- South Korea

- /

- Biotech

- /

- KOSDAQ:A086900

Samsung Biologics And 2 Other High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

South Korea's economic landscape has been marked by a current account surplus of $6.60 billion in August, reflecting robust export growth despite a slight decline from July, while the financial account saw an increase in net assets. In this context, high-growth tech stocks like Samsung Biologics are gaining attention as investors look for companies that can capitalize on strong export performance and navigate the complexities of global market conditions effectively.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of ₩1.19 trillion.

Operations: The company's primary revenue stream is derived from its biotechnology segment, generating ₩246.25 billion.

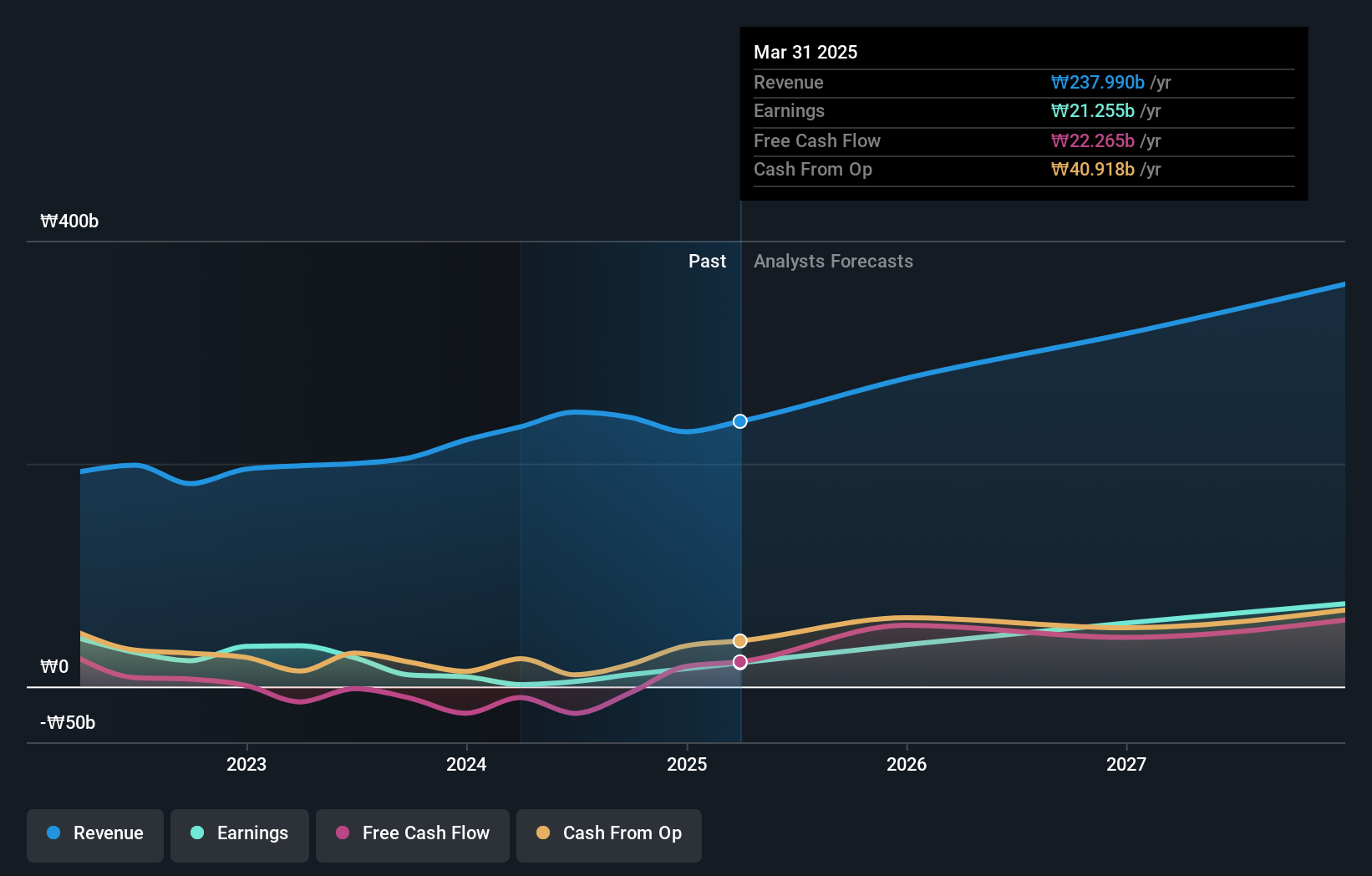

Medy-Tox, amidst a challenging year with a 82.2% drop in earnings, has announced a share repurchase program to stabilize its stock price and boost shareholder value, planning to buy back up to 16,008 shares by the end of December 2024. Despite these hurdles, the company's revenue growth outlook remains positive at 12.2% annually, outpacing the South Korean market's average of 10.5%. Moreover, Medy-Tox is poised for significant earnings recovery with an anticipated growth rate of 62% per year over the next three years. This strategic pivot towards stabilizing financial metrics while fostering substantial future growth encapsulates their adaptive approach in navigating market dynamics.

- Unlock comprehensive insights into our analysis of Medy-Tox stock in this health report.

Understand Medy-Tox's track record by examining our Past report.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.60 trillion.

Operations: The company generates revenue primarily through its biotechnology segment, amounting to ₩90.79 billion. Its focus on developing innovative biotechnological solutions positions it within the niche market of long-acting biobetters and antibody biosimilars.

In the dynamic landscape of South Korean high-tech, ALTEOGEN stands out with its aggressive investment in R&D, dedicating a significant portion of its revenue to innovation. This strategy is evidenced by a robust annual increase in R&D spending, aligning with the company's vision to spearhead advancements in biotechnology. Despite current unprofitability, ALTEOGEN's revenue is projected to surge by 64.2% annually, significantly outpacing the broader market's growth rate of 10.5%. Moreover, earnings are expected to skyrocket by approximately 99.5% each year over the next three years, reflecting potential for substantial financial improvement and market impact. This growth trajectory underscores ALTEOGEN’s commitment to evolving within the high-tech sector and suggests promising prospects for its role in shaping future technological landscapes.

- Get an in-depth perspective on ALTEOGEN's performance by reading our health report here.

Examine ALTEOGEN's past performance report to understand how it has performed in the past.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market capitalization of ₩7.44 trillion.

Operations: HYBE generates revenue primarily from its Label and Solution segments, contributing ₩1.28 trillion and ₩1.24 trillion respectively. The Platform segment adds an additional ₩361.12 billion to the company's revenue stream.

HYBE, a South Korean entertainment powerhouse, has demonstrated a keen commitment to innovation through its R&D investments. In 2024 alone, the firm allocated an impressive 14% of its revenue towards enhancing and developing new technologies and content. This strategic focus is reflected in its robust earnings forecast, with an anticipated annual growth rate of 42.2%, significantly outpacing the broader market's expectation of 30.6%. Additionally, HYBE recently completed a share repurchase program, buying back shares worth KRW 26 billion to stabilize its stock price—a move that underscores confidence in its financial health and future prospects.

- Take a closer look at HYBE's potential here in our health report.

Assess HYBE's past performance with our detailed historical performance reports.

Where To Now?

- Embark on your investment journey to our 48 KRX High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A086900

Undervalued with excellent balance sheet.