- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A332570

If EPS Growth Is Important To You, Wireless Power Amplifier Module (KOSDAQ:332570) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Wireless Power Amplifier Module (KOSDAQ:332570), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Wireless Power Amplifier Module with the means to add long-term value to shareholders.

View our latest analysis for Wireless Power Amplifier Module

How Quickly Is Wireless Power Amplifier Module Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Wireless Power Amplifier Module's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 43%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

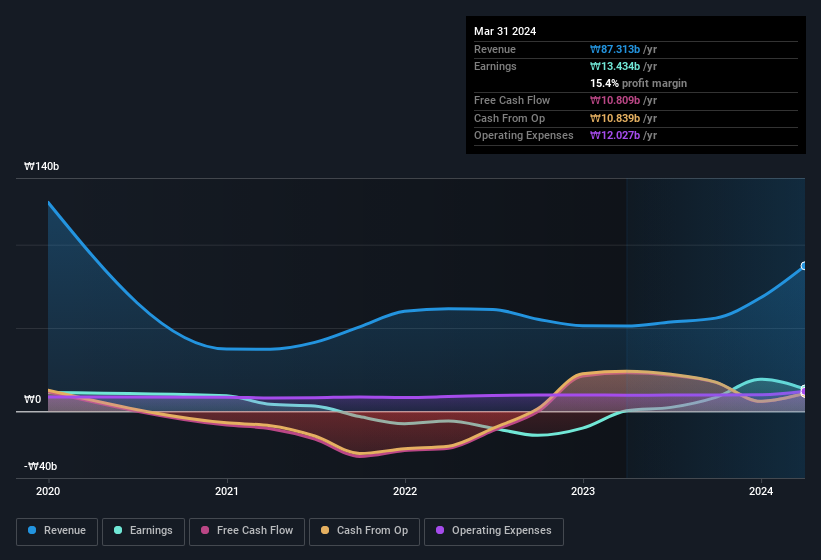

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Wireless Power Amplifier Module's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Wireless Power Amplifier Module shareholders is that EBIT margins have grown from 9.3% to 13% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Wireless Power Amplifier Module is no giant, with a market capitalisation of ₩135b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Wireless Power Amplifier Module Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Wireless Power Amplifier Module insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at ₩45b. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 33% of the company; visible skin in the game.

Should You Add Wireless Power Amplifier Module To Your Watchlist?

Wireless Power Amplifier Module's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Wireless Power Amplifier Module very closely. Still, you should learn about the 3 warning signs we've spotted with Wireless Power Amplifier Module.

Although Wireless Power Amplifier Module certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of South Korean companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A332570

Pentastone Electronics

Supplies power amplifier modules for mobile devices.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026