- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A096630

Market Cool On S Connect Co., LTD.'s (KOSDAQ:096630) Revenues Pushing Shares 27% Lower

Unfortunately for some shareholders, the S Connect Co., LTD. (KOSDAQ:096630) share price has dived 27% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

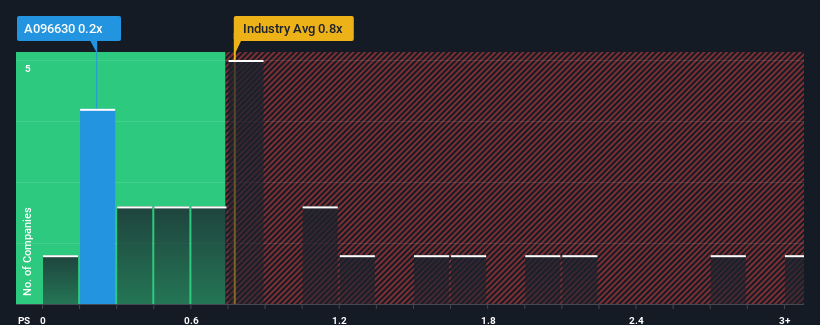

Since its price has dipped substantially, given about half the companies operating in Korea's Tech industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider S Connect as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for S Connect

What Does S Connect's P/S Mean For Shareholders?

S Connect has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on S Connect will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on S Connect will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For S Connect?

There's an inherent assumption that a company should underperform the industry for P/S ratios like S Connect's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 19% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that S Connect's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On S Connect's P/S

S Connect's recently weak share price has pulled its P/S back below other Tech companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that S Connect currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for S Connect that you should be aware of.

If these risks are making you reconsider your opinion on S Connect, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A096630

S Connect

Produces and sells various metal processing parts of IT products in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives