshed so your fair value stays in tune with the latest information.

For example, the most optimistic Narrative for Samsung Electronics forecasts earnings reaching ₩68,440 billion by 2028, while the most cautious perspective expects just ₩24,149 billion. This demonstrates how Narratives reflect a spectrum of investor views and helps you decide which outlook best matches your own.

Do you think there's more to the story for Samsung Electronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives