- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

Investors Appear Satisfied With Seojin System Co.,Ltd's (KOSDAQ:178320) Prospects As Shares Rocket 31%

Despite an already strong run, Seojin System Co.,Ltd (KOSDAQ:178320) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 87% in the last year.

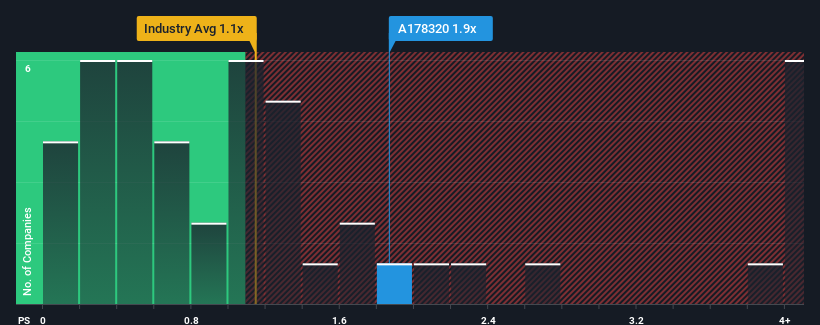

Since its price has surged higher, you could be forgiven for thinking Seojin SystemLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in Korea's Communications industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Seojin SystemLtd

What Does Seojin SystemLtd's Recent Performance Look Like?

Recent times have been advantageous for Seojin SystemLtd as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Seojin SystemLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Seojin SystemLtd would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The strong recent performance means it was also able to grow revenue by 141% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 57% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

With this information, we can see why Seojin SystemLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Seojin SystemLtd's P/S Mean For Investors?

The large bounce in Seojin SystemLtd's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Seojin SystemLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Seojin SystemLtd is showing 4 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on Seojin SystemLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

High growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026