- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

Top KRX Growth Companies With High Insider Ownership In August 2024

Reviewed by Simply Wall St

The South Korean market is up 3.1% in the last 7 days, led by Information Technology and all sectors gaining ground, though it has been flat overall in the past year. In this environment where earnings are forecast to grow by 28% annually, identifying growth companies with high insider ownership can be a strong strategy for investors looking to capitalize on potential market gains.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 34% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 90.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 38.3% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| HANA Micron (KOSDAQ:A067310) | 20% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

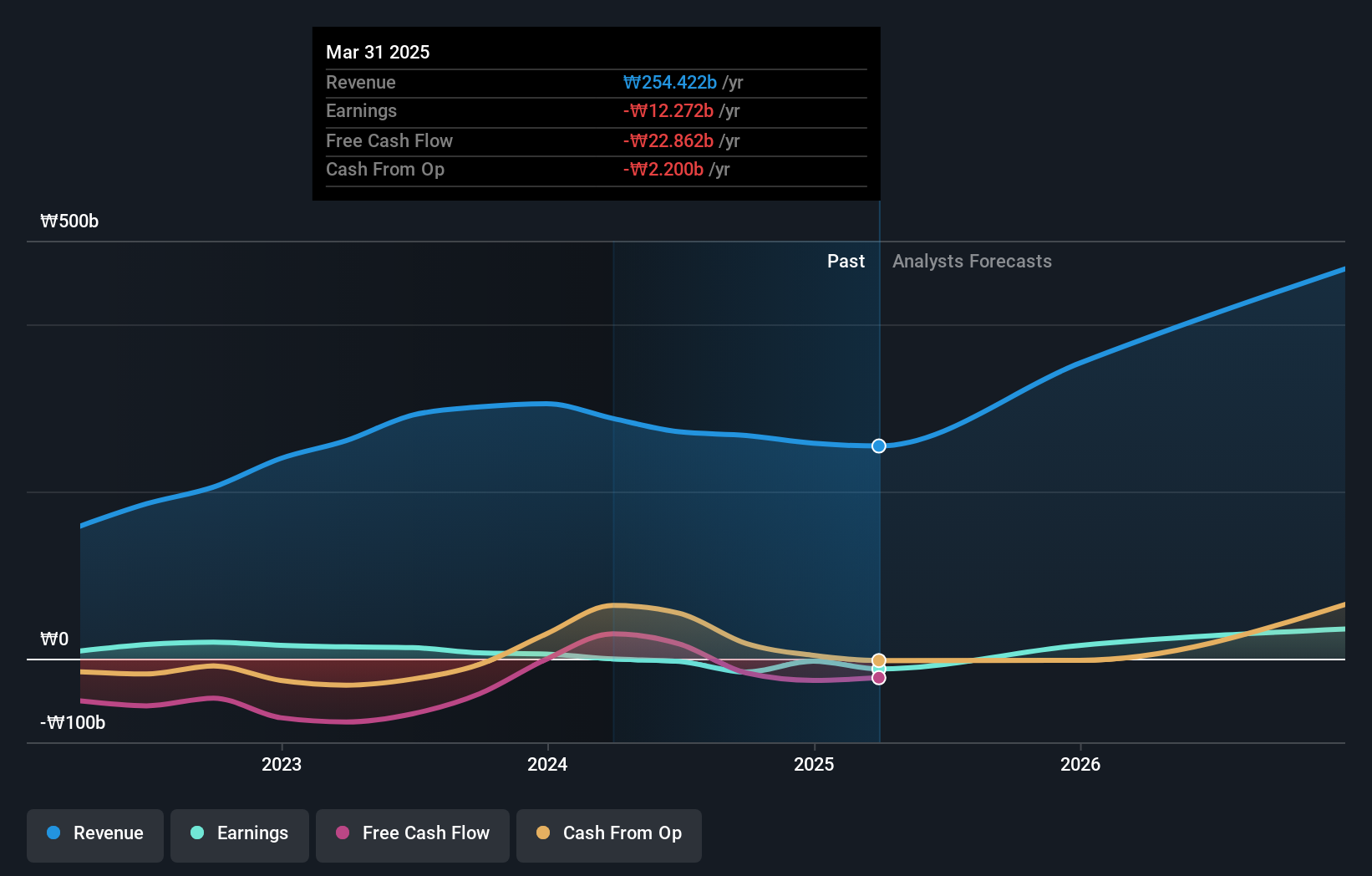

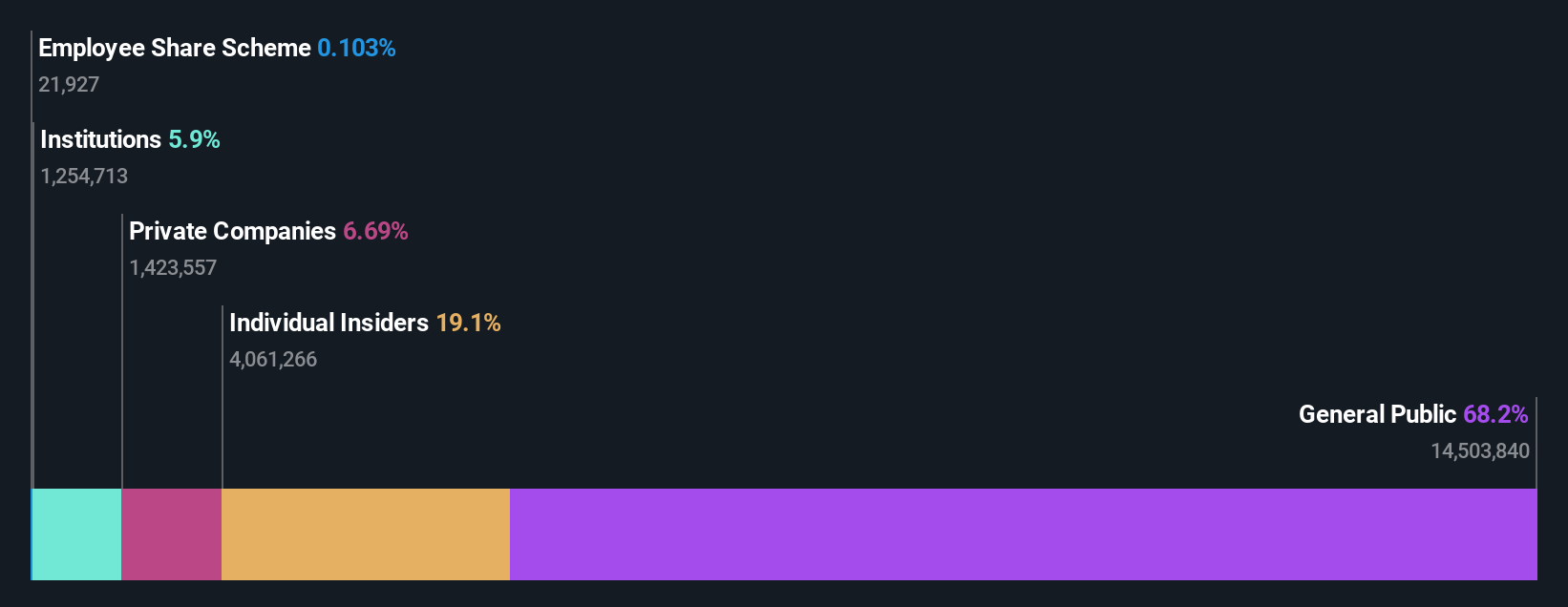

Overview: Intellian Technologies, Inc. provides satellite antennas and terminals in South Korea and internationally, with a market cap of ₩532.60 billion.

Operations: Intellian Technologies generates revenue primarily through the sale of telecommunication equipment, amounting to ₩287.35 billion.

Insider Ownership: 18.9%

Revenue Growth Forecast: 29.3% p.a.

Intellian Technologies, trading at 53.1% below its estimated fair value, is expected to see annual revenue growth of 29.3%, outpacing the South Korean market's average. Earnings are forecast to grow by 78.82% annually, with profitability anticipated within three years—significantly above market averages. Recent buybacks totaling KRW 4,992.97 million indicate strong insider confidence despite no substantial insider buying or selling in the past three months.

- Take a closer look at Intellian Technologies' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Intellian Technologies' share price might be too pessimistic.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a bio company with a market cap of ₩15.54 billion, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Operations: The company's revenue from biotechnology amounts to ₩121.09 million.

Insider Ownership: 26.6%

Revenue Growth Forecast: 48.7% p.a.

Alteogen, trading at 73.2% below its estimated fair value, is forecast to achieve significant revenue growth of 48.7% annually and earnings growth of 72.95% per year, both surpassing market averages. The recent MFDS approval for Tergase® marks a pivotal transition to commercial-stage operations, potentially expanding product applications beyond traditional uses. Despite high-quality earnings and strong insider ownership, the company has experienced shareholder dilution and volatile share prices recently.

- Click here and access our complete growth analysis report to understand the dynamics of ALTEOGEN.

- The analysis detailed in our ALTEOGEN valuation report hints at an inflated share price compared to its estimated value.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩3.85 trillion.

Operations: Enchem's revenue primarily comes from its Electronic Components & Parts segment, generating ₩357.37 billion.

Insider Ownership: 19.4%

Revenue Growth Forecast: 56.5% p.a.

Enchem, a growth company with high insider ownership, is forecast to achieve substantial revenue growth of 56.5% annually, significantly outpacing the South Korean market average of 10%. While earnings are expected to grow at an impressive rate of 144.8% per year and become profitable within three years, the stock has experienced high volatility over the past three months. Despite these positive forecasts, shareholders have faced dilution in the past year.

- Click here to discover the nuances of Enchem with our detailed analytical future growth report.

- Our valuation report here indicates Enchem may be overvalued.

Where To Now?

- Get an in-depth perspective on all 86 Fast Growing KRX Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

Undervalued with high growth potential.