- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A290740

Not Many Are Piling Into ActRO Co., Ltd (KOSDAQ:290740) Just Yet

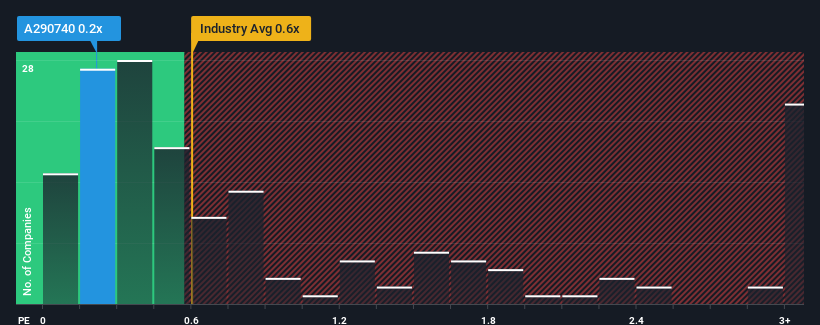

There wouldn't be many who think ActRO Co., Ltd's (KOSDAQ:290740) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Electronic industry in Korea is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for ActRO

How ActRO Has Been Performing

Recent times have been quite advantageous for ActRO as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ActRO's earnings, revenue and cash flow.How Is ActRO's Revenue Growth Trending?

ActRO's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 46%. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that ActRO is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On ActRO's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ActRO currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with ActRO (at least 1 which can't be ignored), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A290740

ActRO

Manufactures optical image stabilizers (OIS) and voice coil motors that are applied in compact camera modules in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026