- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A190510

Namuga Co., Ltd. (KOSDAQ:190510) Stock Rockets 36% As Investors Are Less Pessimistic Than Expected

Namuga Co., Ltd. (KOSDAQ:190510) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

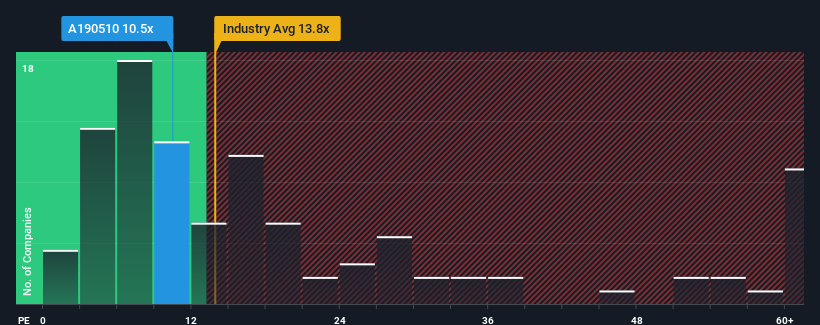

Even after such a large jump in price, there still wouldn't be many who think Namuga's price-to-earnings (or "P/E") ratio of 10.5x is worth a mention when the median P/E in Korea is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Namuga certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Namuga

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Namuga's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 160% last year. As a result, it also grew EPS by 15% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

This is in contrast to the rest of the market, which is expected to grow by 34% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Namuga is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Namuga's P/E?

Its shares have lifted substantially and now Namuga's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Namuga currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Namuga with six simple checks on some of these key factors.

You might be able to find a better investment than Namuga. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Namuga might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A190510

Namuga

Designs, produces, and sells cameras and 3D sensing modules in Korea and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success