- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

November 2024's Leading Growth Companies With Insider Influence

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices hitting record highs amid expectations of growth-friendly policies, investors are closely watching how these developments might influence corporate earnings and economic expansion. In this environment of optimism and uncertainty, companies with high insider ownership can offer a unique perspective on potential growth opportunities, as insiders often have a deep understanding of their business's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

We'll examine a selection from our screener results.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intellian Technologies, Inc. is a company that provides satellite antennas and terminals both in South Korea and internationally, with a market cap of ₩566.29 billion.

Operations: The company generates revenue from telecommunication equipment sales amounting to ₩271.45 billion.

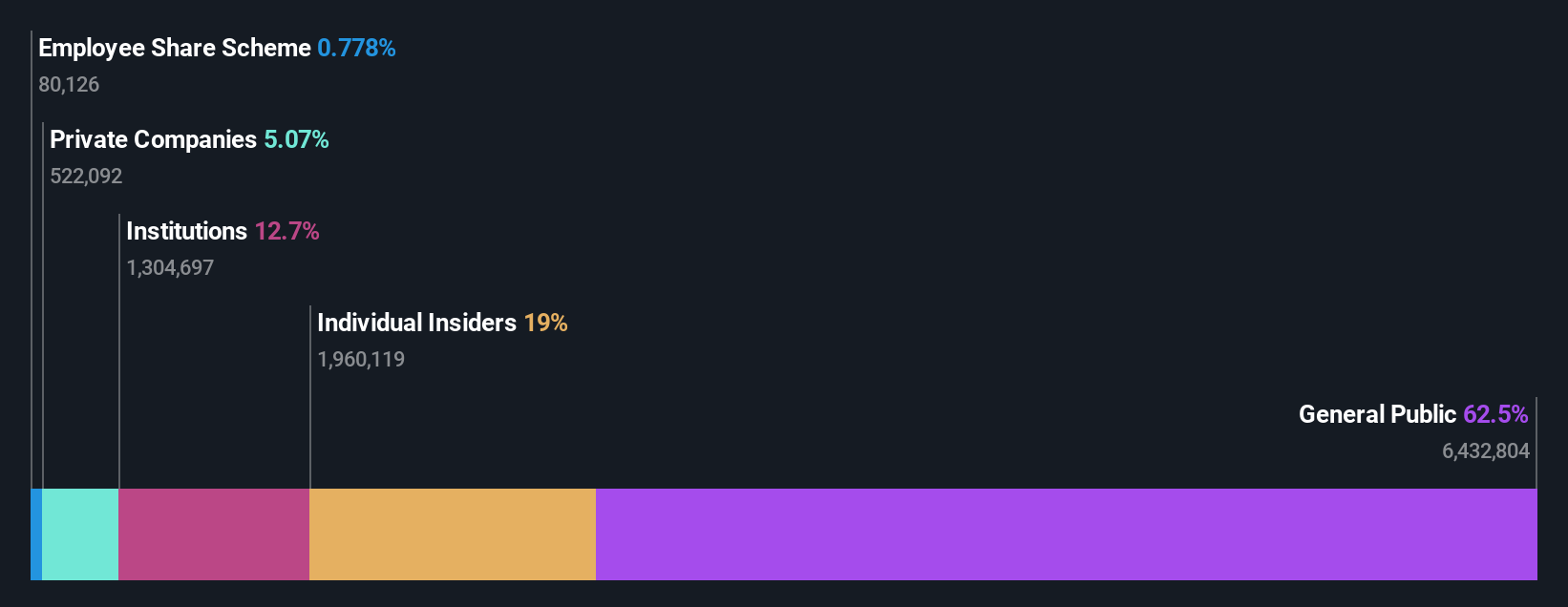

Insider Ownership: 18.8%

Revenue Growth Forecast: 35.5% p.a.

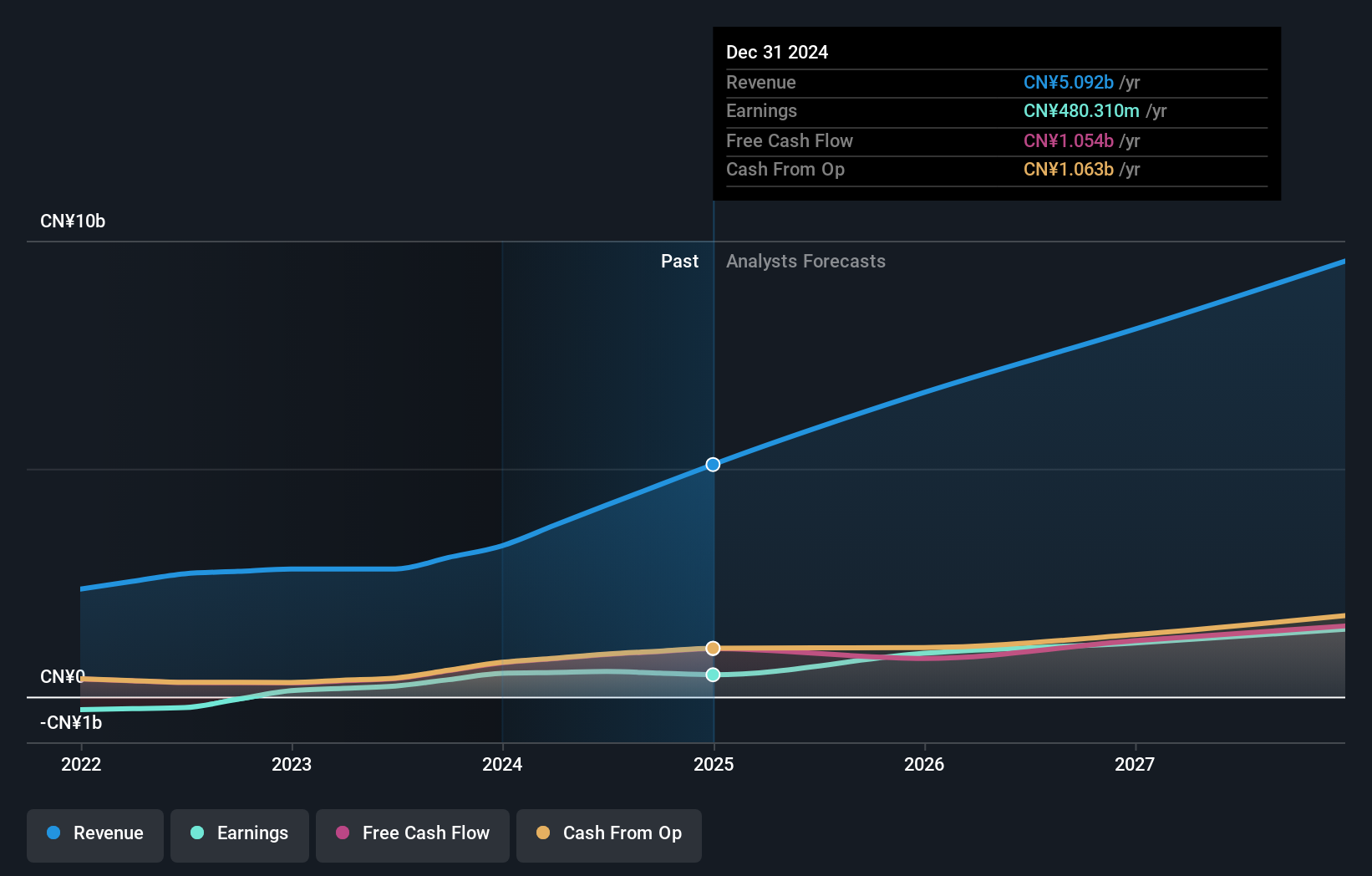

Intellian Technologies is poised for significant growth, with earnings forecasted to expand 109.6% annually and revenue expected to grow 35.5% per year, outpacing the Korean market. Analysts agree on a potential stock price increase of 42.4%, and it trades at a substantial discount to its estimated fair value. A recent contract with Telesat for Gateway Antenna Systems enhances its growth prospects, though risks related to Telesat's operations remain noteworthy.

- Click to explore a detailed breakdown of our findings in Intellian Technologies' earnings growth report.

- Our comprehensive valuation report raises the possibility that Intellian Technologies is priced lower than what may be justified by its financials.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the social networking sector globally, with a market cap of HK$4.48 billion.

Operations: The company's revenue segments include CN¥3.80 billion from the Social Networking Business and CN¥406.28 million from Innovative Business.

Insider Ownership: 35.4%

Revenue Growth Forecast: 15.6% p.a.

Newborn Town's earnings have grown by 137.3% over the past year and are expected to continue expanding at 21% annually, surpassing the Hong Kong market's growth rate. The company trades at a significant discount to its estimated fair value. Recent financial results show sales of CNY 2.27 billion, up from CNY 1.37 billion the previous year, driven by market expansion and strategic acquisitions in diverse regions such as the Middle East and North Africa.

- Click here to discover the nuances of Newborn Town with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Newborn Town's current price could be quite moderate.

China Railway Prefabricated Construction (SZSE:300374)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Railway Prefabricated Construction Co., Ltd. (SZSE:300374) operates in the construction industry, focusing on prefabricated building solutions, with a market cap of CN¥5.29 billion.

Operations: The company's revenue segments are not provided in the text.

Insider Ownership: 24.9%

Revenue Growth Forecast: 23.3% p.a.

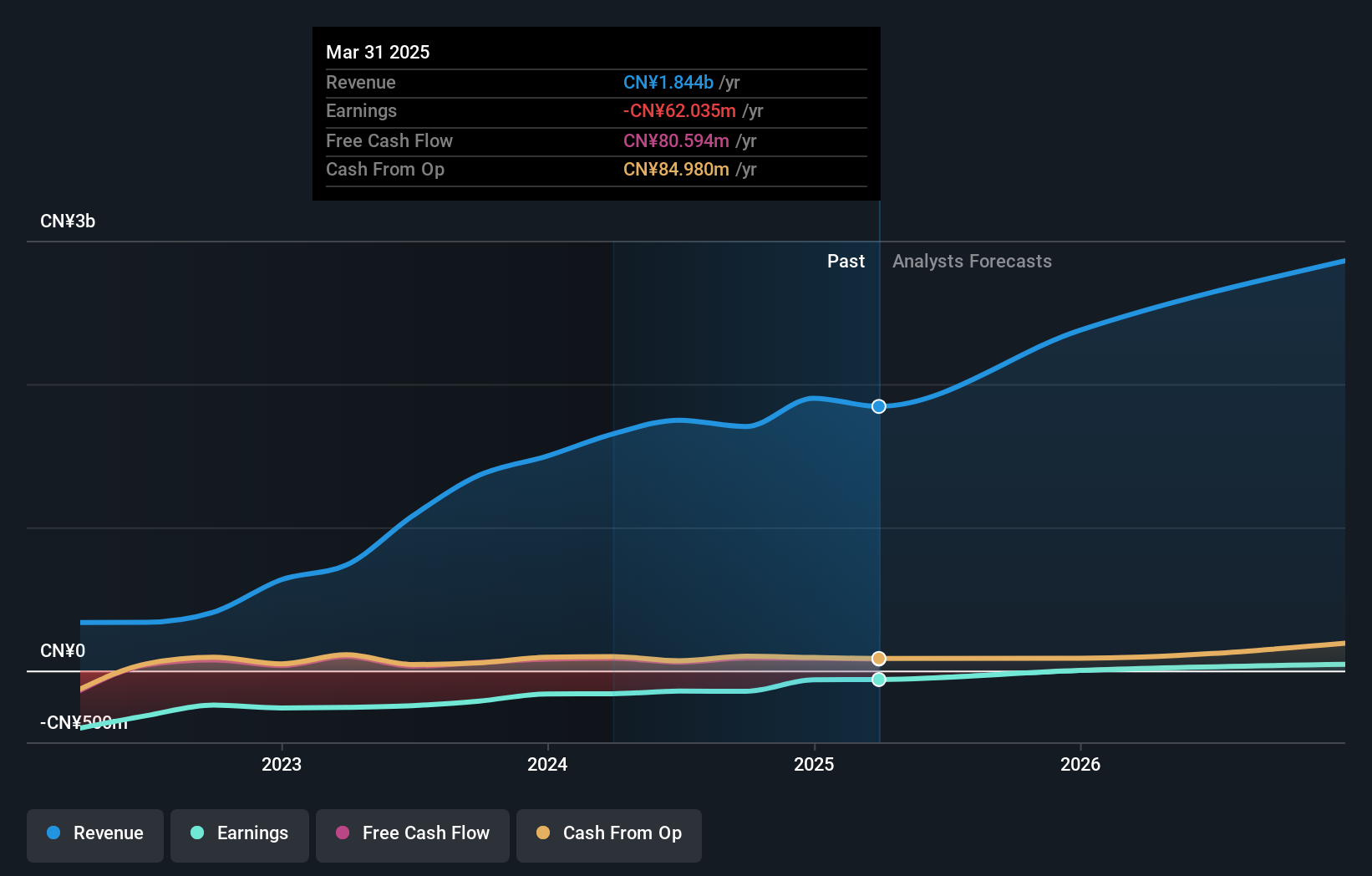

China Railway Prefabricated Construction has demonstrated significant revenue growth, reporting CNY 1.2 billion for the first nine months of 2024, up from CNY 991.5 million a year ago. Despite a net loss reduction to CNY 66.89 million, the company is forecasted to achieve profitability within three years with expected earnings growth of over 166% annually. While insider trading activity remains minimal, its high share price volatility could pose risks for investors seeking stability.

- Unlock comprehensive insights into our analysis of China Railway Prefabricated Construction stock in this growth report.

- Our comprehensive valuation report raises the possibility that China Railway Prefabricated Construction is priced higher than what may be justified by its financials.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1530 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives