- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A131400

EV Advanced MaterialLtd (KOSDAQ:131400) Is In A Strong Position To Grow Its Business

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should EV Advanced MaterialLtd (KOSDAQ:131400) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for EV Advanced MaterialLtd

When Might EV Advanced MaterialLtd Run Out Of Money?

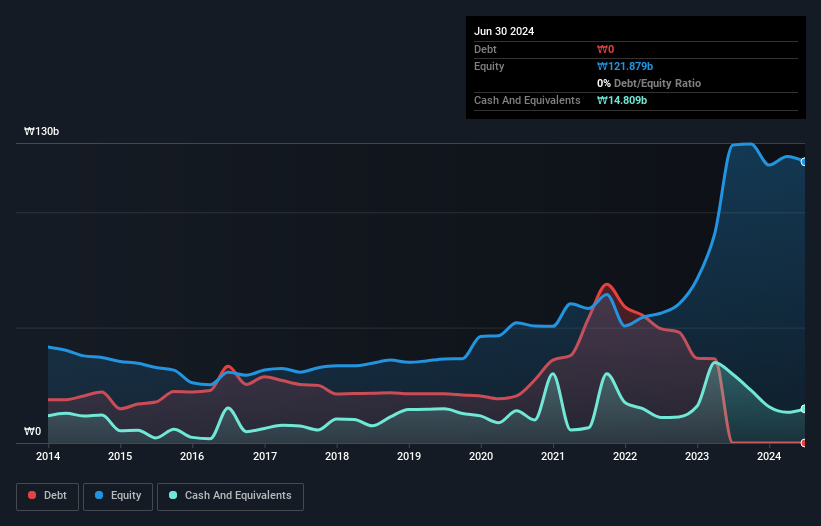

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When EV Advanced MaterialLtd last reported its June 2024 balance sheet in August 2024, it had zero debt and cash worth ₩15b. In the last year, its cash burn was ₩3.9b. That means it had a cash runway of about 3.8 years as of June 2024. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

Is EV Advanced MaterialLtd's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because EV Advanced MaterialLtd actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. While it's not that amazing, we still think that the 8.6% increase in revenue from operations was a positive. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how EV Advanced MaterialLtd is building its business over time.

How Easily Can EV Advanced MaterialLtd Raise Cash?

Notwithstanding EV Advanced MaterialLtd's revenue growth, it is still important to consider how it could raise more money, if it needs to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of ₩143b, EV Advanced MaterialLtd's ₩3.9b in cash burn equates to about 2.7% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is EV Advanced MaterialLtd's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way EV Advanced MaterialLtd is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. Its weak point is its revenue growth, but even that wasn't too bad! After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for EV Advanced MaterialLtd (1 is a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EV Advanced MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A131400

EV Advanced MaterialLtd

Engages in the manufacture and sale of flexible printed circuit boards (FPCBs) in South Korea.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion