- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A126340

Investors Appear Satisfied With VINA TECH Co.,Ltd.'s (KOSDAQ:126340) Prospects As Shares Rocket 31%

Despite an already strong run, VINA TECH Co.,Ltd. (KOSDAQ:126340) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 73%.

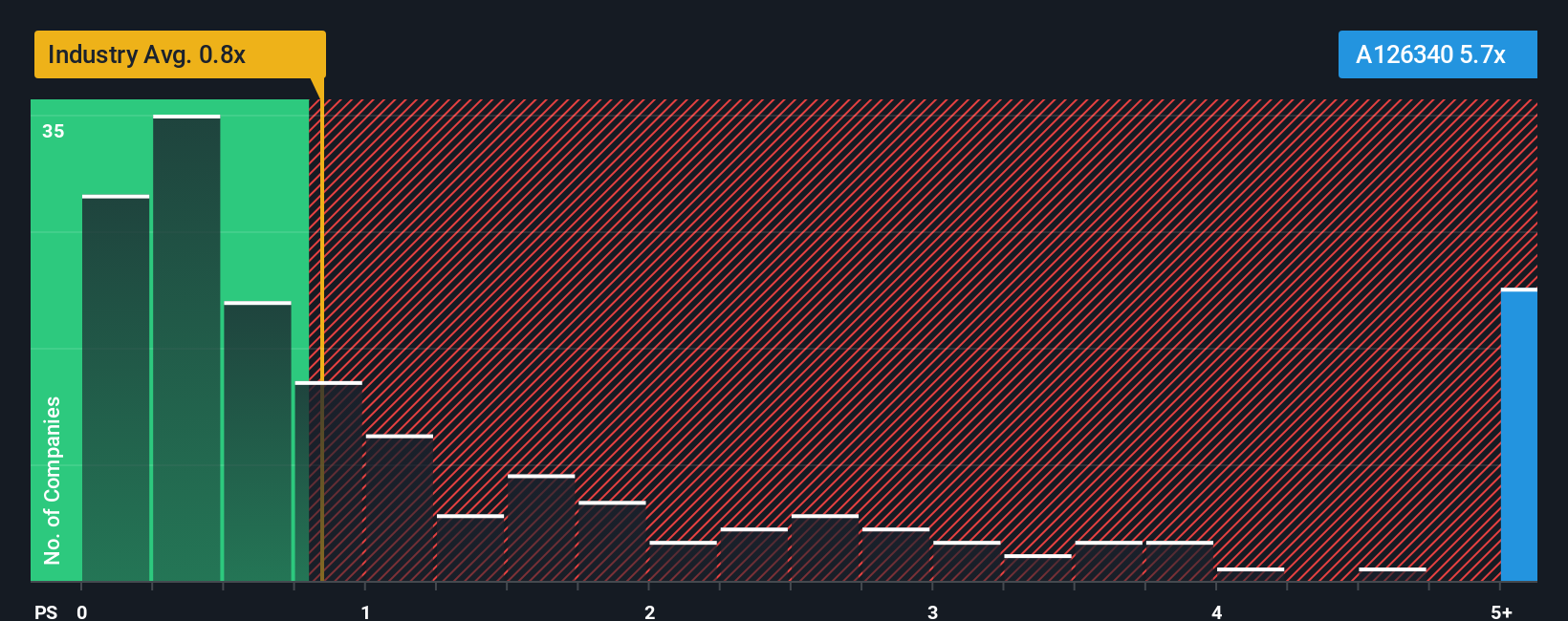

After such a large jump in price, given around half the companies in Korea's Electronic industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider VINA TECHLtd as a stock to avoid entirely with its 5.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for VINA TECHLtd

How Has VINA TECHLtd Performed Recently?

Recent times have been pleasing for VINA TECHLtd as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on VINA TECHLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as VINA TECHLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 55% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this information, we can see why VINA TECHLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From VINA TECHLtd's P/S?

Shares in VINA TECHLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that VINA TECHLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for VINA TECHLtd that we have uncovered.

If these risks are making you reconsider your opinion on VINA TECHLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A126340

VINA TECHLtd

Manufactures and sells energy storage devices under the Hy-Cap brand in South Korea and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives