- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A131290

KRX And 2 Other Stocks That May Be Trading Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

The South Korean stock market has shown steady growth over the past year, with a notable increase of 6.5% and earnings expected to grow by 29% annually. In such a promising environment, identifying stocks that may be trading below their estimated intrinsic values could present valuable opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Solum (KOSE:A248070) | ₩21050.00 | ₩40080.03 | 47.5% |

| Grand Korea Leisure (KOSE:A114090) | ₩13030.00 | ₩24618.09 | 47.1% |

| Protec (KOSDAQ:A053610) | ₩30050.00 | ₩55214.32 | 45.6% |

| Caregen (KOSDAQ:A214370) | ₩23900.00 | ₩43428.59 | 45% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49600.74 | 49.8% |

| Revu (KOSDAQ:A443250) | ₩11510.00 | ₩21005.05 | 45.2% |

| Intellian Technologies (KOSDAQ:A189300) | ₩56000.00 | ₩107495.30 | 47.9% |

| IMLtd (KOSDAQ:A101390) | ₩7070.00 | ₩13607.23 | 48% |

| Hancom Lifecare (KOSE:A372910) | ₩5430.00 | ₩10711.18 | 49.3% |

| NEXON Games (KOSDAQ:A225570) | ₩14150.00 | ₩25731.72 | 45% |

Let's explore several standout options from the results in the screener

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd. specializes in providing semiconductor test solutions both domestically in South Korea and internationally, with a market capitalization of approximately ₩586.63 billion.

Operations: The company generates its revenue from semiconductor test solutions across both domestic and international markets.

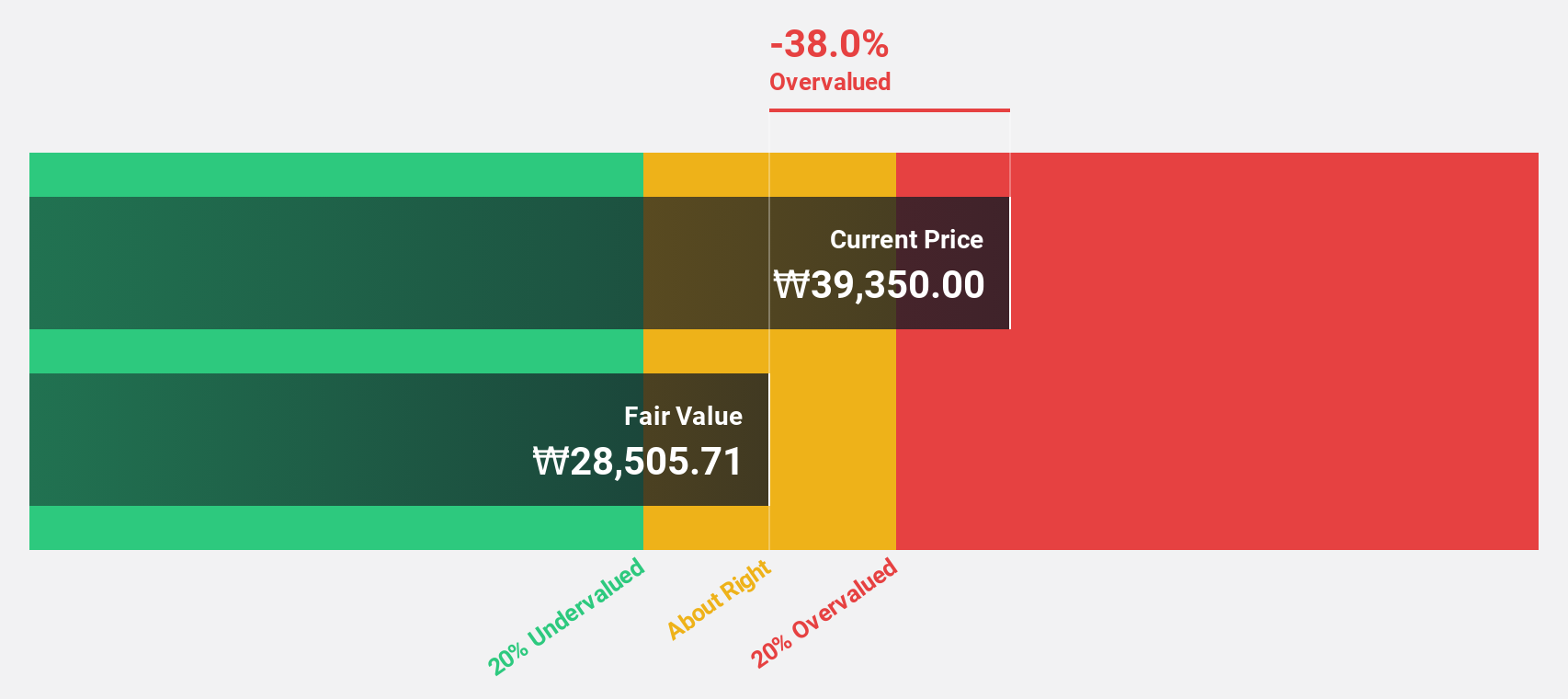

Estimated Discount To Fair Value: 26.8%

TSE Co., Ltd, with a current trading price of ₩54900, is identified as significantly undervalued based on discounted cash flow analysis, showing a potential undervaluation by over 20% against an estimated fair value of ₩75028.46. Despite low return on equity projections at 10.6%, the company's earnings are expected to surge by approximately 63.8% annually, outpacing the South Korean market's growth. However, caution is advised due to highly volatile share prices and profit margins that have decreased from last year's 9.4% to just 1.2%.

- Our comprehensive growth report raises the possibility that TSE is poised for substantial financial growth.

- Navigate through the intricacies of TSE with our comprehensive financial health report here.

Intellian Technologies (KOSDAQ:A189300)

Overview: Intellian Technologies, Inc. specializes in providing satellite antennas and terminals both domestically in South Korea and internationally, with a market capitalization of approximately ₩585.97 billion.

Operations: The company generates revenue through the sale of satellite antennas and terminals across domestic and international markets.

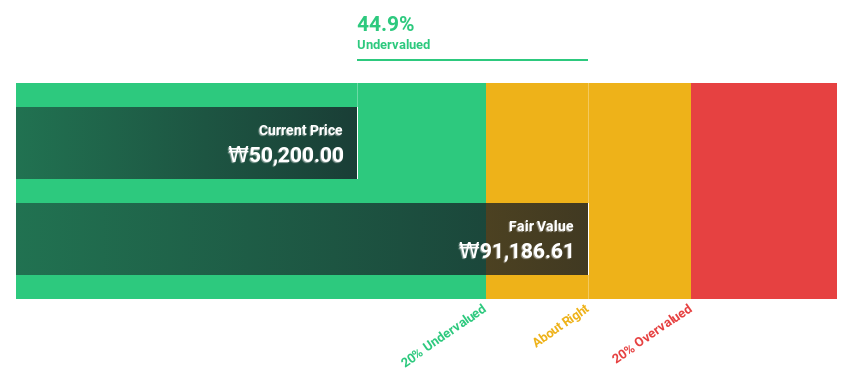

Estimated Discount To Fair Value: 47.9%

Intellian Technologies, trading at ₩56000, appears undervalued by over 20% compared to its fair value of ₩107495.3 based on discounted cash flow analysis. The company is poised for significant growth with revenue expected to increase by 30.1% annually, outstripping the South Korean market's average of 10.5%. Despite this promising outlook, shareholder dilution has occurred over the past year and return on equity is projected to be modest at 15.5% in three years.

- Our expertly prepared growth report on Intellian Technologies implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Intellian Technologies.

Grand Korea Leisure (KOSE:A114090)

Overview: Grand Korea Leisure Co., Ltd. is a casino operator based in South Korea, with a market capitalization of approximately ₩806 billion.

Operations: The company generates ₩385.47 billion from its Casinos & Resorts segment.

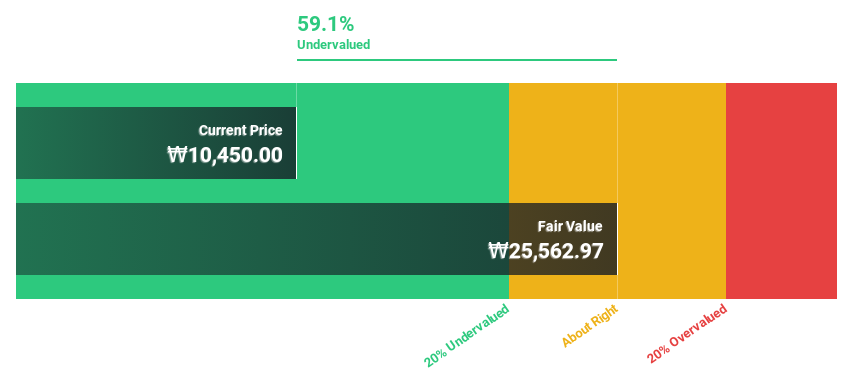

Estimated Discount To Fair Value: 47.1%

Grand Korea Leisure, priced at ₩13030, is significantly undervalued with a fair value estimate of ₩24618.09. Its earnings have surged by 236.9% over the past year and are projected to grow by 28.94% annually, outpacing the South Korean market's forecast of 28.7%. Despite this robust growth, its revenue increase is modest at 12.2% per year compared to higher industry benchmarks, and its return on equity is expected to remain low at 15.1%.

- According our earnings growth report, there's an indication that Grand Korea Leisure might be ready to expand.

- Unlock comprehensive insights into our analysis of Grand Korea Leisure stock in this financial health report.

Where To Now?

- Explore the 34 names from our Undervalued KRX Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A131290

TSE

Provides semiconductor test solutions in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.