- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A179900

UTI Inc. (KOSDAQ:179900) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

Unfortunately for some shareholders, the UTI Inc. (KOSDAQ:179900) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

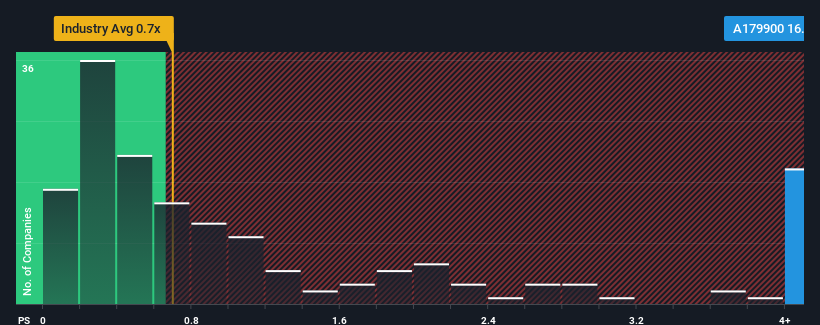

Even after such a large drop in price, you could still be forgiven for thinking UTI is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 16.7x, considering almost half the companies in Korea's Electronic industry have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for UTI

How UTI Has Been Performing

UTI could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on UTI will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For UTI?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like UTI's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 62% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 134% over the next year. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why UTI's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

A significant share price dive has done very little to deflate UTI's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into UTI shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for UTI with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of UTI's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A179900

UTI

Engages in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives