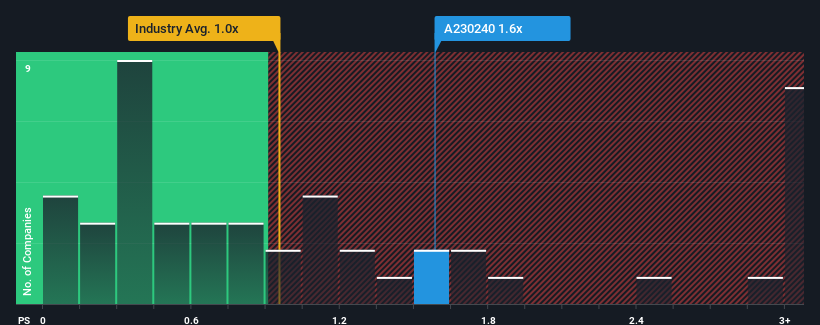

When close to half the companies in the Communications industry in Korea have price-to-sales ratios (or "P/S") below 1x, you may consider HFR, Inc. (KOSDAQ:230240) as a stock to potentially avoid with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Our free stock report includes 1 warning sign investors should be aware of before investing in HFR. Read for free now.Check out our latest analysis for HFR

What Does HFR's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, HFR's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HFR.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as HFR's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 57% over the next year. That's shaping up to be materially higher than the 39% growth forecast for the broader industry.

With this information, we can see why HFR is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From HFR's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that HFR maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for HFR you should be aware of.

If you're unsure about the strength of HFR's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HFR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A230240

HFR

Provides digital infrastructure solutions for telco/enterprise markets in the field of wired and wireless access in South Korea.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives