- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A001820

SAMWHA CAPACITORLTD (KRX:001820) Seems To Use Debt Quite Sensibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, SAMWHA CAPACITOR Co.,LTD (KRX:001820) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for SAMWHA CAPACITORLTD

What Is SAMWHA CAPACITORLTD's Net Debt?

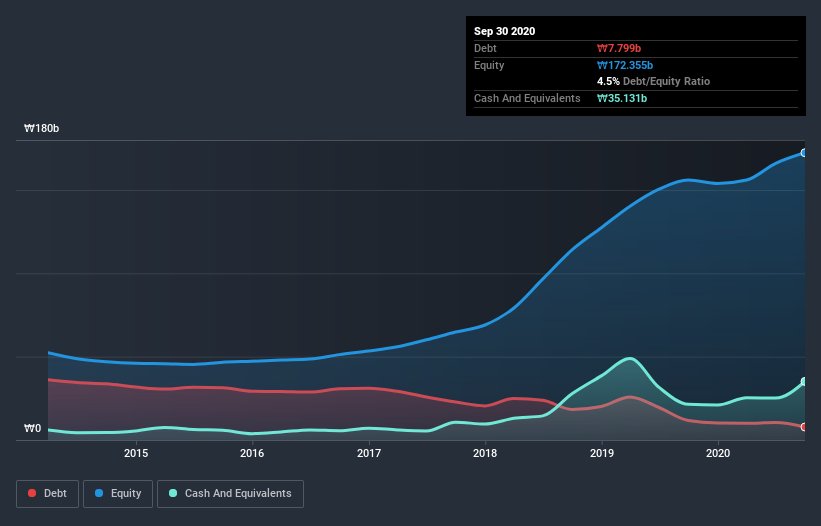

The image below, which you can click on for greater detail, shows that SAMWHA CAPACITORLTD had debt of ₩7.80b at the end of September 2020, a reduction from ₩11.7b over a year. However, its balance sheet shows it holds ₩35.1b in cash, so it actually has ₩27.3b net cash.

A Look At SAMWHA CAPACITORLTD's Liabilities

The latest balance sheet data shows that SAMWHA CAPACITORLTD had liabilities of ₩50.8b due within a year, and liabilities of ₩14.0b falling due after that. Offsetting these obligations, it had cash of ₩35.1b as well as receivables valued at ₩59.6b due within 12 months. So it can boast ₩29.8b more liquid assets than total liabilities.

This surplus suggests that SAMWHA CAPACITORLTD has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that SAMWHA CAPACITORLTD has more cash than debt is arguably a good indication that it can manage its debt safely.

In fact SAMWHA CAPACITORLTD's saving grace is its low debt levels, because its EBIT has tanked 56% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if SAMWHA CAPACITORLTD can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. SAMWHA CAPACITORLTD may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, SAMWHA CAPACITORLTD's free cash flow amounted to 24% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that SAMWHA CAPACITORLTD has net cash of ₩27.3b, as well as more liquid assets than liabilities. So we don't have any problem with SAMWHA CAPACITORLTD's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - SAMWHA CAPACITORLTD has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading SAMWHA CAPACITORLTD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A001820

SAMWHA CAPACITORLTD

Engages in the manufacture and sale of capacitors in South Korea.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion