- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A368770

FIBERPRO, Inc.'s (KOSDAQ:368770) Popularity With Investors Under Threat As Stock Sinks 30%

FIBERPRO, Inc. (KOSDAQ:368770) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 20%.

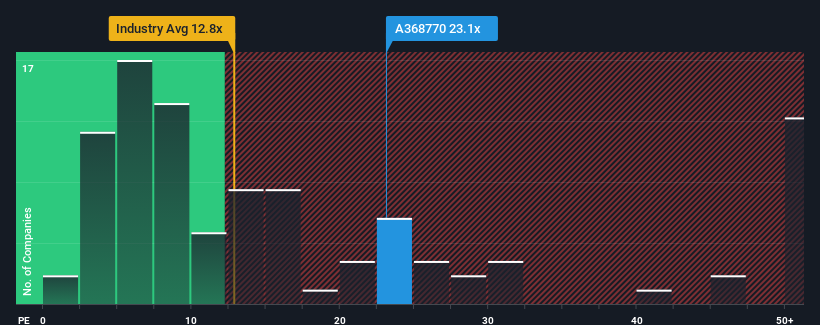

Even after such a large drop in price, FIBERPRO's price-to-earnings (or "P/E") ratio of 23.1x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

FIBERPRO certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for FIBERPRO

How Is FIBERPRO's Growth Trending?

In order to justify its P/E ratio, FIBERPRO would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 77%. The strong recent performance means it was also able to grow EPS by 63% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 36% during the coming year according to the lone analyst following the company. That's not great when the rest of the market is expected to grow by 33%.

In light of this, it's alarming that FIBERPRO's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Bottom Line On FIBERPRO's P/E

FIBERPRO's shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that FIBERPRO currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for FIBERPRO (1 can't be ignored!) that we have uncovered.

You might be able to find a better investment than FIBERPRO. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A368770

FIBERPRO

Manufactures fiber optic solutions for telecommunications and fiber optic sensor interrogation.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success